Back in the Box? Or Launching Toward ATH? Watch This Level

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Very little has changed on the battlefield. SPX didn’t go up… didn’t go down… just sort of stood there – looking confused, like it forgot why it came upstairs.

The plan from Wednesday? Still the plan. The key levels? Still the key levels.

“Is this a breakout? Or just another chart cosplay?”

SPX Pulse Bars Don’t Lie. They Just Pay.

Top 5 % candles = predictable edge. Learn it. Use it. Profit.

SPX Market Briefing:

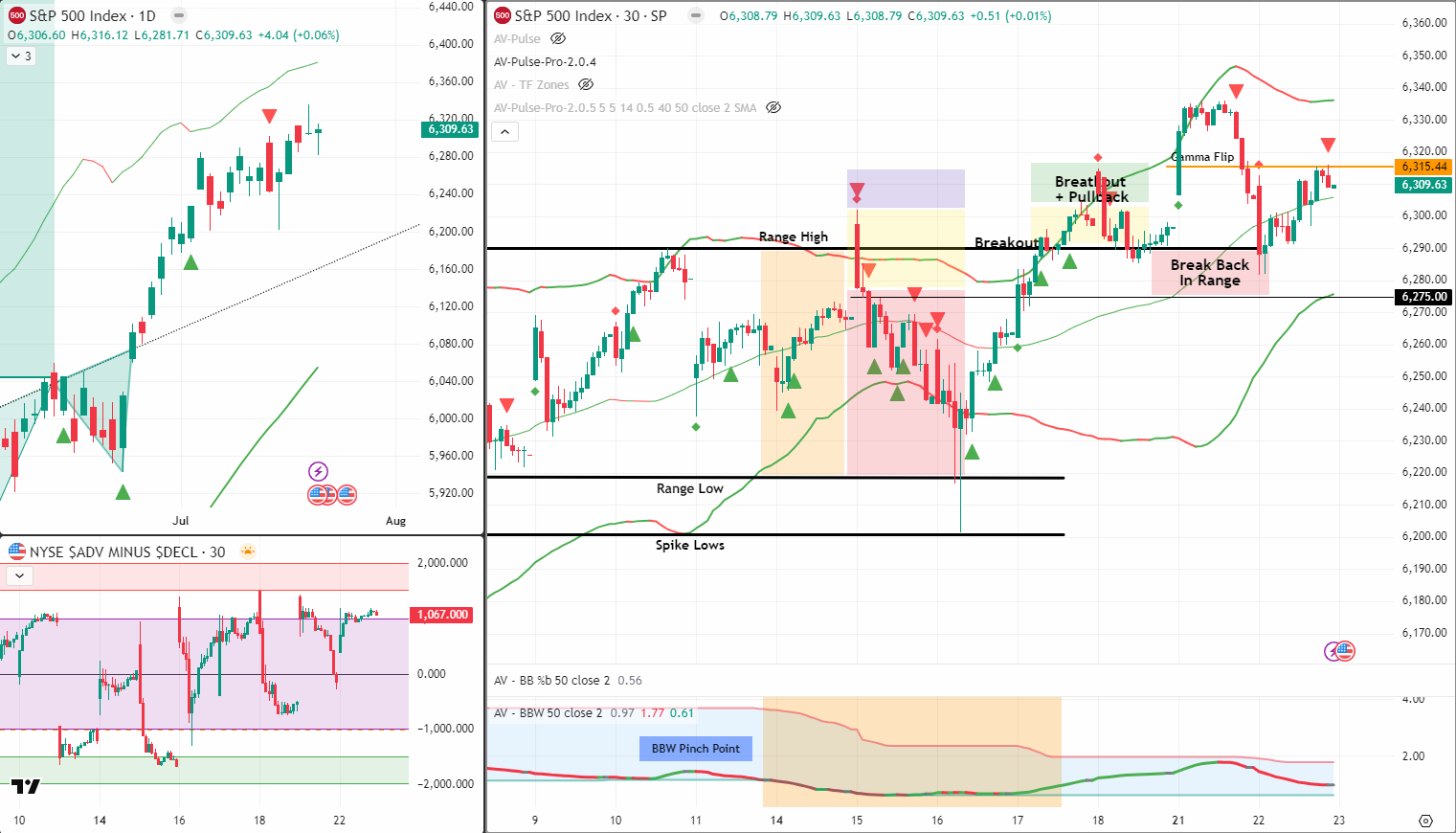

We’ve got a breakout above the 6290 range highs – technically. But it’s the kind of breakout you eye suspiciously, like a stray balloon at a funeral. Price tried to re-enter the range yesterday. A clean move below 6280-6275 should give us that familiar pop n drop we’ve been waiting for – with 6200 as the natural magnet at the range lows.

As for the bull camp?

Hard to get excited until we’re back above 6340. That’s the level that earns my attention – not this indecisive candle cosplay… also its the current hedge trigger level.

The daily chart’s still rocking back-to-back rejection bars, and when you zoom in to the 30-min, there’s zero conviction either way. We’re straddling the fence and pretending it’s strategy.

I’m leaning bearish – not because of vibes or headlines, but because price hasn’t earned a bullish stance. Give me a clean rejection. Give me a clear shove. Until then? I’m sitting on my hands and letting the SPX pick a side.

In Other News…

Markets Stare Into the Void, Blink Twice, and Keep Driving

Flat charts, twitchy FX, moody oil, and crypto sneaking out the back

• Asia pulls a ‘meh’.

The MSCI Asia index lifted a polite 0.3% like it was holding the door for Wall Street. Japan’s Nikkei looked up from its soba noodles just long enough to say, “election? What election?” Risk appetite? More like risk tapas-just a nibble, no commitment.

• Europe gets FX‑slapped.

SAP just reminded the class that every time the euro breathes, €30 million gets punched out of its quarterly numbers. Milan’s doing an anxious shuffle, Frankfurt’s clutching a calculator and whispering “please don’t rise again.” Margin season’s open and the euro’s swinging elbows.

• Wall Street… waiting for dad to come home.

Futures went full statue-mode ahead of Powell’s speech. Monday was beige, and today might be taupe. Traders are poised like kids staring at the thermostat, praying the Fed doesn’t notice inflation creeping back in.

• Oil leaks, crypto flexes.

Brent’s lost its footing thanks to trade tension fog, slipping 0.5% into the indecision zone. Meanwhile, the dollar stood tall in the hallway, bullying everything with a balance sheet. Crypto? Quietly pumping iron in the basement, getting ready for its next unsolicited comeback tour.

Expert Insights:

According to Goldman Sachs Prime Brokerage, net leverage among hedge funds remains near YTD highs, with exposure skewed toward mega-cap tech and AI names. SPX breadth, however, remains narrow and highly reactive to rotation signals across sectors like energy, discretionary, and financials.

The AntiVestor Truth:

When everyone’s crowding into the same AI boat, it only takes a ripple to flip the whole thing. If you’re betting long at these highs without a cashflow cushion, you’re not a trader – you’re a volunteer tribute.

[Source: Bloomberg – “Goldman Says Hedge Funds Are Piling Into Tech Again”]

Rumour Has It…

FinNuts News Desk BREAKING :

“SPX CONFIRMS UPTREND. AGAIN. PROBABLY.”

Hazel says the breakout candle has been awarded an honorary MBA in Momentum. Percy’s waving around a Risk On pennant while Wallie’s still trying to recalculate fair value with a calculator from 1983.

Their take? ATH incoming. Again.

Our take? The range isn’t dead until it’s dust.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact

Forecast: 72% Rally Week, but beware of the fakeout storm

Research from SpotGamma shows SPX has historically rallied into earnings weeks when Gamma levels flip positive – but the largest intraday reversals often occur mid-week as volatility spikes and positioning compresses.

[Source: SpotGamma – “Gamma Flip & Earnings Week Positioning”]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.