Tech Earnings Week Hype vs Reality – Mind the Gap

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

…and it’s another new week for the markets.

The talking heads are losing their minds over “Big Tech Earnings Week” like it’s some sort of holiday. Spoiler alert: it never lives up to the hype – with a few wild exceptions.

So while the financial media and their minion army chant in unison [minion gibberish intensifies], I’m lacing up my boots (ankles willing), and getting back to work… premium-selling work.

After a partial week of injury-induced feet-up trading, I am now fully fee-down.

“Ignore the hype. Sell the edge. Collect the check.”

SPX Doesn’t Need You To Be Right. Just Consistent.

Pulse bar tells you when. Credit spreads handle the rest.

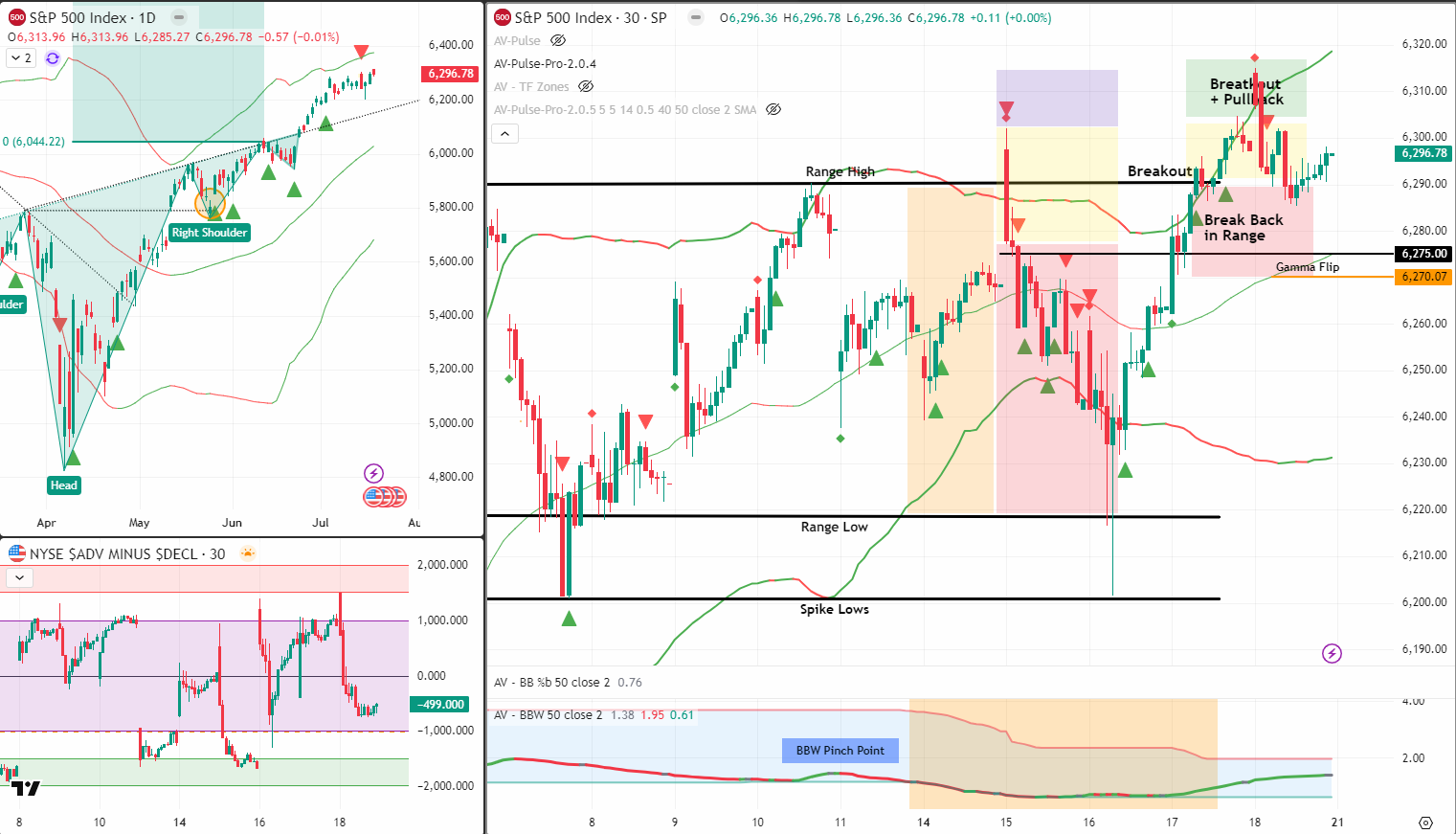

SPX Market Briefing:

SPX did it – broke out clean from the range that capped price for most of July.

The textbook reversal we were tracking at the range lows? It happened… but I personally missed it due to a cocktail of late entries, early exits, and foot-related misadventure. (Think long walk and a short pier!)

Several students hit it bang on. That’s a community win.

We’re now trading just above range highs, with an early pullback inside the range now clearly rejected.

Today’s chart shows:

-

A breakout above the 6,290 ceiling

-

A retest that briefly dipped into the prior box

-

And now? Futures are saying “Up she goes” – sitting +20pts at the open.

Two plans now sit in front of us:

-

Breakout Continuation – clean hold above range and new trend leg forming.

-

Range Rejection Reversal – fakeout rally meets resistance, drops back in.

Futures strength and positive earnings whisper suggest the former.

Tech stocks may exaggerate the moves, but we’re already positioned – spreads on, theta dripping.

And yes, that deep retracement from earlier July? Might be canceled. But the pause we expected? Landed it perfectly.

In Other News…

Circuits Hot, Policies Half-Baked

Markets flatline with confidence while chaos reheats in the microwave

Asia sneezes, markets don’t flinch.

Japan’s government tripped over itself in the upper-house elections and the Nikkei shrugged like a teenager asked to do chores. Currency pairs barely moved. Traders calmly concluded that if it doesn’t come with an ETF ticker, it doesn’t matter.

Meanwhile, AI is still juicing the tape.

TSMC rolled out a sparkling Q2 print-profits hotter than a soldering iron at a GPU factory. But management slid in a plot twist: surprise tariffs may crash the party in late 2025. Traders nodded solemnly, then immediately bid up every semiconductor on the planet.

Oil and hope float.

Rumors of a last-minute US–EU trade peace summit gave cyclicals a caffeine jolt. Brent oil ticked higher, silver popped 1.2%, and somewhere in a hedge fund bunker, a macro PM started Googling “tariff détente.”

Crypto enters the chat with legal swagger.

Trump signed the Genius Act, finally giving stablecoins a legal wardrobe. Bitcoin soared past $123k, Ether flexed a six-month high, and Wall Street banks suddenly remembered their blockchain keynote slides from 2021. BOA wants a coin, Morgan Stanley wants a seat-just don’t ask who’s reading the fine print.

Big picture: Calm, but cocked.

The VIX naps near 14. Markets feel balanced like a unicycle on a frozen lake. One nudge-AI earnings, CPI shock, or a tweet from 1600 Pennsylvania-and this whole thing could start cartwheeling.

Expert Insights:

The Fakeout Break-Back Test

False breakouts often return to the range top – the “kiss of death” for weak longs.

What we’re seeing instead:

Price popped back into the range, then reversed right back out.

That’s your clean trigger.

Combine it with the +20pts from futures and it’s hard to call this anything but bullish bias – for now.

IMAGE HERE

Rumour Has It…

Tech earnings hype is at fever pitch.

But seasoned SPX traders know what usually happens: a lot of noise, a few 4% pops, and no lasting market direction.

The chart doesn’t care what Apple announces. But it does care about reactions.

Let the minions argue – we follow the setup.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

According to historical data, SPX tends to rally 72% of the time in weeks where futures are green premarket and tech earnings dominate headlines.

But guess what? Those rallies also experience larger intraday reversals than average – perfect for premium sellers who time the turns.

[Source: MarketWatch – “SPX Reactions to Tech Earnings – 2024 Summary”]

Meme of the Day:

Ignore the drama, sell the levels

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.