Espresso Martini Trading: Wait, Don’t Chase

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Welcome to Monday’s edition of Charts, Chill & Cheeky Profit.

While the US market is live and ticking, I’m taking a backseat for the day – it’s the UK early May Bank Holiday, and in true AntiVestor style, I like to honour both flags when they’re resting.

Now… I may be off the charts, but the charts themselves?

They’re very much still working.

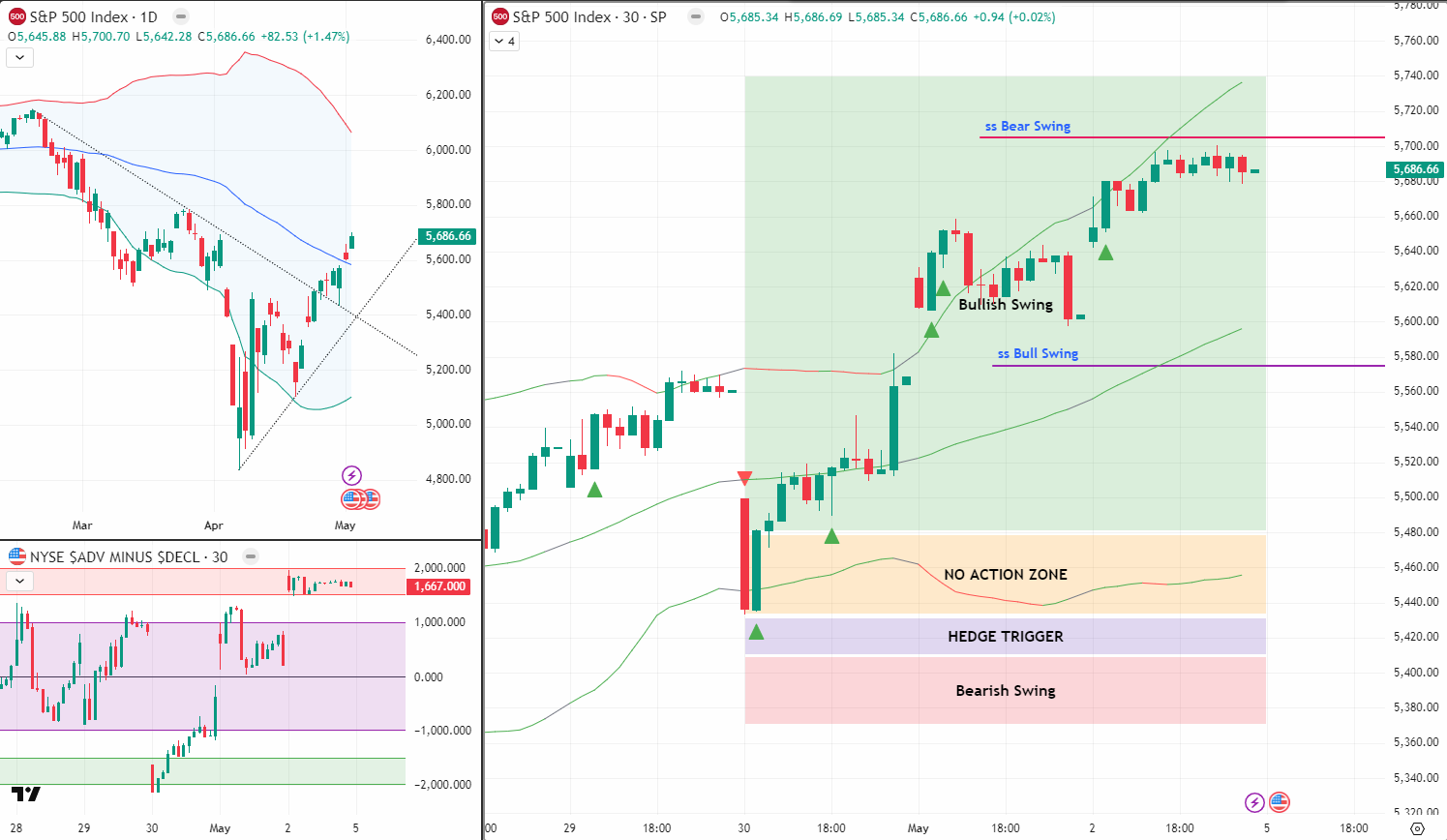

The Tag n Turn system remains bullish as we come into the week.

Several swing positions are approaching their profit zones, and unless we see something mechanical flash the other way, there’s no reason to deviate from the path.

That said – warning signs are brewing.

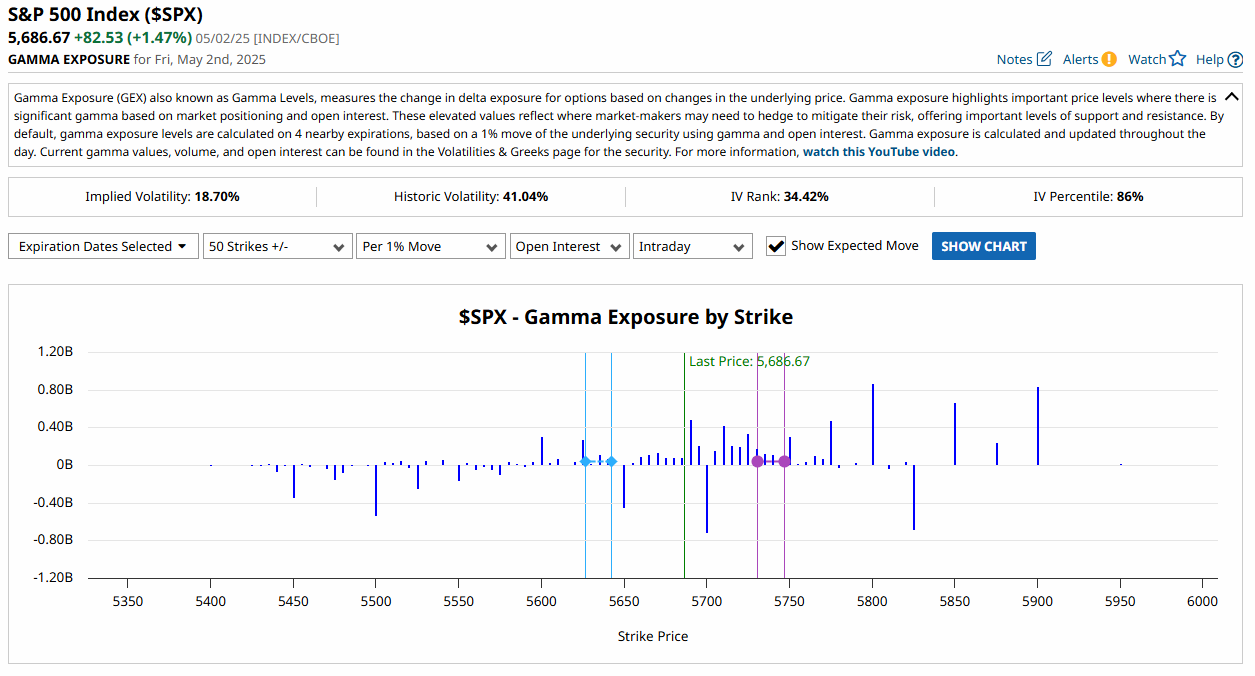

We’ve got GEX clustering around 5700 and 5800, which lines up almost perfectly with chart-based resistance zones.

Could these act as reversal magnets?

Absolutely.

But not until the Turn confirms with a proper bearish pulse bar.

Until then, it’s the same discipline as always:

Trade the setup. Not your opinion.

Let the system pay you.

Enjoy your espresso martini while the profits stack.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

SPX Market View

SYSTEM STILL BULLISH (BUT EYES ON THE TURN)

The market’s been running hot – eight straight days higher leading into the weekend, and we’re now seeing price tension build at key levels.

The Tag n Turn system remains bullish, with multiple swing positions already in play. Some are closing in on profit targets. But the smart money knows that this kind of run doesn’t go unchallenged forever.

So what are we watching?

5700 and 5800 are the standout battlegrounds.

That’s where GEX hedging is thickest and where chart resistance stacks up too.

These levels matter.

Why?

Because they could be exhaustion points.

If price hits them and stalls, we might just get the bearish pulse bar needed to complete the next Tag n Turn reversal.

But until that Turn fires… it’s all potential, no confirmation.

There’s no guesswork here.

You either have the setup or you don’t.

And today – we don’t.

That’s why we wait.

Because our swing trades are working, our mechanical edge is clean, and there’s no signal to switch gears yet.

So take the long weekend if you’re in the UK.

Keep a loose eye on the 5700–5800 zone if you’re in the US.

Either way?

We trade the strategy. Not the noise.

And not the holiday FOMO, either.

GEX Analysis Update

- 5700 / 5800 overhead resistance

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact

The Espresso Martini Indicator

There’s a little-known rule in the AntiVestor playbook called the Espresso Martini Indicator.

It works like this:

If the market’s already bullish, and your chart’s telling you to do nothing but wait – it’s time to close the screens and shake something over ice.

The cocktail was born in London, not far from where many of us power down for May Day.

A bartender once said, “The espresso martini exists for people who want to go out and stay awake.”

We say it’s for traders who want to stay profitable and stay chill.

Cheers to that.

Meme of the Day

xxx

IMAGE HERE

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.