Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

Imagine pouring your life savings into a “can’t lose” investment, only to watch it crash spectacularly. That’s the story of the South Sea Bubble—a tale of unchecked greed, market mania, and the dangers of hype-driven investing. From soaring profits to devastating losses, let’s explore how Britain’s 18th-century investors fell for the original “get rich quick” scheme.

A Nation Entranced

1711: The Birth of the South Sea Company

The South Sea Company was founded with a bold mission: to manage Britain’s national debt in exchange for exclusive trading rights in South America. Hopes of lucrative trade opportunities mesmerised the public, setting the stage for what was to come.

1719: A Grand Proposal

The company proposed taking on Britain’s £50 million debt (worth £9.5 billion today) by issuing shares. Promises of financial stability and unimaginable profits lured investors from all walks of life, igniting a frenzy.

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

From FOMO to Frenzy

Early 1720: Mania Takes Hold ✨

By January, South Sea shares were trading at £128 (£22,000 today). As FOMO spread, ordinary Britons poured their life savings into the company, leveraging loans with as little as 1-2% upfront costs to increase their stakes.

Spring 1720: Hype Machine Ignites

Promoters claimed the company was a surefire path to wealth. By March, shares hit £290; by May, £480. Easy credit and wild optimism pushed prices even higher, reaching £1,050 (£180,000 today) by June—a 700% rise in just six months.

Summer 1720: Cracks Appear ⚠️

Insiders began cashing out as confidence waned. By September, panic selling replaced euphoric buying, and share prices plummeted to £700 before collapsing further to £150 by October—a staggering 85% drop from their peak.

The Aftermath

1721: Inquiry & Reform ⚖️

An inquiry revealed widespread fraud and corruption, implicating directors and even government officials. While many escaped punishment, reforms were introduced to regulate joint-stock companies. Shares eventually stabilised at £100 (£18,000 today), but for most investors, the damage was irreversible.

Lesson Learned: Greed and hype can override rationality, turning dreams of wealth into financial nightmares.

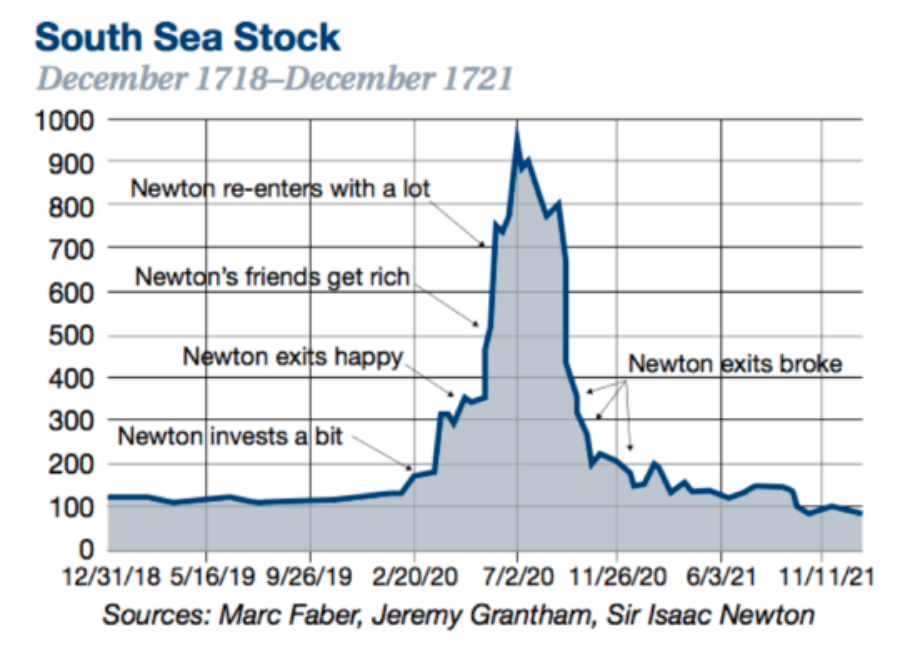

Even Isaac Newton Fell Victim

Even Sir Isaac Newton, one of the brightest minds in history, wasn’t immune to the mania. Initially, he sold his South Sea shares early for a tidy profit. But as prices soared, Newton couldn’t resist re-entering, lured by the prospect of greater riches.

This second foray proved disastrous. Newton bought near the peak, only to see his investment collapse. He reportedly lost £20,000—equivalent to millions today—and famously lamented, “I can calculate the motions of heavenly bodies, but not the madness of people.”

Newton’s tale is a stark reminder: no matter how brilliant, emotional investing can cloud anyone’s judgment.

A Warning Echoed Through Time

The South Sea Bubble reminds us of the dangers of speculation, overconfidence, and herd mentality. Whether it’s stocks, cryptocurrencies, or NFTs, the lesson is timeless: unchecked greed and hype can lead to ruin.

Fun Fact:

During the South Sea Bubble, other bizarre investment schemes emerged, including a company promising “a venture of great advantage but no one to know what it is.” It successfully raised funds before disappearing entirely.

The mania surrounding the South Sea Bubble wasn’t limited to one company. Speculative fever gave rise to absurd ventures, including one offering shares for “a company for carrying on an undertaking of great advantage, but nobody to know what it is.” This mystery scheme managed to raise funds and then vanished overnight, leaving investors empty-handed. It remains a comical yet cautionary tale about the gullibility of frenzied markets.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece