Monday’s Bear Scare Had Little To No Follow Through VIX U-Turned And Allayed Those Bear Fears

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Well, that was anticlimactic.

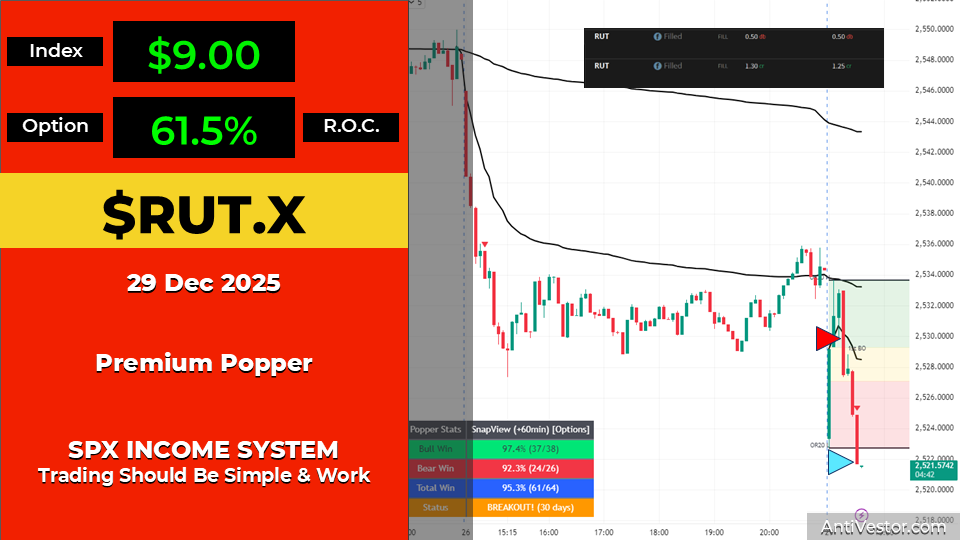

After Monday’s bear scare, it seems there was little to no follow through. Although my RUT premium popper did pull that bear premium (again) right at the opening bell.

VIX U-turned and allayed those bear fears.

Today it seems likely that the monumental Santa Rally – coming in at an average of 1.3% – could be on.

Which for premium sellers is not too bad.

As long as prices don’t move down significantly – we still get paid.

As we looked at in yesterday’s morning briefing – it’s when we don’t see this teeny tiny Santa Rally that’s the real setup. The warning signal. The foreboding.

Keep scrolling for RUT’s 97.4% win rate on Premium Poppers…

Bear scares come and go. The process stays the same.

Market Briefing:

Current Multi-Market Status:

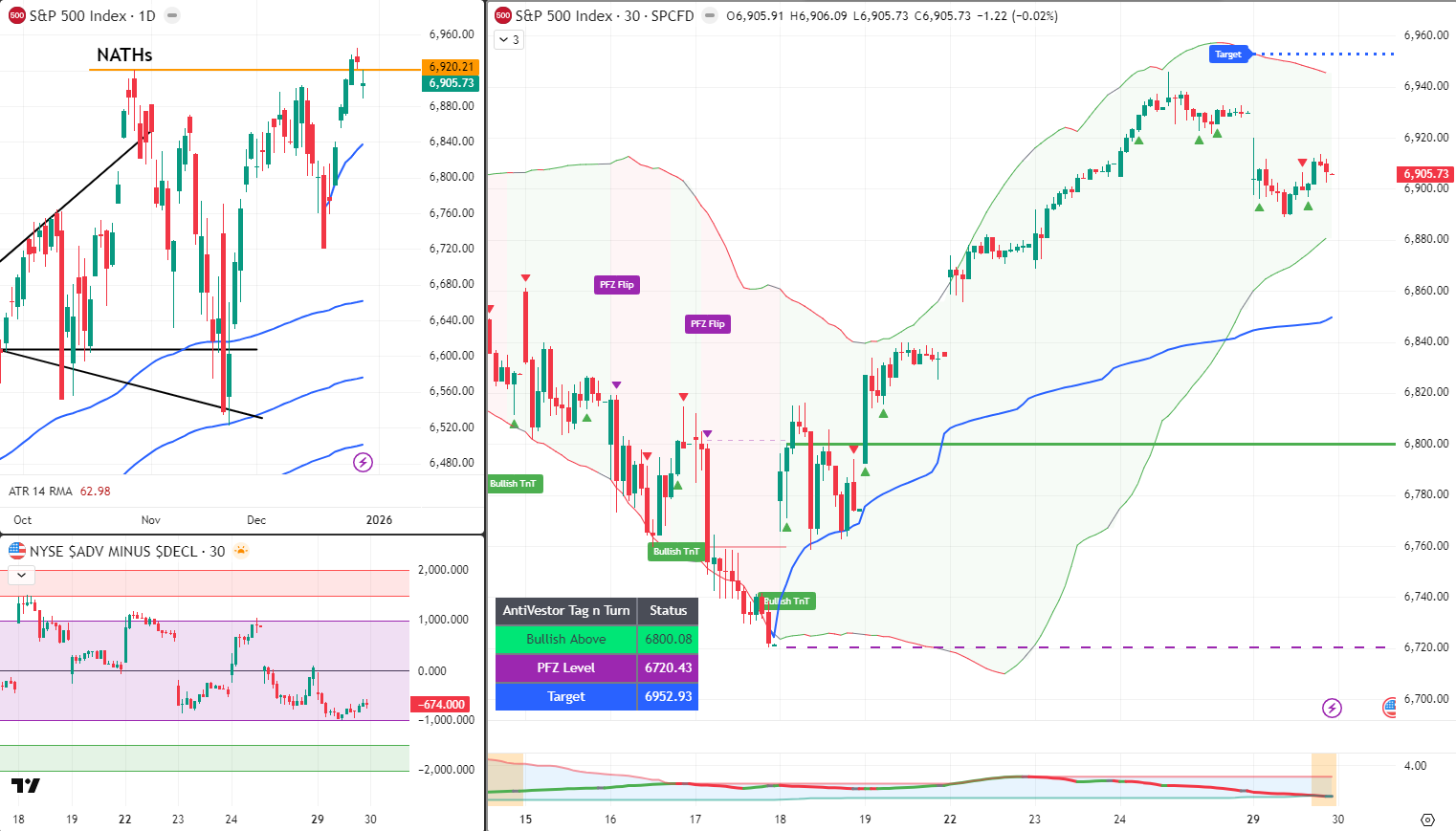

- SPX: 6,905.73 – Bull TnT – Bullish Above 6800.08, PFZ 6720.43, Target 6952.93

- RUT: 2,519.80 – Bull TnT (FLIPPED!) – Bullish Above 2518.6, PFZ 2515.66, Target 2564.23

- ES: 6,955.00

- NQ: 25,742.75

- YM: 48,758

- RTY: 2,540.2

- VIX: 14.46 (U-turn from uptick ✅)

- GC: 4,393.2

- CL: 58.34 / 55.12

- BTC: 93,161.86 / 87,847.34

Yesterday’s Action

Wicks on the lower portion of yesterday’s activity suggest a neutral to bullish day ahead.

The bear scare tried. The bear scare failed. Moving on.

The Swing Status

SPX: Remains firmly bullish. No change. Target 6952.93 still in sight.

RUT: Has developed a new setup. The bear swing was profitable and now flips to a new bull swing setup – just in time for said rally.

Both swings now bullish. Aligned. Ready.

Premium Seller’s Paradise

Here’s the thing about premium selling during the Santa Rally period:

As long as prices don’t move down significantly – we still get paid.

Theta decay doesn’t care if the market goes up 1.3% over 7 days. It just keeps eroding option value day after day.

Sideways? Paid.

Slightly up? Paid.

Grinding holiday grind? Paid.

It’s the sharp down moves that hurt. And right now, with VIX U-turning back to calm territory, the market isn’t pricing in any sharp moves.

The RUT Premium Popper Stat

Looking at the data, RUT is by far the standout winner for my premium popper setups:

97.4% of the bullish setups in the last 30 days turned out to be winners.

That’s 37 of the last 38 trades.

Just waiting for that opening ding-a-ling-ding.

PopPop.

Expert Insights:

Bear scare fizzled, VIX U-turned, both swings now bullish, premium poppers ready.

Premium sellers benefit from what’s called “theta decay” – the gradual erosion of option value as time passes. For option sellers, this is beneficial – time decay erodes the price of short options regardless of small directional moves.

According to Charles Schwab’s options education: “Theta measures the inevitable loss in value that options experience as time passes. Of all the options risk measures, the passage of time is the one thing that’s certain.” This is why range-bound or gently bullish markets like the typical Santa Rally period (averaging just 1.3% over 7 days) are ideal for premium sellers.

The strategy works best in what traders call “sideways markets with low volatility” – which is exactly what holiday trading tends to produce. Iron condors and credit spreads “profit if the stock stays within a defined range” – and with both swings now aligned bullish and VIX back at calm levels, the range appears set.

[Source: Charles Schwab – “Theta Decay in Options Trading”]

In Other News…

Silver Crashes Day After 1979 Celebration: Timing Perfection

CME margin hike kills 155% YTD rally. AI bubble “concerns” emerge. Peace talks bad for gold because stability unwelcome.

Silver flash-crashed 8% Monday (worst day since 2021) day after celebrating strongest year since 1979—CME margin hike perfectly timed to kill momentum proving regulatory timing requires coordination. Gold fell 4% as Ukraine peace talks drained geopolitical premium because apparently threat of stability worse for metals than actual war. Tech extended selloff as BD8 Capital’s Doran warned about “overbuilding this AI bubble”—markets discovering valuations occasionally matter after ignoring for months.

When 155% YTD Rally Meets Margin Requirements

Silver’s worst day since 2021 came immediately after treating historic gains as routine. CME raised margin requirements triggering liquidation cascade dragging Newmont down 5.6% and materials sector into crater. Gold -4% joined party proving regulatory intervention can end rallies faster than fundamentals. China announcing silver export restrictions starting January adds supply fears after crash rather than before demonstrating policy timing perfection.

AI “Overbuilding Bubble” Becomes Actual Concern

BD8 Capital’s Doran articulated what nobody wanted to hear: “People are concerned about overbuilding this AI bubble.” Nvidia -1.2%, Tesla -3.3%, Palantir -2.4%, Oracle -1.3% as sector discovered spending billions on infrastructure eventually requires returns. SoftBank-DigitalBridge $4B deal highlights AI infrastructure theme same day bubble concerns vocalized proving timing everything.

️ Peace Talks: Bad for Gold, Good for Oil (Pick One)

Ukraine peace talks drained geopolitical premium from precious metals whilst adding 2% to oil—commodities choosing opposite interpretations of same event. Markets treating potential stability as negative for safe havens, positive for energy suggesting peace threat worse than war reality for gold investors. Year-end positioning “light” meaning nobody actually trading but narratives dominating anyway.

☕ Hazel’s Take

Silver crashes 8% day after 1979 celebration, CME margin hike kills rally, AI bubble concerns emerge, peace talks bad for metals. When regulatory timing, policy implementation, and narrative shifts coordinate perfectly, probably acknowledging year-end chaos requires orchestration.

—Hazel, FinNuts

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was spotted celebrating the VIX U-turn by teaching his pigeons “Bear Scare Fizzle Recognition Protocols” whilst updating their “No Follow Through Detection Systems.”

Hazel immediately archived yesterday’s “Early Hiccup Warning” flowcharts and replaced them with “Both Swings Bullish Alignment Celebration Procedures” complete with theta decay appreciation diagrams.

Mac raised his morning whisky and declared, “When Monday’s bear scare has no follow through and the VIX U-turns back to calm, the proper response is obviously to wait for that opening dingalingding! PopPop!”

Kash attempted to explain that “37 of 38 winning trades is basically a 97.4% uptime SLA on the RUT Premium Popper smart contract” before getting distracted by the theta decay mathematics.

Wallie grumbled that in his day, “we didn’t have fancy statistics telling us 97.4% win rates – we just pulled the premium and counted our money at the end of the week!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Why Premium Sellers Love The Santa Rally Period

In sideways or gently bullish markets, premium sellers profit from theta decay eating away at option value – regardless of small price moves. The Santa Rally’s average 1.3% gain over 7 days is theta heaven.

Everyone bangs on about the Santa Rally like it’s some massive profit opportunity. 1.3% average over 7 days. Whoop-de-doo. But for premium SELLERS? It’s bloody paradise. Here’s the secret: we don’t need the market to do anything spectacular.

We just need it to NOT collapse. Theta decay – the gradual erosion of option value – works in our favour every single day. Time passes. Premium evaporates. We collect. The Santa Rally period with its low volume, holiday grind, and range-bound action is exactly what premium sellers dream about.

Sharp down moves hurt us. Sideways grinds pay us. Gentle up moves? Still paid. That’s why RUT Premium Poppers have hit 37 of 38 winners (97.4%) in the last 30 days.

The market doesn’t need to rally for us to win. It just needs to NOT collapse. And with VIX at 14.46, the market isn’t pricing in any collapses.

PopPop.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.