Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

The Santa Rally appears to have officially left the building this year, and the January effect seems to be tripping over itself with recent bearish moves. Historical data suggests this could mean a more challenging year ahead. Let’s dive into the latest SPX price action and see where the bears are leading us!

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

Santa’s No-Show and January’s Stumble

When Santa fails to rally the markets, it’s often a red flag. The well-known adage rings true: “If Santa Claus should fail to call, bears may come to Broad and Wall.” Unfortunately, this year appears to be no exception.

SPX Patterns Confirm a Bearish Breakout

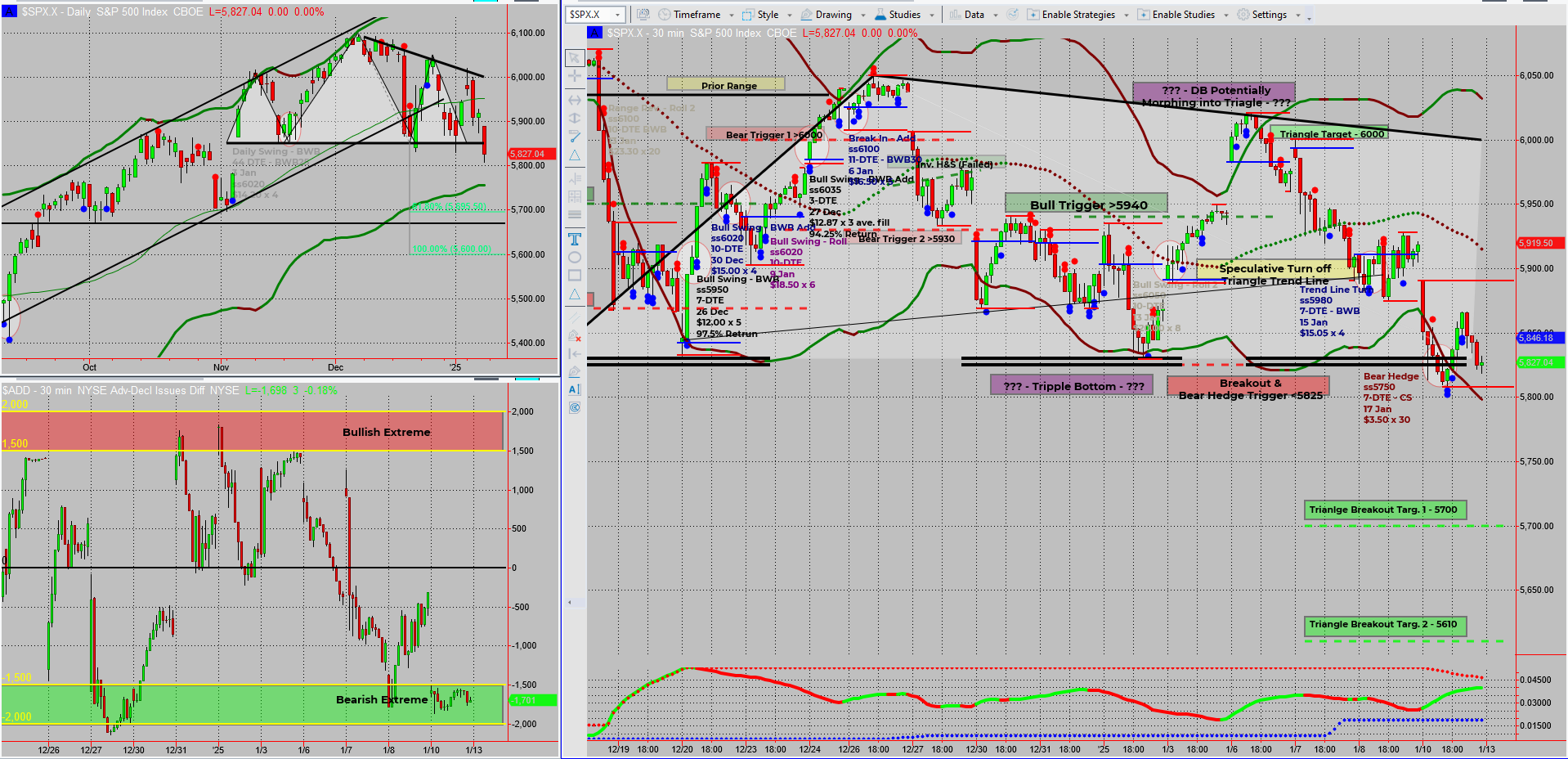

Looking at the SPX 30-minute chart:

- Last week’s price patterns morphed and broke south, triggering the daily head-and-shoulders breakout.

- The right shoulder evolved into a descending triangle, setting up a clear bearish move.

Overnight Futures Signal a Bearish Day

- Futures are already down 50 points, setting the tone for the main markets.

- A bearish day ahead seems likely, with downside targets at 5700 and 5610 in view.

Opportunities in a Bearish Market

- Friday’s bearish breakout/hedge trigger is in play, offering potential for a trending move downward.

- Compounding into this movement could allow for maximising profits while offsetting losses from bullish trades that didn’t reach their targets.

For now, it’s all eyes on the charts to see if SPX can deliver the anticipated move to targets.

Fun Fact

The January Effect Isn’t Always Bullish

The January Effect is the idea that stocks, particularly small caps, tend to rise in January. But here’s the twist: in years when December’s performance falters (like this year), January has historically been weaker too. It’s not a guarantee, but a fascinating seasonal quirk to keep in mind!

The January Effect was first observed in the 1940s and attributed to year-end tax-loss selling and reinvesting in the New Year. While it’s true that small caps often shine in January, when December’s performance is poor, January’s gains can be muted or even negative, bucking the trend entirely. Seasonal strategies can offer insights, but they’re not immune to broader market sentiment and volatility.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece