While Everyone Talked Santa Rally, RUT Quietly Delivered Bear Swing Profits

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Right before the Christmas break – while most people were talking about the Santa Rally (including myself) – RUT quietly setup a new bear swing trade.

And yes, I was mostly expecting this to turn tail and flip to bullish.

But the setup is the setup.

And I ain’t smarter than the data and my system.

So on it pops – bearish below 2543 with a broken wing butterfly and collected $6 in premium.

Then? A slow grind down through Christmas Day. No drama. Just theta collecting while everyone else argued over who got the last Yorkshire pudding.

Keep scrolling for why this Santa Rally failure might spell doom for 2026…

When systems do the thinking, holidays stay holidays.

DeBriefing:

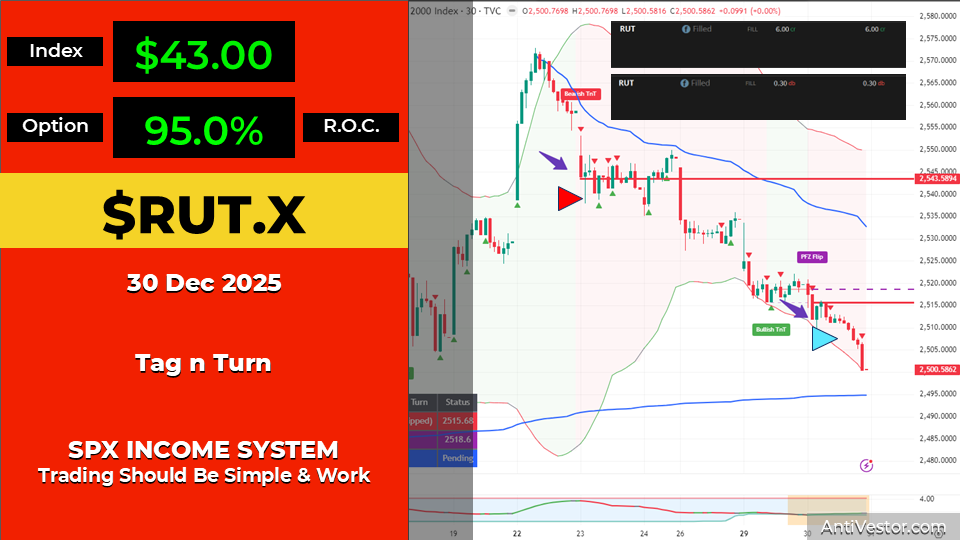

The Trade

| Field | Detail |

|---|---|

| Ticker | $RUT.X |

| Strategy | Tag n Turn (TnT) Swing Trade |

| Direction | Bear Swing |

| Position | Broken Wing Butterfly |

| Entry Signal | Bearish Below 2543 |

| Premium Collected | $6.00 |

| Exit Price | $0.30 |

| Index Move | $43.00 |

| Return on Capital | 95.0% |

| Status | ✅ WINNER |

The Execution

And so we come to the 30th December.

$43 move down later.

The premium gets popped and the swing trade is bought back for 30c.

95% ROC.

The Bonus Round

Interestingly – and due to enjoying myself (being holidays and all) – the bull TnT was avoided and the system flipped back to bearish.

Which was used to add to the bear swing.

Sometimes the best trades happen when you’re not overthinking them.

The Bigger Picture

It’s certainly looking like the Santa Rally is failing to call.

You know what Yale Hirsch said about that:

“If Santa Claus should fail to call, bears may come to Broad and Wall.”

Expect doom n gloom in 2026.

And richer premiums to pop.

Final Notes

Trading should be simple and work.

This one was both.

Setup appeared. Entry taken. Premium collected. Patience held. Exit executed.

95% ROC while eating mince pies.

That’s the dream.

Trade Visualisation

Entry Zone: 2543 (Bearish Below)

│

│ ← Bear Swing Initiated (Pre-Christmas)

│

▼ Slow grind through holidays

│

│ ← $43 Index Move

│

▼

Exit Zone: ~2500 area

Premium: $6.00 → $0.30 = 95% ROC ✅Expert Insights:

RUT bear swing delivered through Christmas while Santa Rally expectations dominated headlines.

The beauty of systematic trading is that it doesn’t care about your expectations.

Yale Hirsch, founder of the Stock Trader’s Almanac, documented that the Santa Claus Rally period (last 5 trading days of December + first 2 of January) averages 1.3% gains since 1950 – but crucially, when Santa fails to call, it tends to precede bear markets or times when stocks could be purchased at lower prices later in the year.

Historical data shows that when the Santa Rally is positive, the S&P 500 averages 10.4% in the following year. When it’s negative? Only 6.1%. The system saw bear whilst everyone expected bull – and the system was right.

[Source: Stock Trader’s Almanac – “Santa Claus Rally”]

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was spotted updating his “Santa Rally Failure Tracking Database” whilst his pigeons practiced “Doom And Gloom 2026 Emergency Protocols.”

Hazel immediately created new flowcharts titled “When Setup Is The Setup Despite Personal Expectations” with sub-categories for “Holiday Trading Whilst Enjoying Yorkshire Puddings.”

Mac raised his seasonal whisky and declared, “When you collect $6 in premium before Christmas and buy it back for 30c afterwards, the proper response is obviously to add to the bear swing whilst everyone else waits for Santa!”

Kash attempted to calculate whether “95% ROC over the Christmas period technically counts as a gift from the market or a systematic inevitability” before getting distracted by 2026 premium projections.

Wallie grumbled that in his day, “we didn’t need Yale Hirsch to tell us that failed rallies meant trouble – we just watched the tape and prepared for doom!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The Setup Is The Setup – Why Systems Beat Expectations

When systematic signals contradict personal expectations, follow the system. RUT said bear. Phil expected bull. RUT was right. 95% ROC delivered.

Here’s the thing about systematic trading that most people never learn: your expectations are irrelevant.

The market doesn’t give a toss what you think should happen. While everyone (including me!) banged on about the Santa Rally, RUT quietly setup a bear swing.

I expected it to flip bullish.

The system said bearish below 2543.

Guess which one was right? Not my expectations. The system.

$6 collected, $43 move down, bought back for 30c, 95% ROC. And here’s the kicker – because I was enjoying the holidays instead of overthinking, I avoided the brief bull TnT flip and caught the system when it reverted back to bearish.

Added to the swing. More premium collected. Sometimes the best trading happens when you’re NOT trying to be clever.

- Follow the setup.

- Eat the Yorkshire pudding.

- Collect the premium.

[Source: AntiVestor SPX Income System – Tag n Turn Framework]

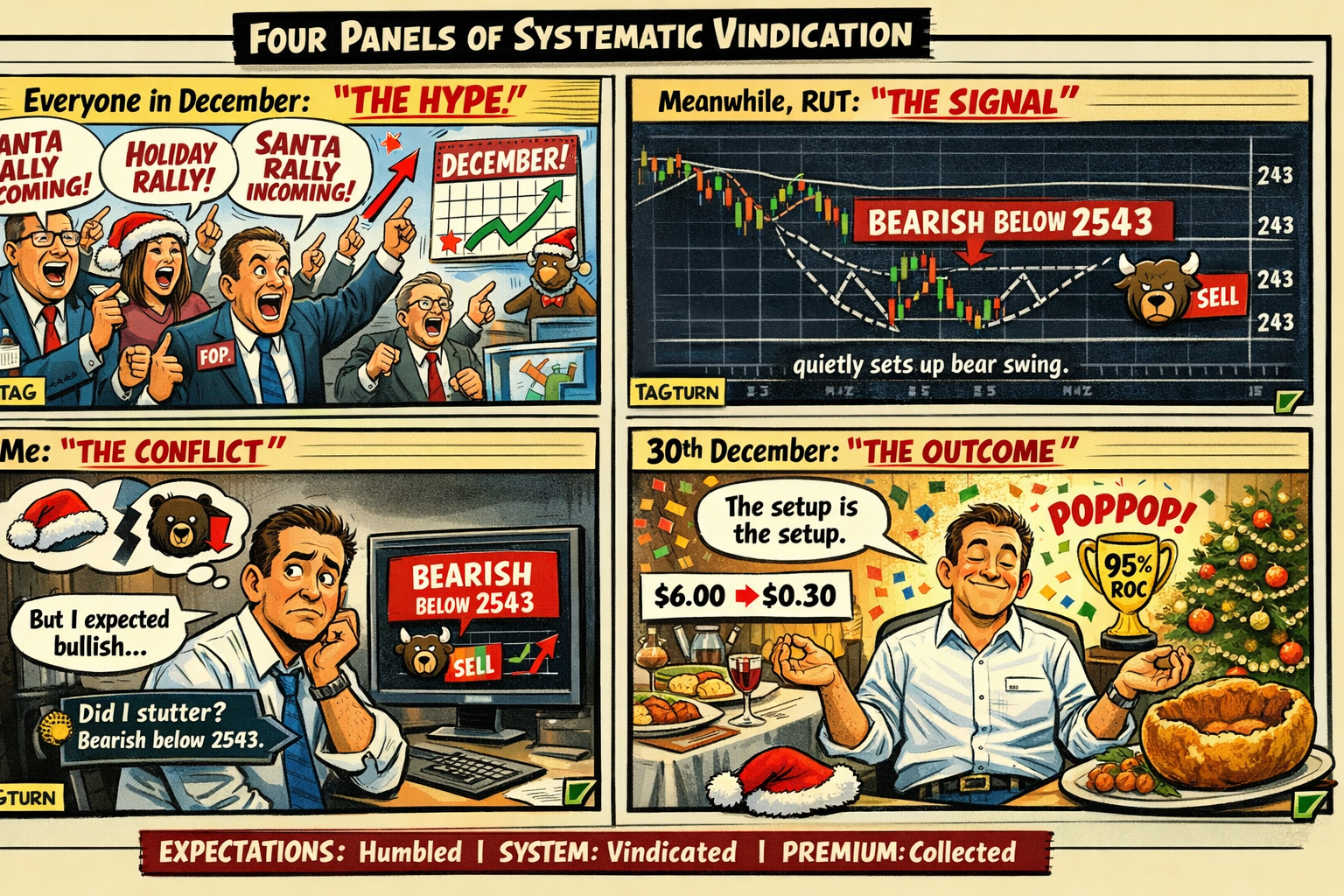

Meme of the Day:

“Everyone in December: ‘SANTA RALLY IS COMING!’

RUT: quietly sets up bear swing

Me: ‘But I expected bullish…’

System: ‘Did I stutter? Bearish below 2543.’

…30th December: 95% ROC

Me: ‘The setup is the setup.'”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.