Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

The markets are buzzing after a surprise December jobs report shattered expectations. A whopping 256,000 jobs added, a drop in unemployment to 4.1%, and a hot labour market have sent shockwaves across stocks, bonds, and beyond. But don’t celebrate yet – the ripple effects could shape the Fed’s next moves and the entire 2025 rate outlook. Let’s dive in!

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

Job Market Breakdown:

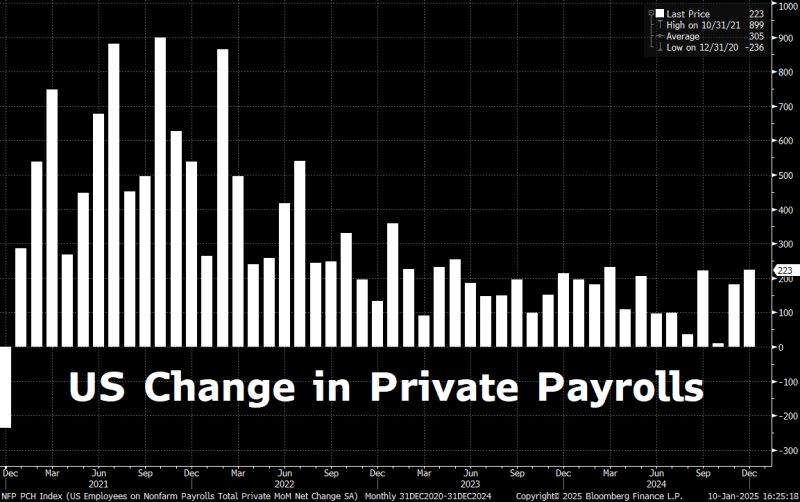

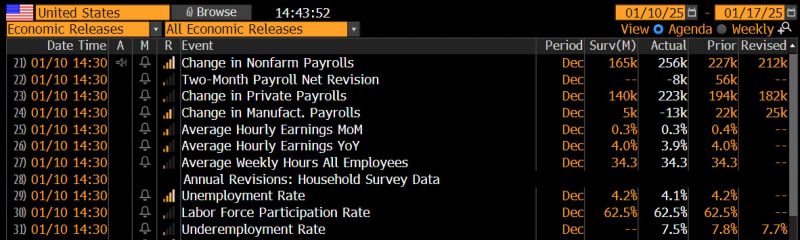

- December’s Non-Farm Payrolls blew past expectations: 256k jobs vs 165k expected.

- Private payrolls added 223k jobs, while the household survey showed a staggering 478k gain.

- The unemployment rate fell to 4.1%, marking a robust end to 2024.

- Wages disappointed slightly, rising 3.9% YoY vs the expected 4%.

Market Reaction:

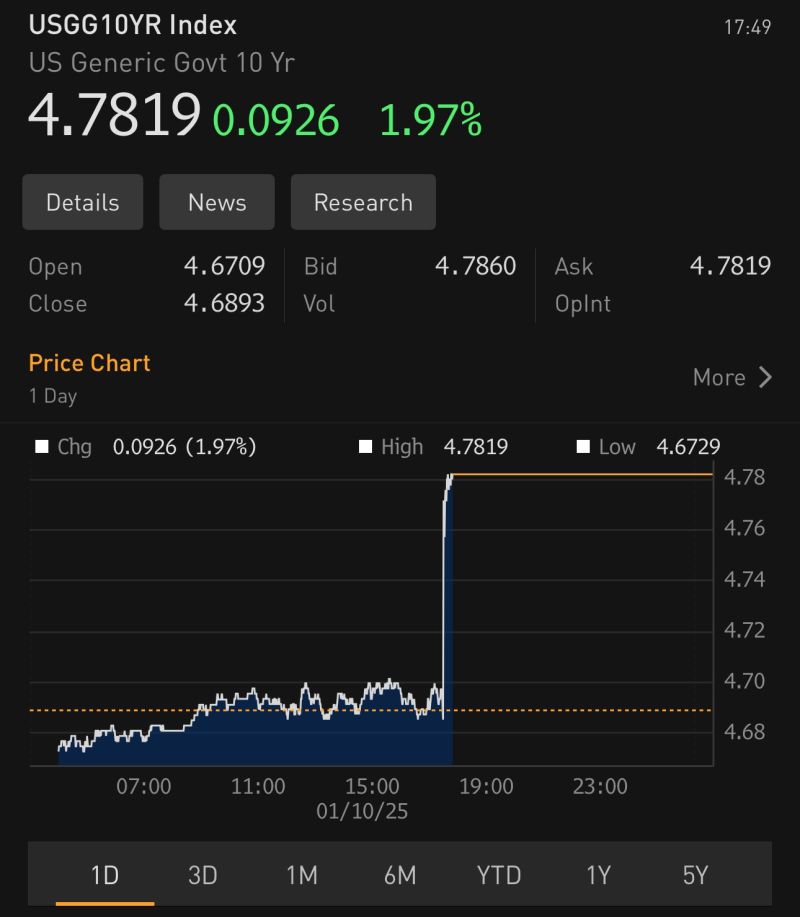

- Treasury yields soared, with the 30-year hitting 5% – the highest since 2023.

- The 2s10s yield curve steepened to 39bps, its sharpest slope since May 2022.

- Stocks didn’t take the news well, with the S&P (-1.5%) and NASDAQ (-1.7%) retreating.

Fed’s Rate Cut Dream Fades:

- Futures now price in just 30bps of rate cuts in 2025, compared to 38bps pre-report.

- Bank of America says the Fed cutting cycle is over and hints at possible hikes if inflation persists.

- Goldman Sachs slashed its 2025 rate cut projection from 75bps to 50bps.

What’s Next for Traders?

- Keep an eye on CPI data next week – it could reignite market volatility.

- Gold surged over 1%, reflecting inflation concerns, while Bitcoin stayed flat at $94k.

- The labour market’s resilience keeps the economic debate alive: Are we heading for more growth or gearing up for a slowdown?

Fun Fact

The U.S. added a record 6.4 million jobs in 2021, rebounding from pandemic lows. While job growth has slowed since then, 2024’s addition of 2.2 million jobs remains a testament to the economy’s durability.

The pandemic saw the U.S. economy shed millions of jobs overnight, but the recovery was equally swift. In 2021, a record 6.4 million jobs were added, thanks to a surge in economic activity. While job growth has since cooled, the steady gains in 2024 highlight a resilient labour market even as inflation and rate hikes challenge broader economic stability.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece