Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

You know that feeling when the market does exactly what you’ve planned for? Yeah… that.

On today’s Fast Forward call, while retail traders were still scrambling to process the weekend tariff noise, we calmly executed a picture-perfect trade at 5400/5425 – the same level we’ve been eyeballing for weeks.

The setup was sharp. The timing was sweet. The confirmation came from both GEX flip alignment and one of those cheeky “…oh and…” analysis nuggets we always look for. Premium collected. Risk defined. Exit set.

By late afternoon, while the markets were flipping and flopping like a fish on a trampoline, we hit our $0.30 target and banked a smooth 90% profit.

No panic. No guessing. Just structure.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

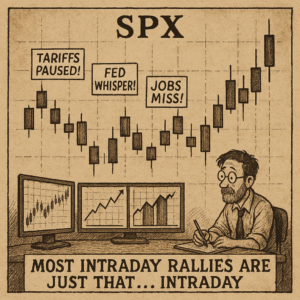

SPX Pays Daily. If You Know This One Setup.

Pulse bar + credit spread = reliable income. It’s that simple.

Let’s rewind for a second.

This trade was built before the open – not after. And that’s the power of planning.

-

Premarket Analysis: 5400 was identified as the GEX flip level – a major decision zone.

-

Market Open: SPX gapped up directly into our zone.

-

Confirmation: Fast Forward group walked through the “oh and…” extras – things you only get from real-time teamwork.

-

Execution: Opted for a 0DTE bear spread, aiming to avoid late-day chop and maximise the intraday opportunity.

-

Result: Entry at $3.00 premium, exit late in the day at $0.30 – textbook 90% win.

What made this work?

-

Pre-determined levels – no guessing.

-

Group discussion – refined the thesis.

-

Low-risk, fast execution – avoided big swings.

The beauty of this trade isn’t just the 90% return – it’s the simplicity. We didn’t need a perfect entry. We didn’t need a news edge. We followed structure. We trusted the system. And we let the levels do the talking.

Expert Insights: Chasing the move after the fact.

This is a common trading mistake:

How to Avoid It:

-

Define your levels before the open (5400/5425 was known hours in advance).

-

Let the price come to you.

-

Use 0DTE tactically when volatility is high – they let you avoid market chop while still capitalising on intraday edge.

Fun Fact

Did you know?

SPX pulse moves near GEX flip points often produce higher win-rate trades with faster time-to-target. This is because market makers adjust exposure quickly when price tags their hedging zone.

In today’s trade, the price literally bounced off the flip line, giving our 0DTE setup maximum edge with minimal time risk.

Let the pros hedge.

We’ll just trade their footprints.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

Join today and I will personally hop on a quick start call with you to get setup and running in my system in less than 45-mins.

- Options 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.