Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

This week’s market action feels like walking a tightrope blindfolded. Thursday’s half-day session adds to the suspense, but all eyes are on Friday’s Non-Farm Payroll for the real show. SPX is consolidating near Bollinger band lows, teasing us with potential moves. Let’s dive in before the market decides to make its big reveal!

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

Thursday brings us yet another mid-week half-day to disrupt momentum ahead of Friday’s much-anticipated Non-Farm Payroll (NFP) release. It’s like pausing your favourite movie during the climax – a mix of frustration and anticipation.

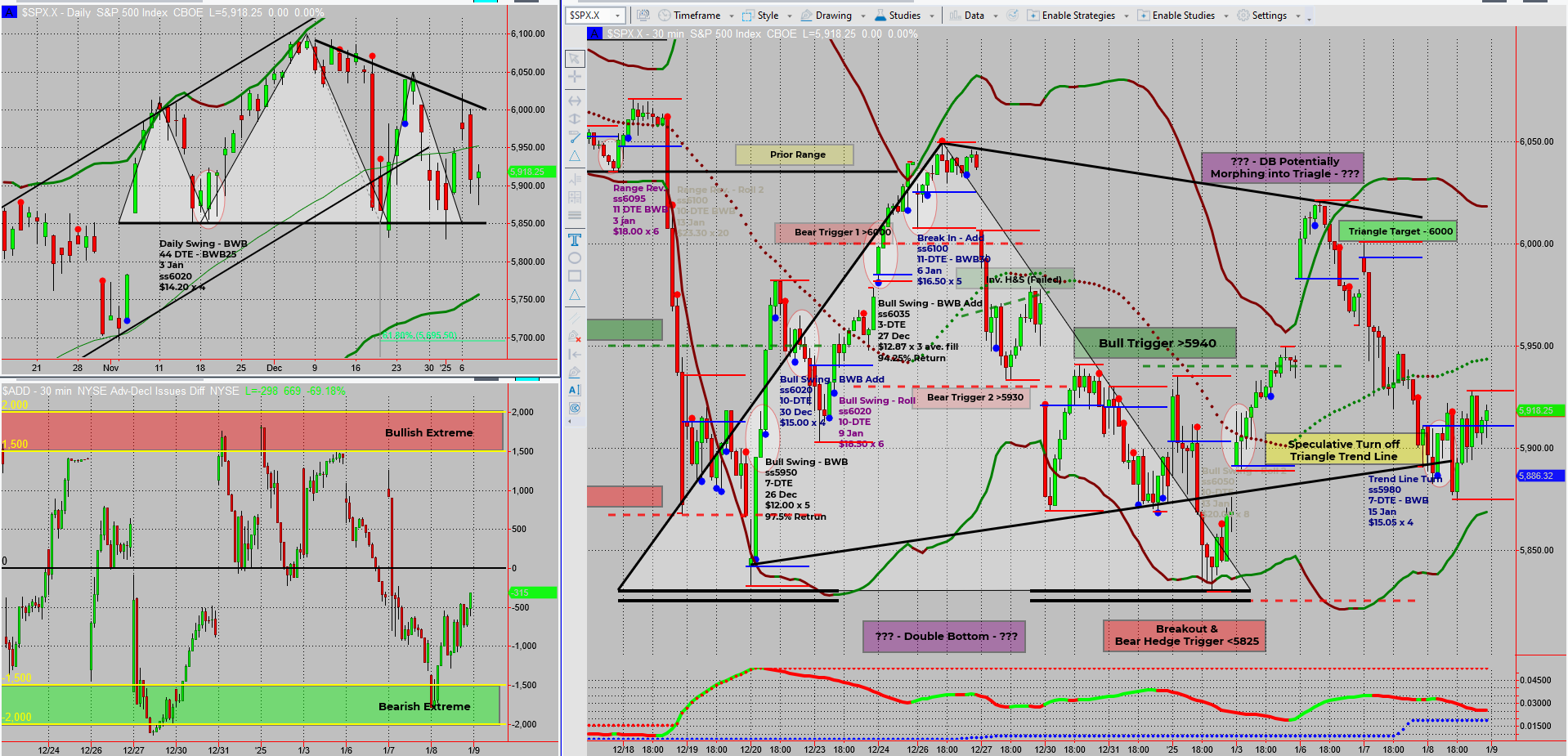

- Bollinger Bands Signal a Tightening Move: SPX prices hover near the Bollinger band low, with bandwidth narrowing tighter for the first time since Dec 20. Translation? The market is gearing up for a potential post-pinch big move.

- Consolidation Patterns Emerge: On the daily chart, a mix of indecision bars and an evolving head-and-shoulders pattern hints at consolidation rather than clear direction.

- A Speculative Swing: A Tag ‘n Turn bullish entry was taken off a tentative symmetrical triangle’s lower trendline, assisted by the $ADD reading hitting a bearish extreme.

- Target in Sight: The 30-min chart suggests a modest income swing from range low to range high, with the psychological level of 6000 as a key milestone.

For now, it’s a waiting game as Friday’s NFP could either validate these setups or shake things up entirely.

Fun Fact

Did you know the NFP report has been known to cause some of the largest intraday market moves in history? In 2013, a surprisingly strong NFP report sent the S&P 500 soaring by 1.7% in a single session!

Non-Farm Payrolls, often referred to as NFP, represent the total number of paid U.S. workers, excluding farm employees, government employees, and a few others. It’s a key barometer of economic health, making it a market-moving event. Traders prepare for volatility as even minor deviations from expectations can trigger massive price swings.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece