Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Well, the heehaw seesaw shenanigans continue…

Trump’s doing his best Oprah impression:

“You get a tariff! You get an exemption! Everyone gets… confusion!”

But SPX? Not impressed.

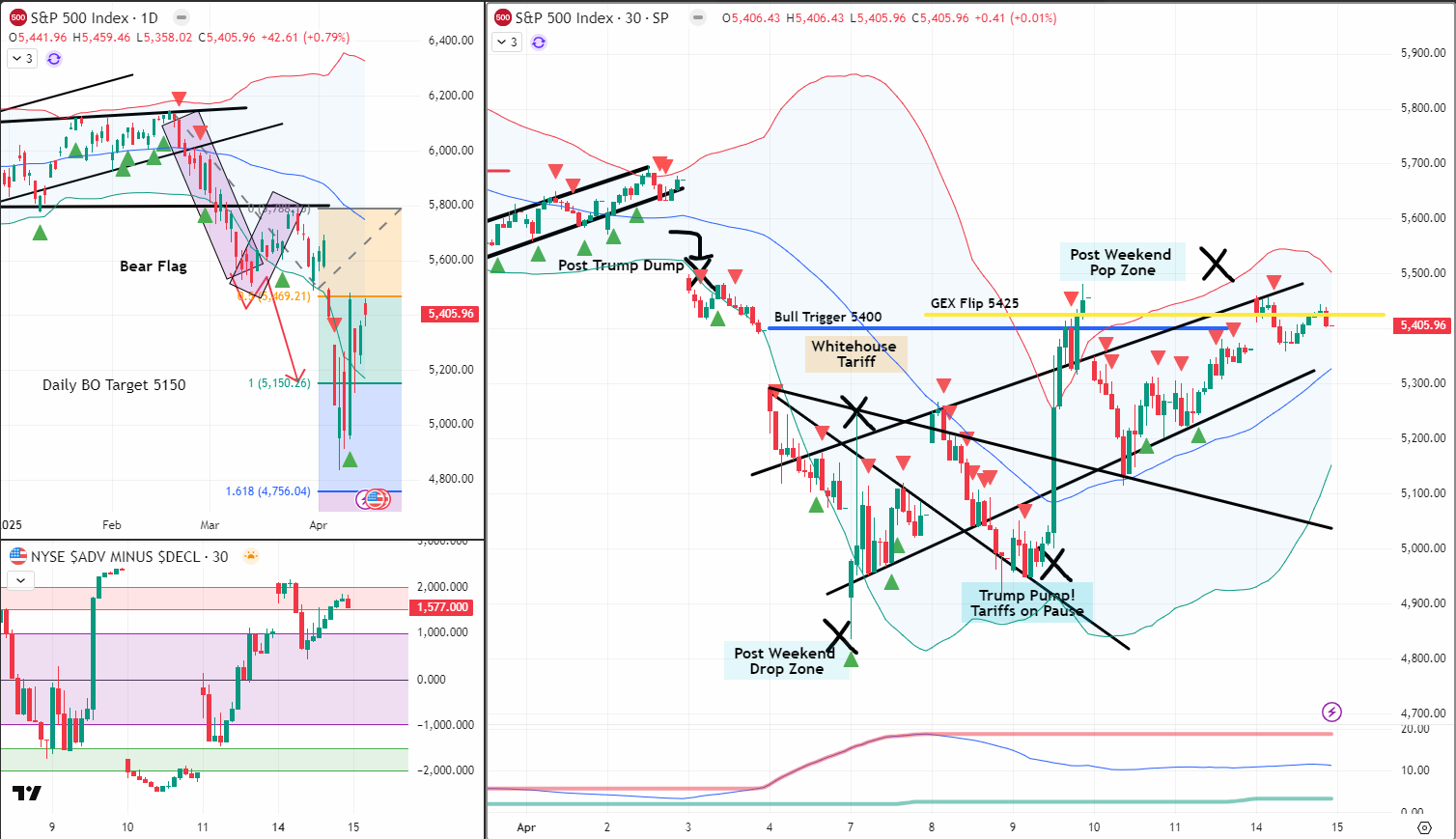

After Monday’s gap-up, we didn’t push higher.

We didn’t hold gains.

We didn’t confirm breakout.

Instead, we saw another turn at 5400/5425 –

That same GEX-backed level we’ve been talking about for weeks.

And that, my friends, was the signal.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

SPX Pays Daily. If You Know This One Setup.

Pulse bar + credit spread = reliable income. It’s that simple.

Chain Reaction + Pattern Recognition

Let’s break it down.

News headline?

“Tariffs paused… for some.”

Cue emotional futures bounce.

Market reaction?

Gap higher.

Hit 5400.

Pause.

Reverse.

Technical setup?

-

Rising wedge

-

Minor consolidation

-

Textbook bearish structure

-

One of my 6 money-making patterns

System action?

-

Short-dated expiry trade triggered

-

0-DTEs to manage volatility

-

Leaning into structure, not opinion

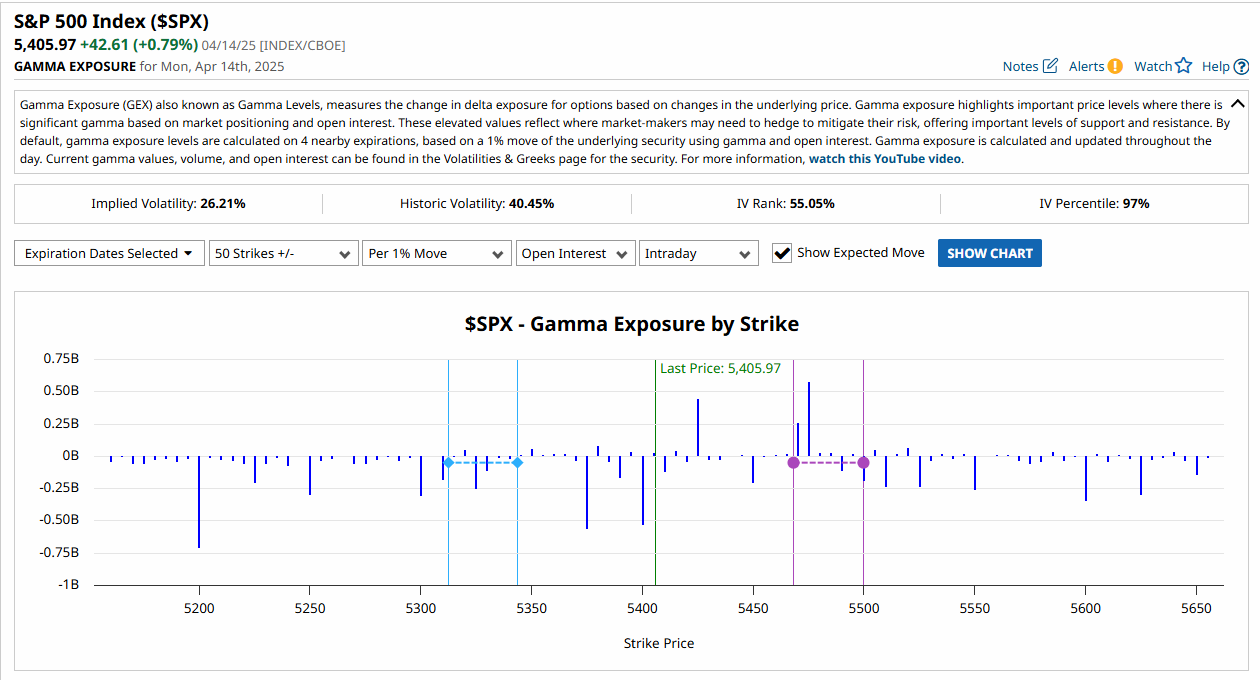

Aditional Confirmation?

-

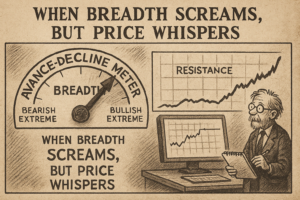

ADD sitting at a bullish extreme

-

Suggests more room down, not up

This isn’t a guess. It’s a repeatable edge.

And we took the trade.

What I’m Watching Now

✅ 5400/5425 = still the bull/bear line

✅ Rising wedge structure active

✅ Short-dated trades only – this market’s still flipping on a dime

✅ ADD extremes + lack of futures action suggest no fire yet under this bounce

If we stay below 5400 – I’m staying bearish.

And I’m hunting pullbacks and pulse bars on the short side like a trader who’s seen this dance before.

Because I have.

GEX Analysis Update

- 5400/5425(again)

Expert Insights: Patterns > Predictions

Mistake:

Assuming a breakout is “real” just because of news or a gap.

Fix:

Recognise and trust pattern structure.

The rising wedge isn’t just a drawing – it’s a time-tested money-making setup.

Combine that with ADD and GEX, and you’ve got alignment.

Want to win consistently?

Stop naming candles & patterns. Start trusting structure.

Fun Fact

Did you know?

The Advance-Decline Line (ADD) hitting a bullish extreme while SPX stalls is one of the strongest contrarian signals for a short-term top.

It means breadth is overstretched, but price isn’t expanding.

Translation?

The rocket ran out of fuel at 5400.

Happy trading,

Phil “You Get a Tariff! But I Get the Trade” Newton

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

Join today and I will personally hop on a quick start call with you to get setup and running in my system in less than 45-mins.

- Options 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.