9-for-9 Week Behind Us – Can Momentum Carry Through August?

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

New month. Fresh charts. Same game.

Friday’s close? Brutal.

August’s open? Cautiously optimistic.

The mission? Stick to the damn system.

Let’s break it down…

Zoom out. Zoom in. Then scroll down to lock in.

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

SPX Market Briefing:

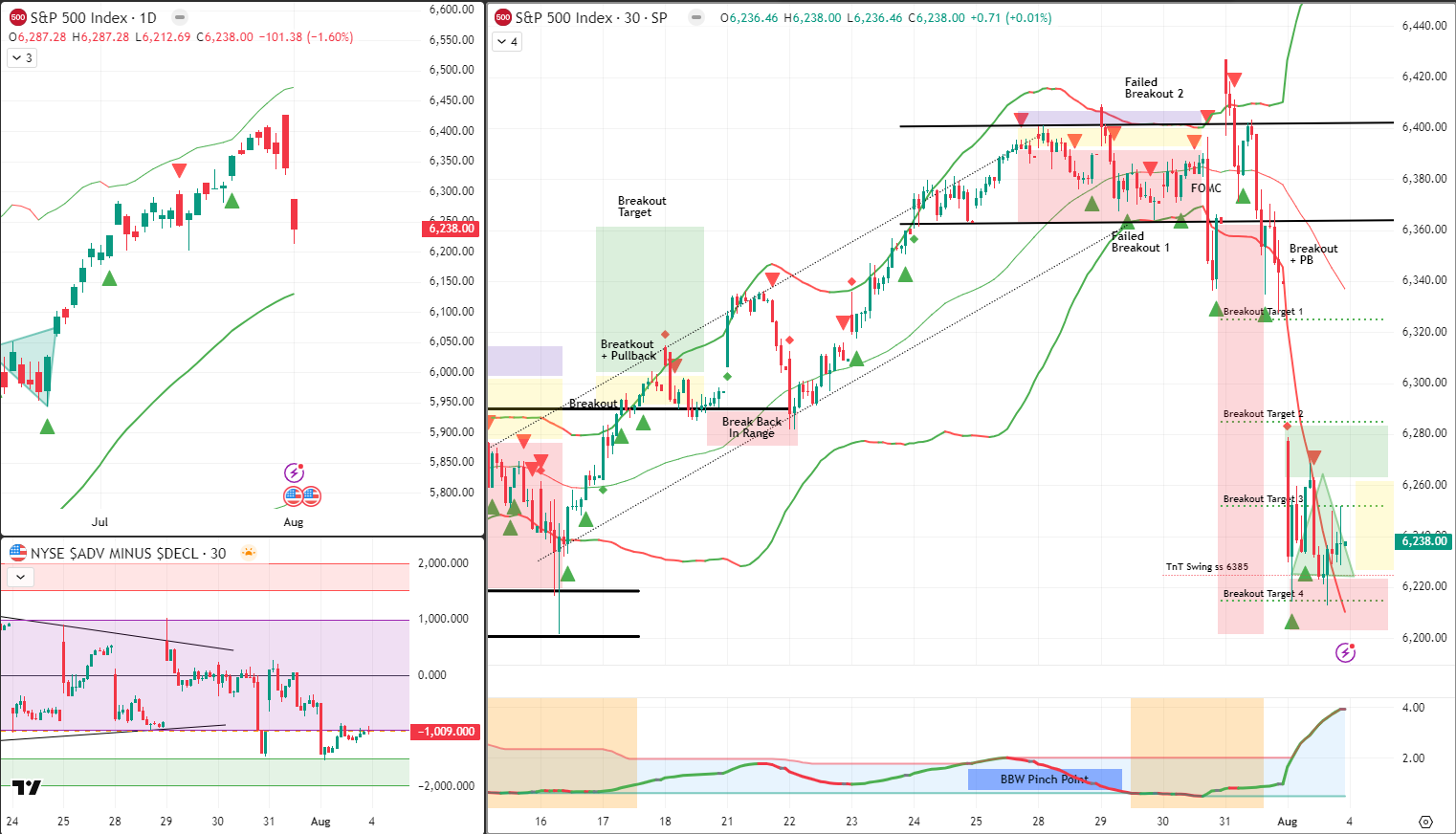

We start the new week and month ever so slightly zoomed out so we can see the landscape – not that it’s too important with a mechanical rule-based process – but it is nice to see what could happen and where it could unfold.

Looking left across the chart (7–17 July), we’re right back where the prior range lows developed.

From a technical point of view, this could be seen as support.

On the daily chart, that small range could even be forming a left shoulder, with the head being the rally higher to those frustrating NATHs and the eventual sell-off.

So what could we expect next – assuming the pattern continues to unfold?

AntiVestor View: same thing continues until something “new” happens. A small pause or attempted rally would make sense here. Flip back to the 30-min chart – Bollinger Band Width is showing maximum expansion. Translation? We’ve just sprinted the 100m dash. It’s time to rest before the next race.

The system is almost in alignment with opinion.

We have a new bullish Tag ‘n Turn setup pending, and I’m delaying entry with a more conservative v-pattern entry (highlighted on chart). That puts the key trigger at above 6260 for bullish trades.

As such – the system remains bearish until we are bullish.

If the bull trigger triggers, then the PFZ (Pulse Flip Zone – our new risk management trigger) sits just below 6220.

The swings shall remain swinging – and I shall continue to scalp the open with the new Premium Popper setup and the reimagined 60min Pulse Bars for lazy premium day trades.

Let’s see if we can keep last week’s 9-for-9 wins rolling into this one.

“The Columbo Comment” – Just one more thing…

Overnight futures are up small – around +40 points or +0.6%. Which, given the recent volatility, is now considered small. Last week during the chop? That would’ve been huge. It’s all relative. And that’s the fly in the ointment – be cautious of those gap-highers and trade lower moves. Don’t get too excited around the opening the bell.

In Other News…

️ Live from the FinNuts News Desk…

“Markets Got Whiplash and a Nosebleed-Blame Payrolls, Probably”

Good evening, I’m your host, still wearing yesterday’s tie and this morning’s hangover-and here’s what the markets coughed up while you were asleep, pretending to understand macro.

Jobs data grabs the wheel, drives straight into a hedge.

Futures started the day flat-like the UK’s favourite pub ale-before lurching higher as traders tried to make sense of Friday’s payroll whiplash. The S&P and Nasdaq now appear to be stabilizing, by which we mean: they’re no longer actively panicking. It’s not so much confidence as it is stunned confusion.

Asia’s doing jazz hands, but Japan tripped over its yen.

MSCI Asia-Pacific eked out a 0.3% gain, with Australia and Taiwan managing not to embarrass themselves. Meanwhile, Japan’s Nikkei fell 2.1% after the yen bulked up overnight, presumably by deadlifting Treasury charts. China, unfazed, nodded politely at its new bond tax rule and went back to pretending everything’s fine.

️ Oil gave up faster than a gym bro in leg day denial.

Brent reversed its early gains after OPEC+ announced more barrels were hitting the dance floor-547k bpd to be exact. That’s barrels per day, not biceps per dude. Add in weak Asian demand and oil slumped ~1%, while gold also lost its Friday glow, slipping 0.3%-a quiet retreat, like someone leaving a party before being asked to explain crypto.

Tariff relief? Ha. Cute.

The U.S. Trade Rep just confirmed Trump-era duties are “set”-in other words: “Yeah, we meant that.” China, meanwhile, may tighten liquidity as bond tax exemptions expire, prompting FX markets to curl into a defensive crouch like a French waiter being asked for ketchup.

That’s the news-still sideways, still sarcastic. Keep your trades tight, your metaphors loose, and remember: in markets, as in marriage, sometimes doing nothing is the only winning move.

Expert Insights:

“Max BBW after an impulse move often signals exhaustion – not continuation.”

If you’re looking for edge, track BBW contractions after expansion. That’s often the real setup.

[Source: Barchart – “Volatility Pulse and SPX Compression Zones”]

Rumour Has It…

FunNuts anchor Hazel was seen toasting last week’s clean sweep with a bottle of “Market Merlot” and a mic-drop. “Three trades? On a Friday? That’s a payout hat-trick.” Ratings up 312%. Bears declined to comment.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.