Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

Welcome to another shortened trading week, thanks to Presidents’ Day (or maybe an extended Valentine’s weekend for the lucky ones).

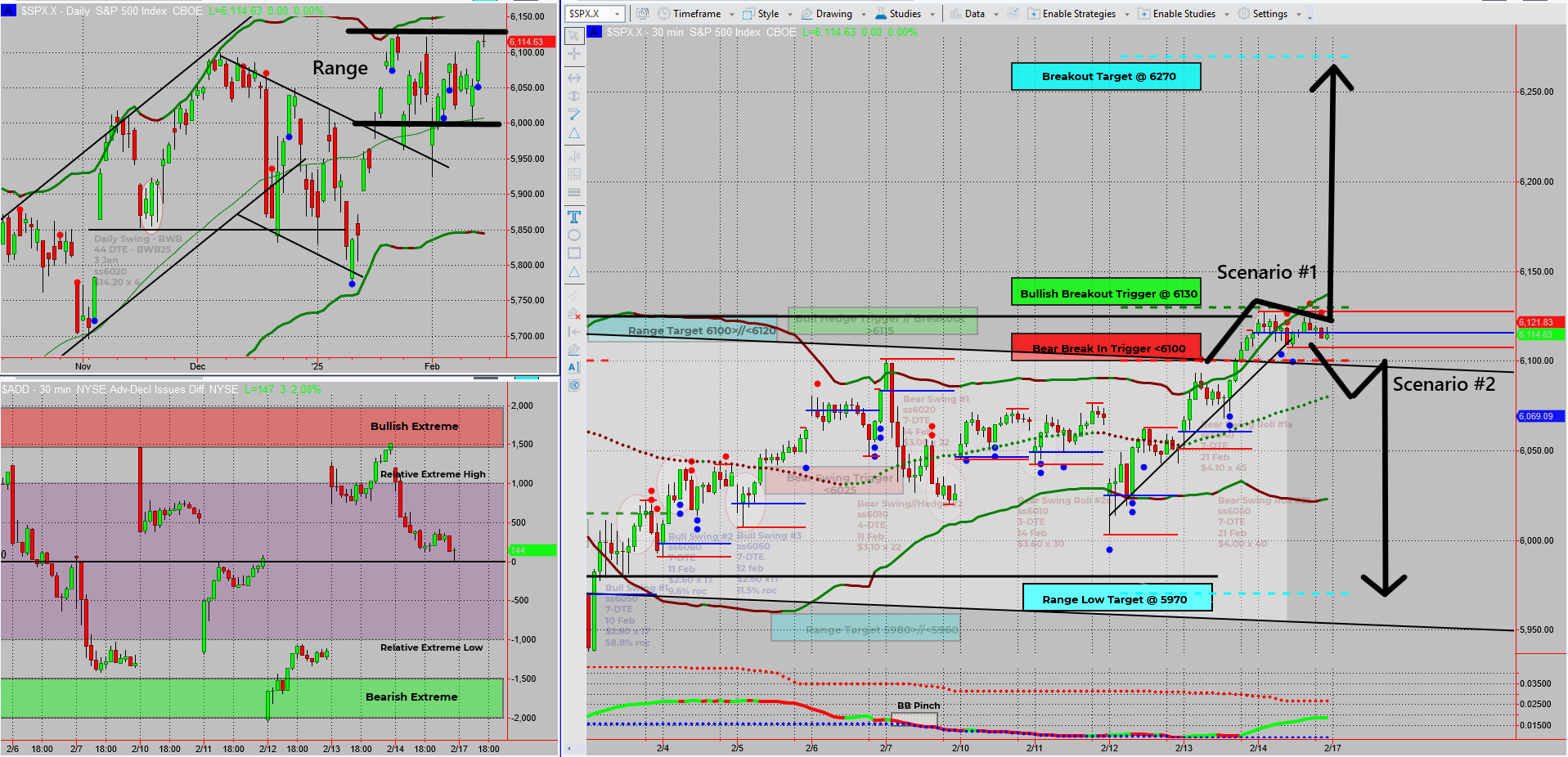

With all the nudge nudge, wink wink out of the way, let’s talk setups. I’m watching two key trade scenarios—a breakout continuation or a break-in reversal (aka a false breakout).

For now, it’s time to grab a cuppa and a hobnob while waiting for the markets to open.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

$500-$5,000+ Days – Even in a Market Collapse!

Important Question: What if you could turn market uncertainty into a $500-$5,000+ daily opportunity – in just minutes?

Imagine logging in, placing a simple trade, and moving on with your day – stress-free.

The SPX Income System has helped traders generate consistent, recession-proof income – WITHOUT needing years of experience.

Now It’s your turn – Click watch free training and start trading smarter today!

SPX Deeper Dive Analysis:

☕ Tea, biscuits, and breakout confirmations

With Tuesday’s open ahead, my focus is on two key setups that could determine the next tradable move.

Scenario #1 – The Breakout That Needs to Prove Itself

On Friday, SPX tried to break out, but price action was about as decisive as someone staring at a restaurant menu for 20 minutes before ordering a burger.

- Price meandered sideways, leaving traders guessing

- I chose to sit this one out, because long weekends can mess with momentum

- Now, we watch if Tuesday brings real follow-through

If this breakout is legit, we should see:

✅ A strong push above Friday’s highs

✅ Sustained momentum without rapid reversals

✅ Clean continuation setups for bullish entries

If we get weak price action, I’ll hold off on longs and consider the next setup…

Scenario #2 – The ‘Break-In’ (A False Breakout Setup)

Now, let’s talk about something you won’t find in trading textbooks—the Break-In setup.

Think of it like this: Imagine SPX breaking out, getting everyone excited, then suddenly doing a U-turn and slamming back into the previous range. Traders who chased the breakout get trapped, and those who spot the reversal early have a golden shorting opportunity.

Signs of a Break-In setup:

❌ Price fails to hold breakout levels

❌ Quick rejection and reversal back into the previous range

❌ Bearish momentum builds instead of continuation

If SPX falls back into the range, I’ll be watching for short setups, because these moves can be quick and brutal.

So What’s the Plan?

1. Watch for Tuesday’s Open – If SPX continues Friday’s breakout, we look for bullish setups. If not, the Break-In trade is on the table.

2. Avoid Jumping in Too Early – Long weekends can create fake momentum that doesn’t hold. Patience is key.

3. Keep an Eye on Volatility – If volume is weak, the move could be another dud. But if volatility spikes, we could get a real tradeable move.

Key Takeaway? SPX has picked a direction, but the real move happens once full liquidity returns. Until then, I’ll be enjoying my tea and biscuits while the market figures itself out.

Fun Fact

Did you know? The biggest post-holiday market crash happened in 1929, when the Dow plunged 12.8% after a weekend—triggering the Great Depression.

The Lesson? Markets don’t take holidays—they just store volatility for later. That’s why smart traders stay prepared for anything after a break.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece