Range High Reject Sends Pulse Bar Signal – Profits Collected Fast

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Back from the lakes, back in the flow.

After last week’s stalled-out price action and a swing that went nowhere, it was good to hit the ground running this week. The new pinch zone marked Friday was the key – and on Tuesday, that same auto-plotted range helped set the trap.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

SPX Options = Cashflow Engine.

With this setup? It’s practically an ATM with a checklist.

SPX Market Briefing:

With last week’s bear setup expiring in the wilderness and little else setting up during my break, Monday’s fresh pulse in the charts gave us exactly what we needed: a clear entry location.

The pinch range that began developing Friday was now clear. With my updated software, the range box was plotted automatically – and as expected, price danced right up to the upper edge on Tuesday’s open.

Then came the pop-and-drop.

We saw a sharp gap higher on the open, briefly poking above the range high, followed by an intraday reversal that triggered a clean Bear Pulse Bar — textbook. Both the swing and the 0-DTE entry were taken live.

And by mid-afternoon?

The 0-DTE was a wrap.

$2.10 collected on entry.

Closed out at $0.10.

That’s a 95.5% ROC with no fuss.

Now we watch to see if this rolls lower toward the range lows – and whether our swing position can catch that move too.

Rumour Has It…

FinNuts tried calling it “bullish continuation” – but forgot to zoom out.

Price tagged the auto-marked range highs. Then sold off.

And one sharp-eyed intern in the back of the studio?

He was spotted dragging a purple box across the chart.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Tuesday was textbook SPX seasonality.

According to Stock Trader’s Almanac, the second trading Tuesday in July often delivers above-average returns – with profit-taking into Wednesday and Thursday ahead of OPEX

[Source: Stock Trader’s Almanac – “July Trends”].

So if it felt a little too easy – that’s because Tuesday usually is.

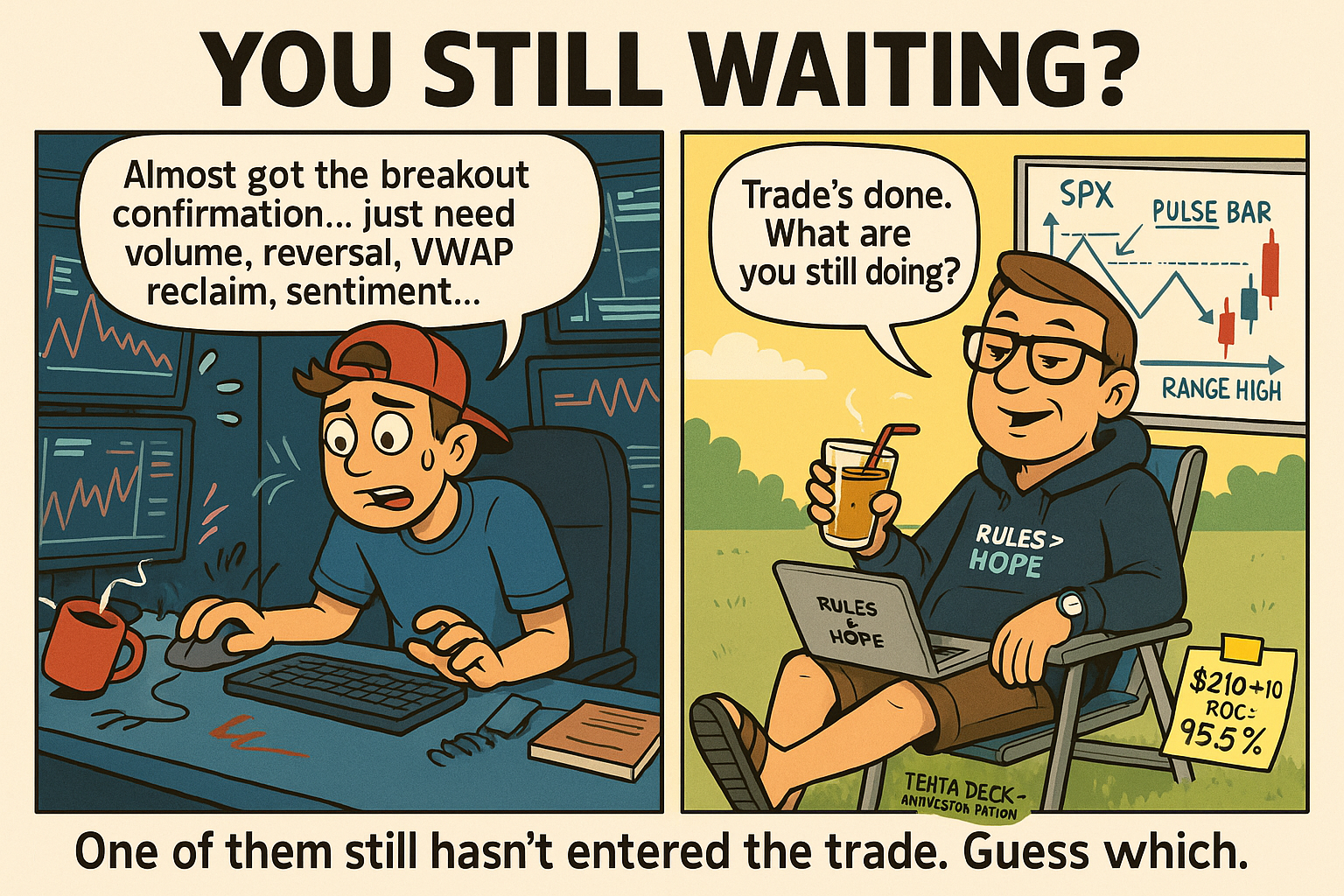

Meme of the Day:

“One of them still hasn’t entered the trade. Guess which.”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.