Yesterday’s Hypothesis Of Upper End Of Range Paid To Be Patient Across All Strategies

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Yesterday’s hypothesis of the bigger picture being at the upper end of the range on the main stock indexes certainly paid to be patient across all the strategies.

This is also something we dived deep on during our Fast Forward Group mentorship calls – not being too eager to think about a bull swing for those that needed one.

The Lazy Poppers and Premium Poppers – only thinking about the bear side of the trading as a filter – worked out perfectly to avoid choppy market conditions.

And one or two traders reported a cheeky little hybrid popper on the failed Premium Popper 1st breakout – well done – you know who you are 😉

Thinking about today’s trading – it’s going to be much of the same.

Overnight futures have held yesterday’s lows with little overnight movement and as nothing new has happened or is developing then yesterday’s viewpoint holds true into today.

Crude Oil – CL – is at its upper range/channel highs – bear moves also make sense here until we see a breakout.

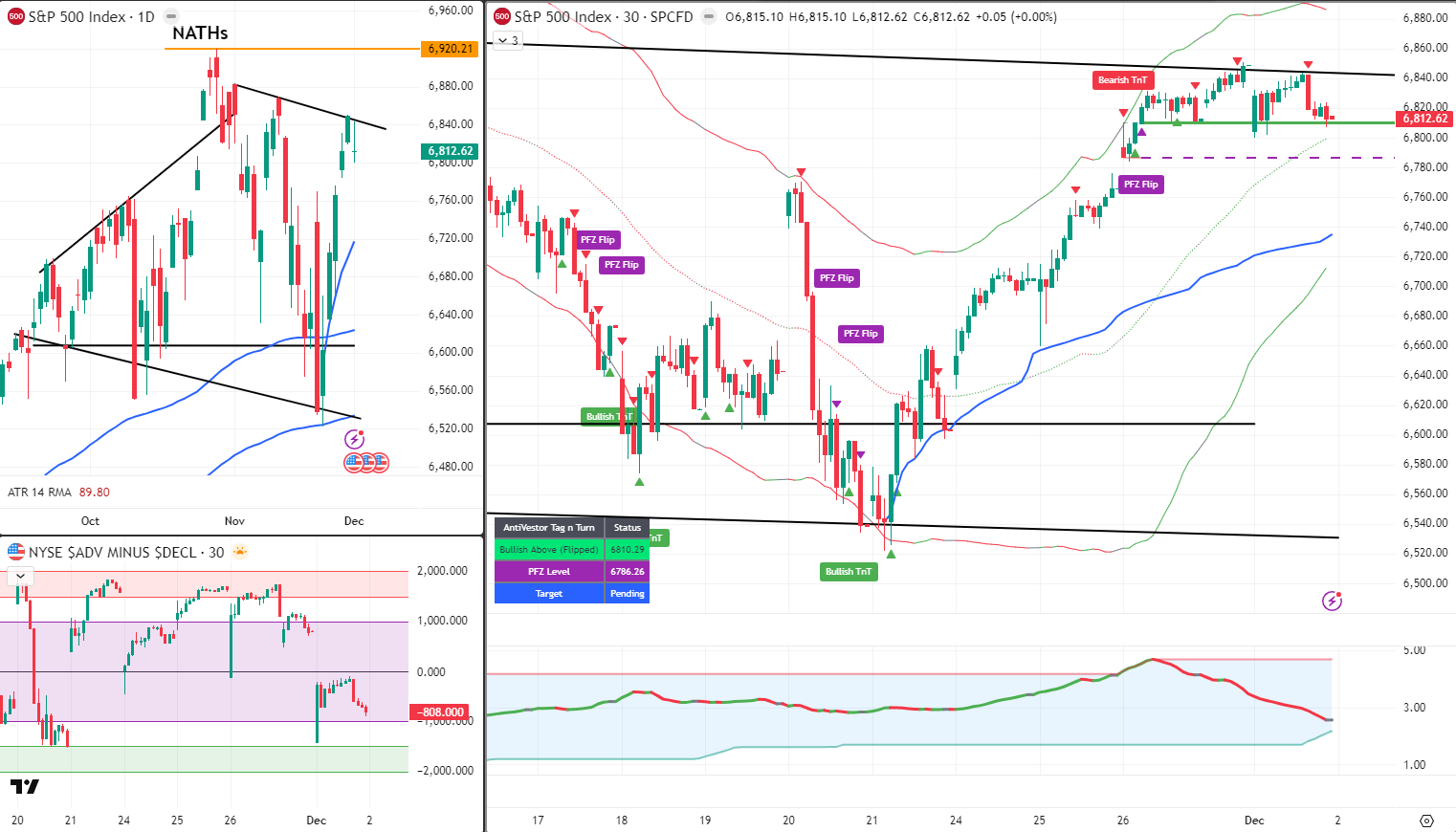

On the Income System layout – for both SPX and RUT the same analysis holds good – we are bullish until bearish. Although not looking for a new bullish position just yet.

SPX bear trigger below 6785.

RUT bear trigger below 2460.

Also I’m seeing that the Bollinger Band width has moved from its widest wide point and expanding (trend) to its narrowest narrow point and about to fire off an official range condition.

Confirming that the discretionary override on bulls may well have been the exact course of action to take as we transition from one phase of movement to another.

I shall again remain bearish on the popper setups and assess when the markets open.

Keep scrolling for the phase transition breakdown…

Patience Paid. Bear Filter Perfect. BB Width Confirms Phase Transition.

SPX Market Briefing:

Tuesday December continues yesterday’s upper range hypothesis (paid to be patient across all strategies),

Fast Forward Group mentorship focus on not being too eager for bull swings (lazy poppers and premium poppers bear filter worked perfectly,

cheeky hybrid popper on failed 1st breakout well done), today much of the same (overnight futures held yesterday’s lows, nothing new developing),

Crude Oil at upper range highs (bear moves make sense until breakout),

Income System bullish until bearish but not looking for new bullish position (SPX bear trigger below 6785, RUT bear trigger below 2460),

BB width moved from widest expanding to narrowest range condition (discretionary override on bulls confirmed correct as we transition phases), remaining bearish on popper setups.

Current Multi-Market Status:

- SPX: Bull TnT active, bear trigger below 6785

- RUT: Bull TnT active, bear trigger below 2460

- ES: Held overnight lows

- CL: Upper range highs – bear bias until breakout

- GC: Consolidating

Patience Paid Yesterday

Yesterday’s hypothesis of the bigger picture being at the upper end of the range on the main stock indexes certainly paid to be patient across all the strategies.

This is also something we dived deep on during our Fast Forward Group mentorship calls – not being too eager to think about a bull swing for those that needed one.

Current Status: Patience validated, upper range hypothesis confirmed

Bear Filter Worked Perfectly

The Lazy Poppers and Premium Poppers – only thinking about the bear side of the trading as a filter – worked out perfectly to avoid choppy market conditions.

And one or two traders reported a cheeky little hybrid popper on the failed Premium Popper 1st breakout – well done – you know who you are 😉

Current Status: Bear filter effective, hybrid poppers banking

Same View Today

Thinking about today’s trading – it’s going to be much of the same.

Overnight futures have held yesterday’s lows with little overnight movement and as nothing new has happened or is developing then yesterday’s viewpoint holds true into today.

Crude Oil – CL – is at its upper range/channel highs – bear moves also make sense here until we see a breakout.

Current Status: Yesterday’s viewpoint holds, no new developments

Income System Status

On the Income System layout – for both SPX and RUT the same analysis holds good – we are bullish until bearish. Although not looking for a new bullish position just yet.

- SPX bear trigger below 6785.

- RUT bear trigger below 2460.

Current Status: Bullish but not adding, bear triggers defined

BB Width Phase Transition

Also I’m seeing that the Bollinger Band width has moved from its widest wide point and expanding (trend) to its narrowest narrow point and about to fire off an official range condition.

Confirming that the discretionary override on bulls may well have been the exact course of action to take as we transition from one phase of movement to another.

I shall again remain bearish on the popper setups and assess when the markets open.

Current Status: BB width confirms range phase, discretionary override validated

Expert Insights

The Observation: Bollinger Band width tells you what phase the market is in.

Widest and expanding = trend.

Narrowest and contracting = range.

The transition between wide to narrow phases is where most traders get chopped up.

The Fix: Watch the BB width, not just price. When you see width moving from expansion to contraction, shift your approach. Yesterday’s discretionary override on bull setups wasn’t a guess – it was reading the phase transition.

Its a good job we have a dedicated custom tool to highlight these phases

In Other News…

Five-Day Rally Snapped: Strategy Learns Buying High Has Consequences

Apple records whilst MicroStrategy crashes 10%. Silver doubles in year. Manufacturing contracts ninth month (ignored).

Monday snapped five-day rally as Strategy crashed 10%—proving averaging up into crash eventually meets reality check—whilst Apple surged to record above $280 because apparently one company’s success validates entire sector. ISM Manufacturing contracted ninth consecutive month but markets ignoring because industrial economy irrelevant when Cyber Monday spending hits $14.2B proving Americans prioritize online shopping over producing things.

When Circular AI Deals Become “Investment”

Nvidia invested $2B in Synopsys sending stock up 4.85%—markets celebrating AI chip company investing in AI chip design tools as validation rather than questioning circular deal structure. Synopsys designs chips Nvidia buys from TSMC who uses Synopsys tools—financial ouroboros where everyone pays everyone proving ecosystem health through perpetual motion.

Strategy’s “Conviction” Meets 10% Reality

MicroStrategy down 10% as crypto-linked names crashed: Coinbase -5%, Robinhood -4%—companies built on Bitcoin volatility discovering volatility works both directions. Meanwhile Strategy’s corporate treasury management strategy of buying BTC at $102K average whilst trading $88K proving diamond hands occasionally hold losing positions.

Silver Doubles Because Why Not

Silver hit record $58.83—doubling in 2025 on supply squeeze—whilst dollar weakened seventh straight day supporting commodities. Gold steady $4,221, oil flat $60 as everything except equities and crypto rallies. Markets discovering precious metals outperform speculation when speculation stops working.

☕ Hazel’s Take

Five-day rally snapped, Strategy -10%, manufacturing ninth month contraction, silver doubled. When Apple records mask crypto carnage and circular AI investments count as bullish, probably acknowledging selective attention determines narrative.

—Hazel, FinNuts

Rumour Has It…

The Financial Nuts team reports from the newsroom…

Percy’s tracking the BB width contraction, muttering “phase transition confirmed” whilst drawing trend-to-range diagrams. His pigeons are learning to recognise contracting bands.

Hazel’s running the “cheeky hybrid popper” awards ceremony. “They know who they are. We know who they are. Everyone knows.”

Mac labelled his Tuesday glass “PATIENCE PAID SPECIAL” whilst Kash counted avoided choppy trades. “Conservative estimate: all of them.”

Wallie summed it up: “Same view. Same range. Same levels. Wake me when 6785 or 2460 breaks.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

[Source: StockCharts / Tom Bowley – “December Historical Tendencies”]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.