Premium Popper Ignites August With Fast-Scalp Fireworks

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

August opened with a bang and the system didn’t disappoint. The Premium Popper scalped the SPX like a pro surgeon on espresso, the Lazy Popper nailed the 60-min swing, and Tag ‘n Turn spun the dial from bearish to bullish coming out of the weekend.

So what did I do?

Nothing. I mentally clocked out, sipped coffee, and waved them all goodbye from the sideline.

Grab your coffee and scroll like you’re scalping a trendline

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

SPX Market Briefing:

Yesterday was a good reminder that sometimes the most profitable action is inaction. The systems were firing. I was not.

Instead of forcing trades in a foggy headspace, I took a step back – and yes, I mean back. All the way off the chart. It wasn’t fear or hesitation – just self-awareness. And that’s worth more than squeezing another 1-DTE for lunch money.

That’s also what I told the crew in yesterday’s group insider calls: some days, trading you matters more than trading the market.

Because let’s be real – if I were a brand new trader yesterday, feeling what I was feeling, I’d have absolutely hammered the buy/sell buttons like I was rage-quitting Donkey Kong.

But I didn’t. I sat it out.

And ironically, the system still won.

Call it System: 1, Trader: 0, and I’m totally fine with that scoreboard.

Today, however? I’m feeling sharp again.

The swing setup remains bullish. That gap from last week has been filled almost perfectly – which means the battlefield is drawn.

Bulls and bears now get to slap each other silly at the line of scrimmage.

Meanwhile, the Premium Popper and Lazy Popper day trades don’t care.

The mechanical rhythm beats on. I’ll be at the open, finger on the trigger, and if the bell rings right – I’m back in.

In Other News…

️ Live from the FinNuts News Desk…

“Markets Breathe, Twitch Slightly, Then Pretend They Meant To”

With your host Hazel-glamorous, unbothered, and armed with more sarcasm than Powell’s press secretary.

Risk-on? Risk-off? Risk-whatever, we’re buying everything.

Futures tiptoed into the session, still traumatised from last week’s macro rollercoaster. But then payrolls flopped harder than a reality TV comeback tour—and poof—yields collapsed, buyers appeared, and equities burst into song like a Disney third act. Apparently, missing expectations is bullish now.

Asia exhaled. Japan and China whispered “growth,” and nobody fainted.

PMI data actually came in better than expected (yes, really), giving the MSCI Asia-Pacific a polite 0.6% lift. The Nikkei added 0.5%—presumably as the yen took a breather from its usual “Olympic-level sprint against logic.”

U.S. markets did the Macarena.

Dow up +0.69%, S&P up +1.47%, and Nasdaq up +1.95%. Tesla surged, Spotify found its rhythm, and small caps outpaced for the first time since dial-up internet. Mega-cap tech? Still marching like it owns the place—which, to be fair, it does.

️ Commodities danced, but forgot the steps.

Brent gave back gains after OPEC+ waved the “more barrels for everyone” wand. The dollar hovered near 147 yen, refusing to pick a direction. Gold stayed shiny above $3,380. Meanwhile, market volatility calmed down just enough to be suspicious.

Final take?

The macro panic button’s been quietly shoved back in the drawer—for now. But FX and commodity nerves are twitchier than a caffeinated squirrel on margin. If you hear the phrase “soft landing” again this week, assume someone’s about to get rug-pulled.

Expert Insights:

NYSE Advancers-Decliners posted a rare +1,700 print yesterday – an extreme breath reversal not seen since March. High-volume breath shifts like these often mark strong rotational inflections or overbought reversals, depending on context.

[Source: Barchart – “NYSE Breadth Data”]

Rumour Has It…

Hazel’s newsroom sources say Goldman’s newest intern blew $4,000 on a 0DTE YOLO, citing “the v-entry looked strong on TikTok.”

He now works in compliance. Sorting printer toner.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

“SPX gaps tend to fill 90% of the time.”

It’s a popular myth… that misses the nuance. While some gap types (e.g. exhaustion gaps) have high fill probabilities, others (like breakaway gaps) may never close.

[Source: StockCharts – “Understanding Gaps”]

Meme of the Day:

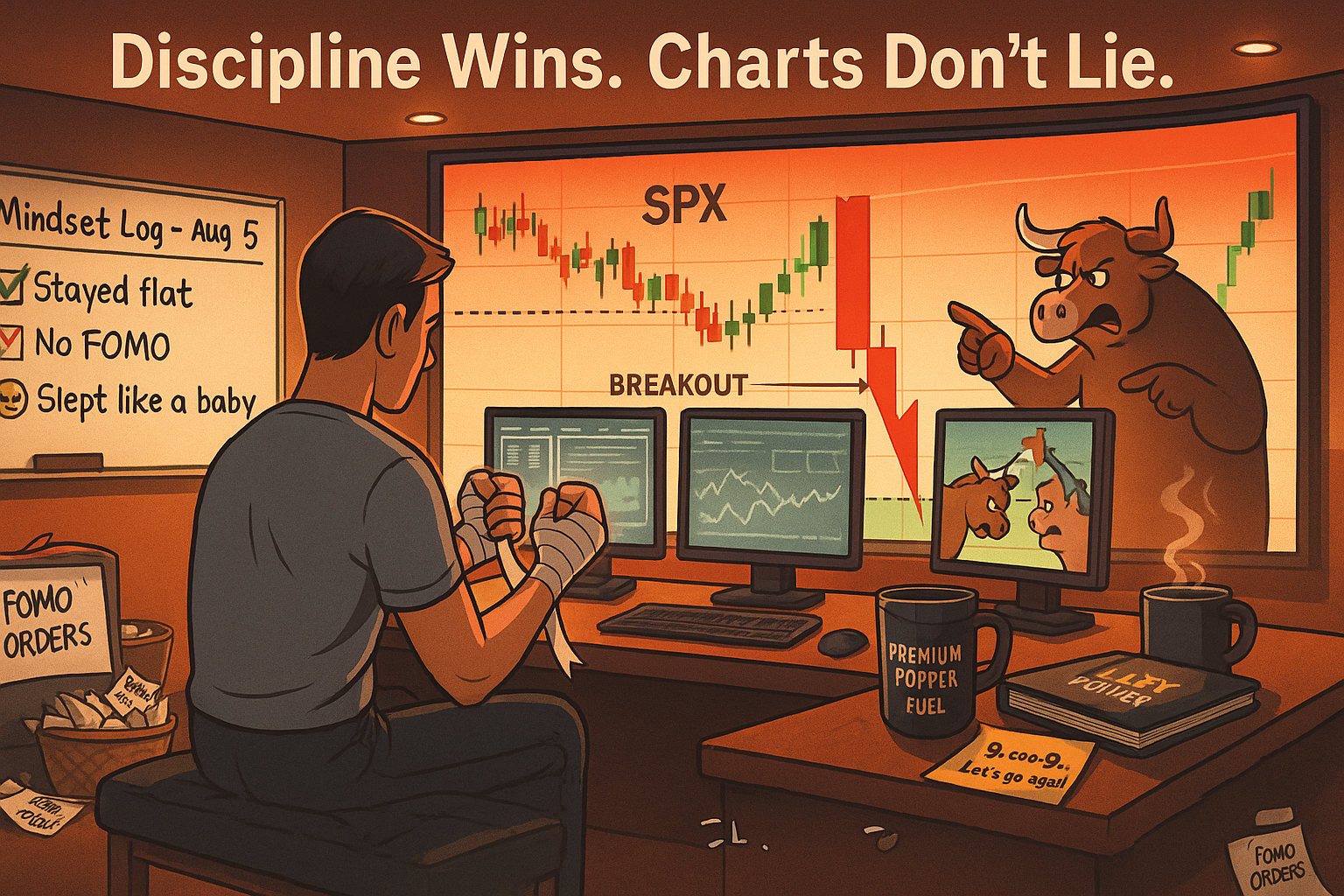

“When you sit out and still win…”

Split-screen: Trader sleeping like a baby vs. chart hitting all profit targets. Caption:

“System trades itself. I rest my case.”

IMAGE HERE

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.