Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

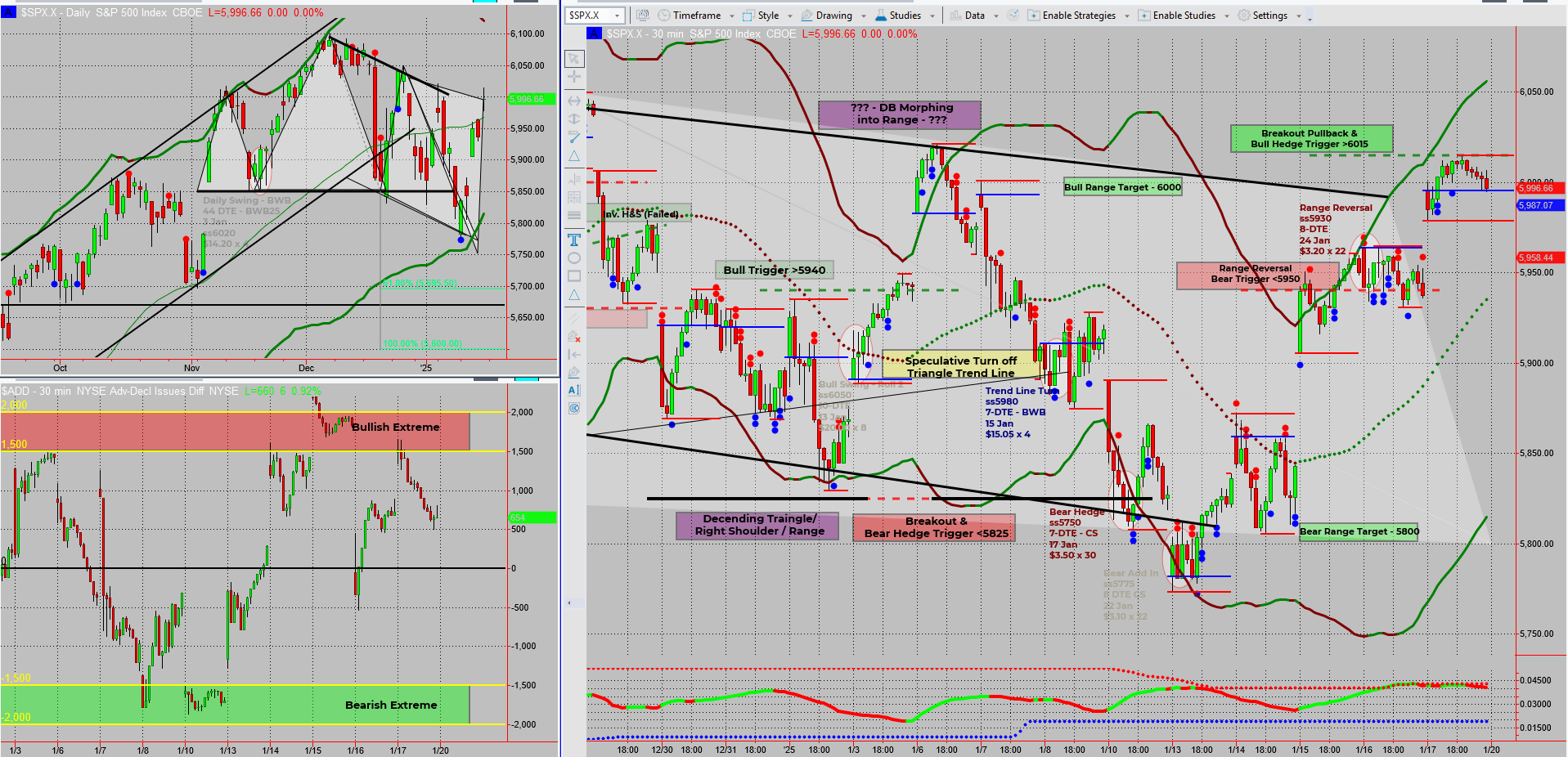

After a long weekend featuring Trump’s second inauguration and MLK Day, markets returned with a bang—or should I say a chaotic shuffle. Futures swung up 40 points, down 65, then up another 55 points. The regular markets are looking to open slightly elevated on Tuesday. Could this be the ultimate “buy the rumour, sell the news” moment? Let’s dive in and chart the path forward!

SPX Deeper Dive Analysis:

A Wide-Ranging Market Dance

The overnight futures gave us a rollercoaster preview: a tug-of-war between bulls and bears, all while the regular markets took a breather. As Trump 2.0 steps into office, we’re left pondering whether this will be a case of “buy the rumour, sell the news.” The data and trend cycles suggest a tilt toward short-term bearish sentiment—always worth keeping an eye on.

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX: Triggers and Tactics

The SPX chart remains in its wide-ranging range, and adjustments are the name of the game. I’ve updated my bullish trigger to 6015, reflecting Friday’s potential breakout-pullback combination.

Here’s the current game plan:

- Bear trades are active from the range reversal setup.

- Above 6015, I’ll hedge and start positioning for bullish moves.

- Long-term calls on IWM and DIA from the post-election win are still active—so I’m not missing out on potential long-term gains.

Exploring the Crypto Frontier

Here’s a curveball: I’m dipping a toe into the crypto corner. Research is underway to explore BTC ETF cash options as a new avenue for applying my SPX Income System. If liquidity holds up, this could open up exciting new opportunities for trading crypto with options—a method that fits right into my wheelhouse.

Getting Back Into the Groove

After another extended weekend, it’s time to saddle up and refocus. The wide-ranging SPX setup provides plenty of room for tactical plays, and with futures showing signs of volatility, the stage is set for some interesting moves this week.

Fun Fact

Bitcoin ETFs have been hailed as the “gateway drug” to institutional crypto adoption. The first US-approved Bitcoin futures ETF launched in October 2021 and hit $1 billion in assets within just two days—faster than any ETF in history!

This rapid adoption highlights the growing institutional interest in crypto, driven by the simplicity and regulation of ETFs compared to traditional crypto investments. While volatility remains a hallmark of Bitcoin, the ETF route offers a structured entry point for traders and investors alike.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece