Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

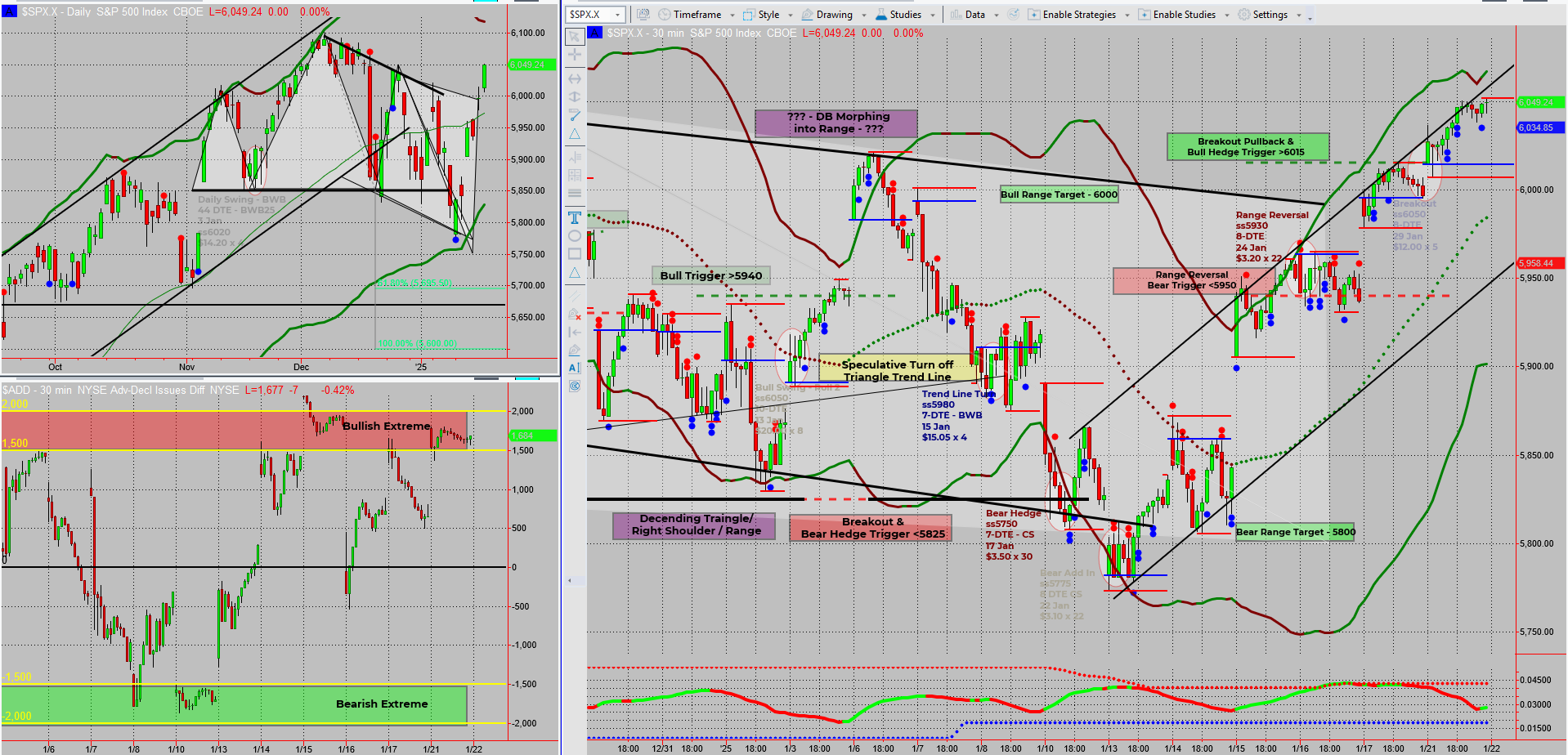

SPX has officially broken out, and the price action is riding the upper Bollinger band like a sailor clinging to shore leave. While the bulls are cheering, I can’t help but feel a twinge of unease. A market that moves in a straight line? It feels like stretching a rubber band too far. Let’s dig into the details and why this bull run could be setting the stage for something sharp and unexpected.

…keep scrolling for more in-depth analysis ⬇️⬇️⬇️

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Breakout Analysis:

SPX Breakout: The Good, the Bad, and the Nervous

The breakout we’ve been eyeing is now official, with SPX prices trending “high and tight” along the upper Bollinger band. According to JB, this alignment is a hallmark of a strong trending movement, suggesting the current trajectory could continue for “a wee while.”

- Strong Momentum, But…: While it’s great to see this kind of sustained upward movement, the lack of pullbacks makes me nervous. Straight-line moves often remind me of a rubber band stretched to its limit—sooner or later, it snaps.

- The Risk of Exhaustion: Markets thrive on rhythm. Steady climbs with pauses along the way signal health. While it’s fantastic to see the trend hold firm, I much prefer steady moves with well-timed pullbacks. A consistent rhythm suggests a healthy market; a relentless climb, on the other hand, feels like we’re stretching the proverbial rubber band. The longer this goes on, the more likely it is to snap back with a “sharp and deep” corrective move.

- The Feb/Mar Correction Season: Historically, February and March have a bit of a reputation for corrections and volatility. Pair that with the current relentless climb, and it feels like the perfect setup for a market reset.

- Trader’s Mindset: For now, the bulls remain in control, and I’ll continue to watch the breakout unfold. But I’m keeping a wary eye on momentum. Should signs of exhaustion creep in—like fading volume or an overextended RSI—it might be time to get defensive.

Pro Tip: Straight-line moves are exciting, but they’re rarely sustainable. Look for pullbacks or consolidation to confirm the trend is holding strong before diving in.

Fun Fact

Did You Know? The concept of Bollinger Bands was developed in the early 1980s by John Bollinger, who noticed that price volatility often moves in cycles. Bollinger’s innovation allowed traders to visualise when markets were “overbought” or “oversold.”

Interestingly, Bollinger Bands remain one of the most popular technical indicators, standing the test of time across decades of market change.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece