Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

It’s happening again…

Markets are selling off.

Headlines are screaming.

Commentators are foaming at the mouth.

And somewhere in the distance, a CNBC anchor is probably sweating through his hair gel yelling, “Is this the BIG ONE?!”

Plot twist:

It’s not.

This isn’t 2008.

It’s not even COVID-2020.

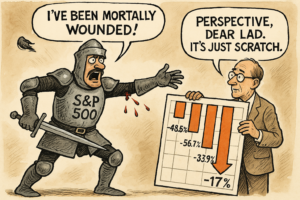

This… is a mild flesh wound.

Now before you roll your eyes, let me explain…

Let’s hop in the time machine.

Dot-Com Bubble (2000–2002):

-48.5% drawdown.

Markets got punched in the bandwidth.

Global Financial Crisis (2007–2009):

-56.7% drawdown.

Lehman brothers forgot how money works.

COVID Crash (2020):

-33.9% drawdown.

A virus sneezed and the world faceplanted.

And today?

Current S&P 500 drawdown: -17%.

Seventeen.

We’re not even halfway to pandemic levels.

Barely a third of GFC territory.

Yet here we are, with social media screaming “collapse” like it’s auditioning for a disaster movie.

This is where the Monty Python reference kicks in:

“Tis but a scratch.”

“A scratch?! Your arm’s off!”

“No it isn’t.”

This market is flinching.

It’s not dying.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Why It Feels Worse Than It Is

Markets don’t move in straight lines.

They lurch.

They panic.

They price in fear… then overshoot.

It’s what they do.

This week’s tariff talk?

It added fuel to already-wobbly sentiment.

Short-term pain? Sure.

But structurally? This is still within the bounds of “normal.”

In fact, drawdowns under 20% are routine.

Like a Tuesday hangover for someone trading SPX 0-DTEs without a system.

What Smart Traders Do Now

Perspective is power.

This is not the time to panic.

It’s the time to stay strategic, stick to structure, and use drawdowns as opportunity – not fear fuel.

This is why I use the SPX Income System.

Because it doesn’t care about noise.

It trades levels.

Patterns.

And edges that repeat.

Expert Insights: Mistaking Noise for Narrative

Common Trading Mistake:

Panicking during drawdowns without historical perspective.

Fix:

Zoom out.

Check your chart’s Y-axis.

Recognise fear spikes for what they are – temporary sentiment flares.

System-Based Traders don’t flinch on red days.

They look for pulses, pivots, and pattern setups – not headlines.

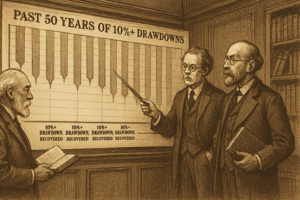

Fun Fact

Did you know?

In the last 50 years, the S&P 500 has suffered 25+ drawdowns greater than 10%.

And yet… it’s hit new highs again every single time.

Markets don’t grow like bamboo.

They grow like brambles.

Messy. Sharp. But upward.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% Off

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

Join today and I will personally hop on a quick start call with you to get setup and running in my system in less than 45-mins.

- Options 3: Join the Fast Forward Mentorship – 50% Off

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.