Ahoy there Trader! ☠️

Ahoy there Trader! ☠️

It’s Phil…

Welcome back (me) to the trading desk! After a few rough days of health, I’m feeling great and ready to dive into the market action.

This week is all about navigating consolidation and knowing your trading options!

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

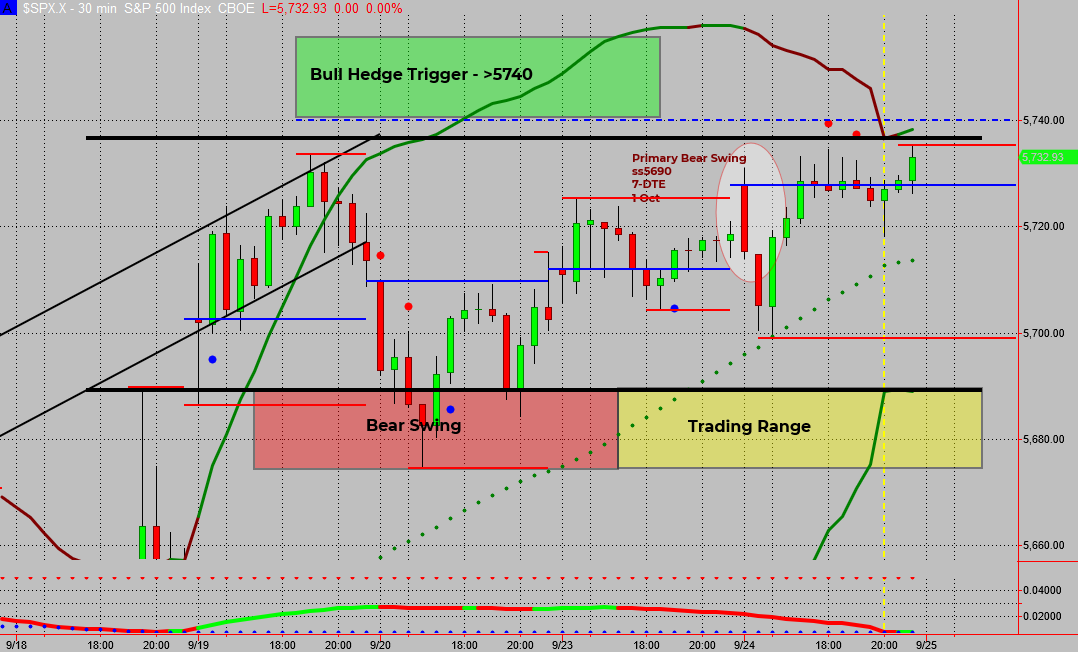

As I catch up on this week’s price action, it’s clear we’re firmly in a consolidation phase.

This means we have two primary choices:

- Trade the range back and forth.

- Wait for a breakout of said range.

Let’s break down how to profit from this situation!

Trading Strategies to Consider

When navigating a consolidation phase, here are the six key strategies to keep in mind:

1 – Buy the Dip: When prices pull back, snagging a bargain.

2 – Sell the Rally: Taking profits as prices rise.

These first two strategies rely on a clear trend, which we’re currently lacking.

3 – Buy Range Lows: Accumulate positions when prices hit the lower end of the range.

4 – Sell Range Highs: Profit when prices touch the upper limit. (and vise versa)

Those last two are where we want to be if we decide to trade the range back and forth, especially with the SPX Swing Trading System and Bollinger Bands in play.

5 – Buy Break of Range Highs: Jump in when prices break above the established high.

6 – Sell Break of Range Lows: Sell short when prices drop below the established low.

These last two strategies focus on waiting for breakouts to maximize profit potential.

By keeping these six money-making patterns in mind, you’ll always stay on the right side of your trading decisions!

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece