Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

It’s Monday… and the markets are once again dancing like a puppet on a tweet-fuelled string.

One minute, tariff fears.

The next, selective exemptions for “favourites.”

Now the weekend’s over and futures are bouncing higher like none of it happened.

SPX looks set to test – or break – the 5400 bull trigger, and if you’ve been following the last few newsletters, you’ll know that’s a big one.

We’ve mapped it.

We’ve rejected it.

Now we’re staring it down… again.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

SPX Is Rigged… In Your Favour (If You Know This).

The markets move. You get paid. No stress. No surprises.

The 5400 Line Returns

Let’s back up.

5400 has been my bull/bear trigger for weeks.

When we’re below it, I’m hunting bear swings.

Above? I start reassessing bullish setups, GEX bulls-eye trades, and pullback long entries.

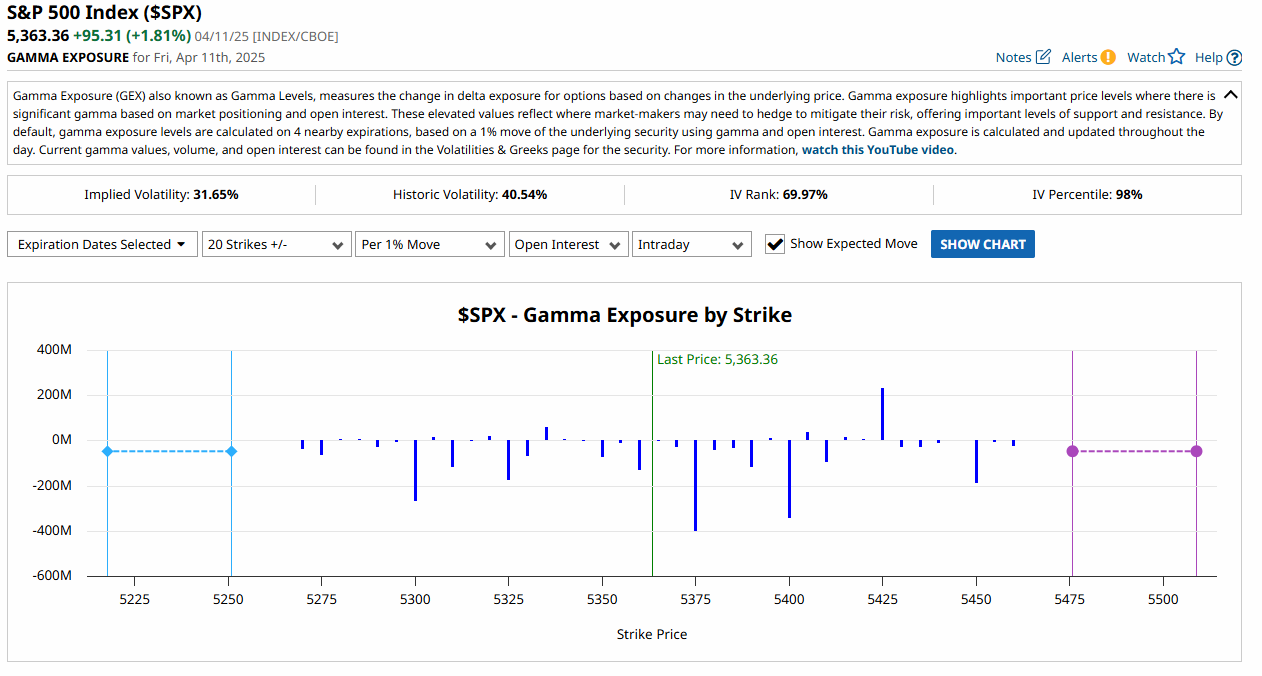

This week, the GEX flip is also sitting around 5400.

That’s no coincidence.

It’s now more than just a price level –

It’s the emotional fault line between headline-driven panic and headline-driven hope.

So… do we flip bullish?

Not so fast.

Strategy: Structure First, Narrative Second

Just because futures are up doesn’t mean momentum is back.

We’ve seen far too many fakeouts, tweet-spikes, and algorithm blinks to trust the first move on a Monday.

That’s why my plan is simple this week:

✔️ 5400 is still the decision line

✔️ No aggressive trades until price confirms

✔️ Will adapt only if structure shifts – not just sentiment

This week isn’t about swinging for the fences.

It’s about precision. Patience. And setup clarity.

Behind the Charts: Tinkering, Rebuilding, Refining

While the markets work out their next identity crisis, I’m taking the time to:

-

Optimise my new charting layout

-

Tweak + update my indicator codebases

-

Re-align my tools for speed and efficiency

Because if the market wants to act like a circus,

I’ll tighten the tent and sharpen the knives.

GEX Analysis Update

- Eyeing 5425

Expert Insight – Don’t Rush the Flip

Common mistake:

Flipping long just because futures are green.

Fix:

Use anchored levels like 5400 as your decision points – and only flip bias when structure confirms.

GEX flips, pulse bars, and price action matter.

Tweets do not.

Fun Fact

Did you know?

In 2023–2024, over 60% of intraday SPX rallies over 1.5% failed to hold past 2 days when triggered by political headlines.

Translation?

Headline rallies are easy to sell into – unless they’re confirmed by price.

Video & Audio Podcast

Coming soon…

Happy trading,

Phil “Tethered to Nothing but My Levels” Newton

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

Join today and I will personally hop on a quick start call with you to get setup and running in my system in less than 45-mins.

- Options 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.