Scalp Scalp – Gobble Gobble – Pop Pop Dat Premium

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

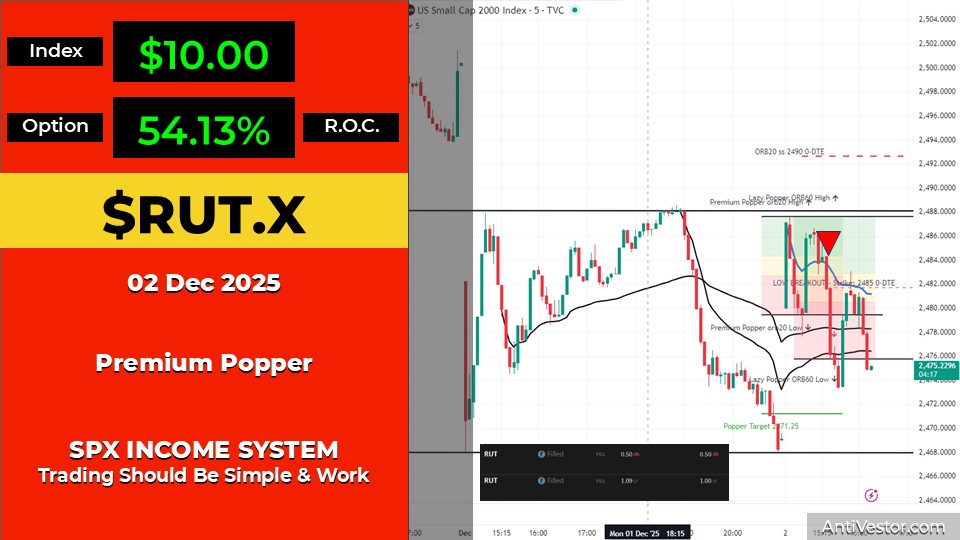

On Tuesday 2nd December I took two Premium Popper setups – SPX banked 58.3% ROC and RUT delivered 54.13% ROC.

Here’s how it played out.

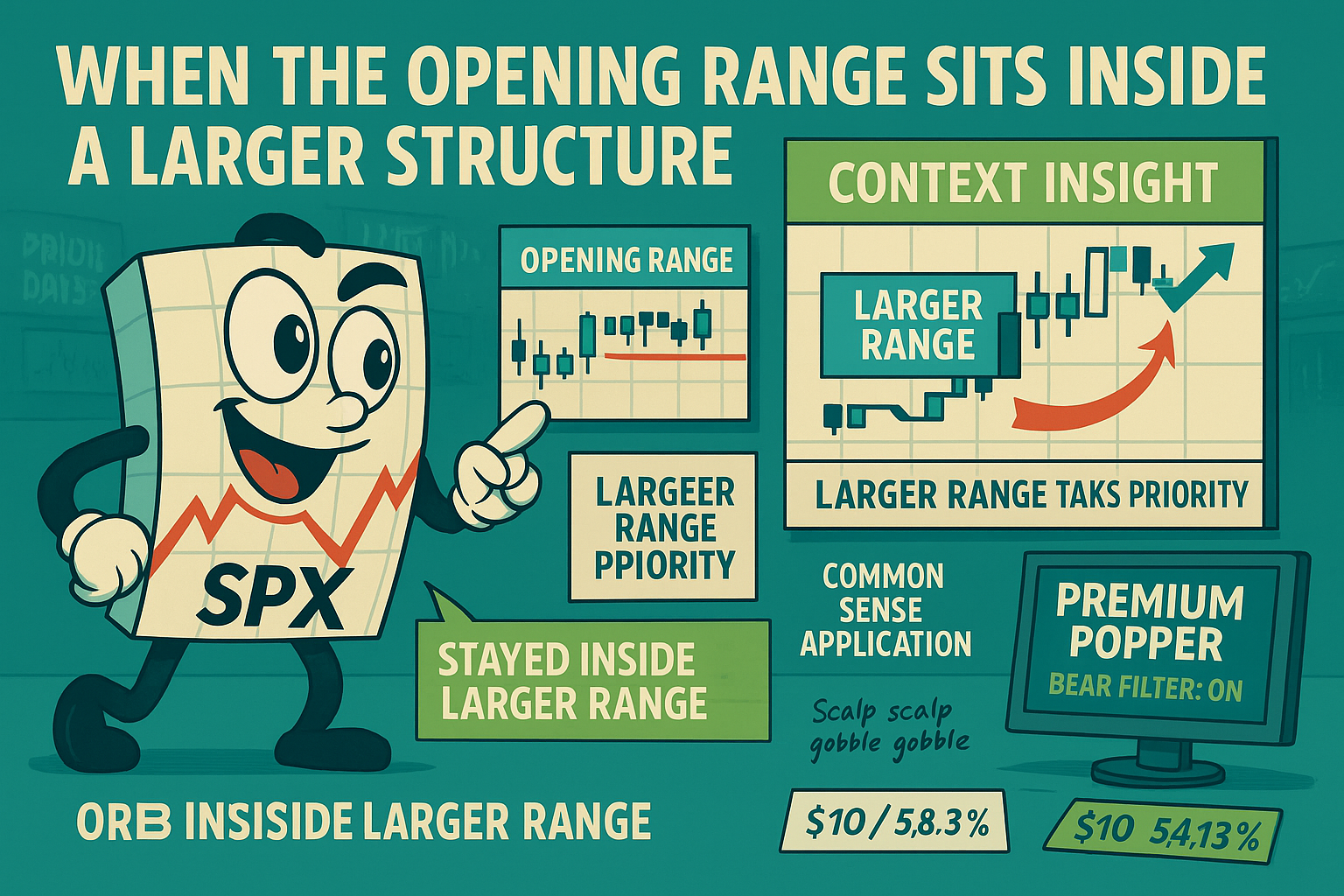

In typical form my software highlighted the usual opening range. However, this time there was a slightly larger consideration in the form of a consolidation spread over the prior few days.

The opening range was inside the larger range.

And until price moves outside the larger range, then price is likely to keep ranging as part of that larger structure.

This is where a little common sense comes in.

SPX attempted to break the upper opening range BUT stayed inside the larger range. So with a little common sense based on this situation – using the failed breakout and subsequent move lower from the larger range highs I can use one of my 6 money making patterns to scalp the move lower.

RUT was a little clearer with the same situation. Break through opening range lows to trade the larger range reversal.

Scalp scalp – gobble gobble – pop pop dat premium.

Keep scrolling for the setup breakdown…

2 Premium Poppers. 2 Wins. Opening Range Inside Larger Range. Common Sense Applied.

SPX Market Briefing:

Tuesday 2nd December brought two Premium Popper opportunities where context mattered more than the usual opening range mechanics. The key insight was recognising that the opening range sat inside a larger multi-day consolidation – changing the approach from breakout hunting to range reversal trading.

Trades Executed:

| Index | Strategy | Entry Logic | Result | ROC |

|---|---|---|---|---|

| SPX | Premium Popper | Failed upper ORB break at larger range highs | $12.00 | 58.3% |

| RUT | Premium Popper | Break through ORB lows for larger range reversal | $10.00 | 54.13% |

The Context That Changed Everything

In typical form my software highlighted the usual opening range. However, this time there was a slightly larger consideration.

A consolidation spread over the prior few days created a larger range. The opening range was inside this larger structure.

Key insight: Until price moves outside the larger range, price is likely to keep ranging as part of that larger structure.

Current Status: Context identified, approach adjusted

SPX Setup – Failed Breakout At Range Highs

SPX attempted to break the upper opening range BUT stayed inside the larger range.

Failed breakout at larger range highs. With a little common sense based on this situation – used the failed breakout and subsequent move lower to scalp using one of my 6 money making patterns.

Result: $12.00 profit, 58.3% ROC.

Current Status: Failed breakout identified, range reversal traded, profit banked

RUT Setup – Clearer Range Reversal

RUT was a little clearer with the same situation.

Break through opening range lows to trade the larger range reversal. Same context, cleaner execution.

Result: $10.00 profit, 54.13% ROC.

Current Status: ORB low break traded larger reversal, profit banked

The Common Sense Application

This is where context matters more than mechanical rules.

The opening range is useful. But when it sits inside a larger structure, that larger structure takes priority. Failed breakouts at the edges of the larger range become scalp opportunities.

Same software. Same setups. Different context. Adjusted approach. Two wins.

Current Status: Context-aware trading delivered

Expert Insights

The Observation: Your opening range breakout tools are brilliant – but they don’t exist in a vacuum. When the ORB sits inside a larger consolidation, the larger range dictates the rules.

The Fix: Before executing the usual ORB mechanics, zoom out. Is the opening range inside a bigger structure? If yes, the edges of that larger range become your priority levels. Failed breakouts at those edges = scalp opportunities using the 6 money making patterns.

Key Takeaways:

- Opening range inside larger range = larger range takes priority

- Failed breakouts at larger range edges = scalp opportunities

- 6 money making patterns apply at multiple timeframes

- Common sense adjusts mechanical execution to context

- Same tools, different context, adjusted approach, same result: profit

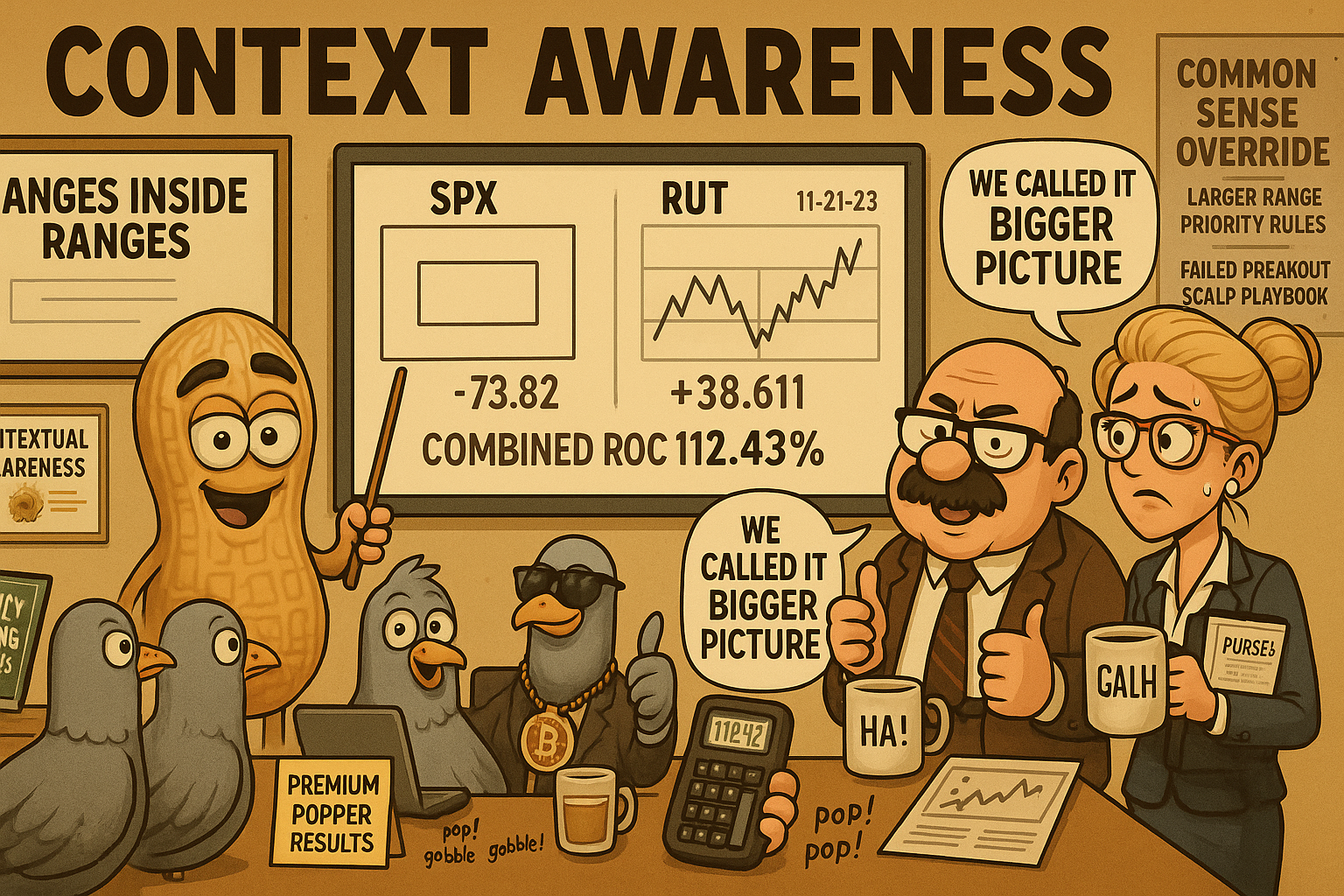

Rumour Has It…

The Financial Nuts team reports from the newsroom…

Percy’s been drawing “ranges inside ranges” diagrams all morning, teaching his pigeons about “contextual awareness in nested consolidation structures.”

Hazel updated the Premium Popper protocols to include “Common Sense Override Procedures For Larger Range Context.”

Mac’s glass is labelled “RANGE REVERSAL SPECIAL” whilst Kash calculated combined ROC. “112.43% total. Not bad for two scalps.”

Wallie grumbled approvingly: “In my day we just called it ‘looking at the bigger picture’ but I suppose ‘nested consolidation context’ sounds more sophisticated.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.