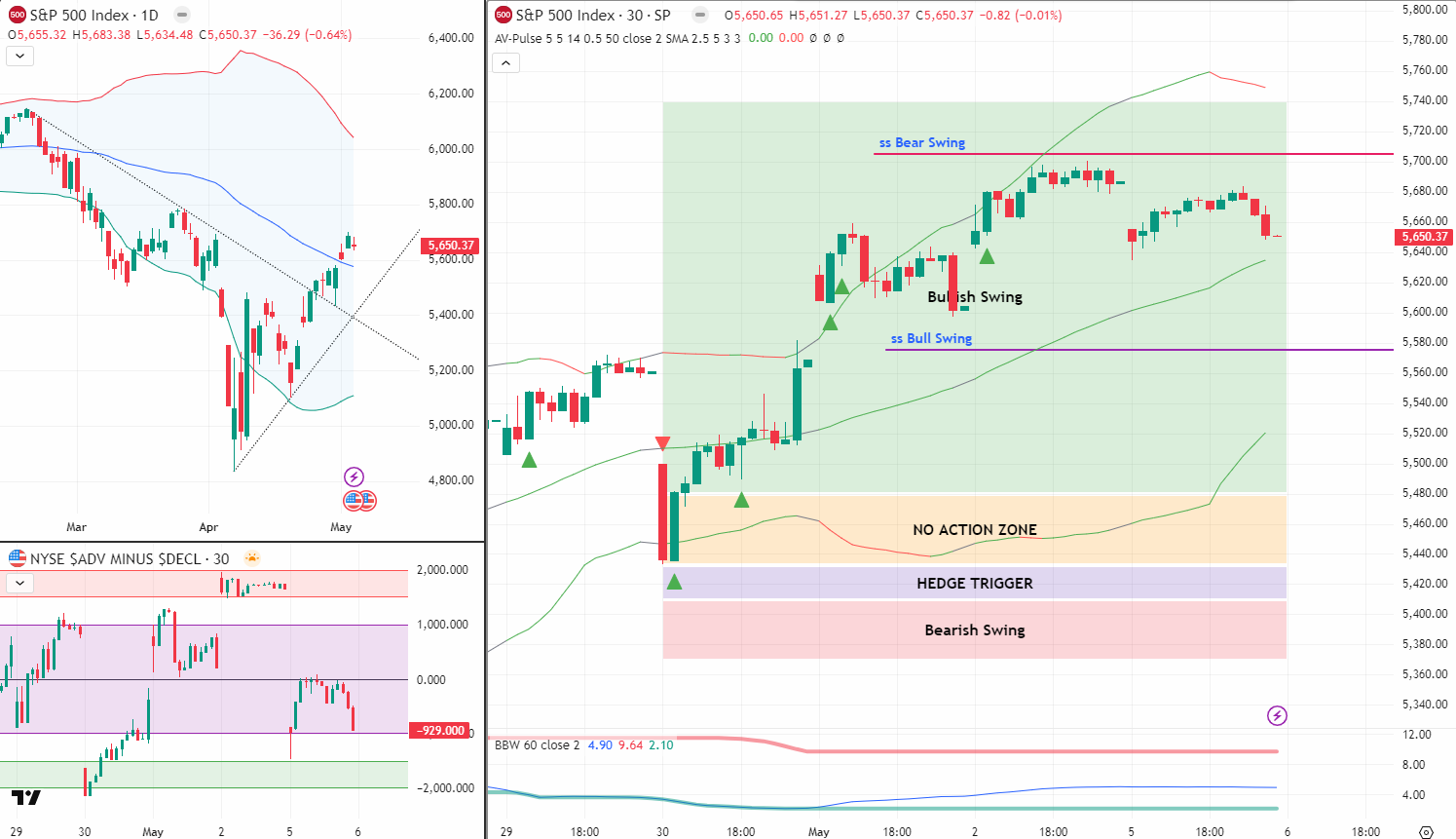

5600–5700: The Chop Shop Range

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Yesterday might’ve been a public holiday for the UK, but it looked like the US market got the memo too.

With zero pulse bars, we were gifted a rare but educational reminder of why sometimes the best trade is the one you don’t place.

SPX spent the day grinding sideways, adding to the already sluggish movement since last Thursday. Not a bad day to be off the screens with a cigar and a compressed volatility chart to come back to.

The Tag n Turn system remains bullish, but it’s like watching a coiled spring now.

Bollinger Bands are tightening again.

5600 is support. 5700 is resistance.

And price?

It’s doing a very good job of not caring yet.

We’ve got a bit of news later today, which might be enough to give us a breakout push.

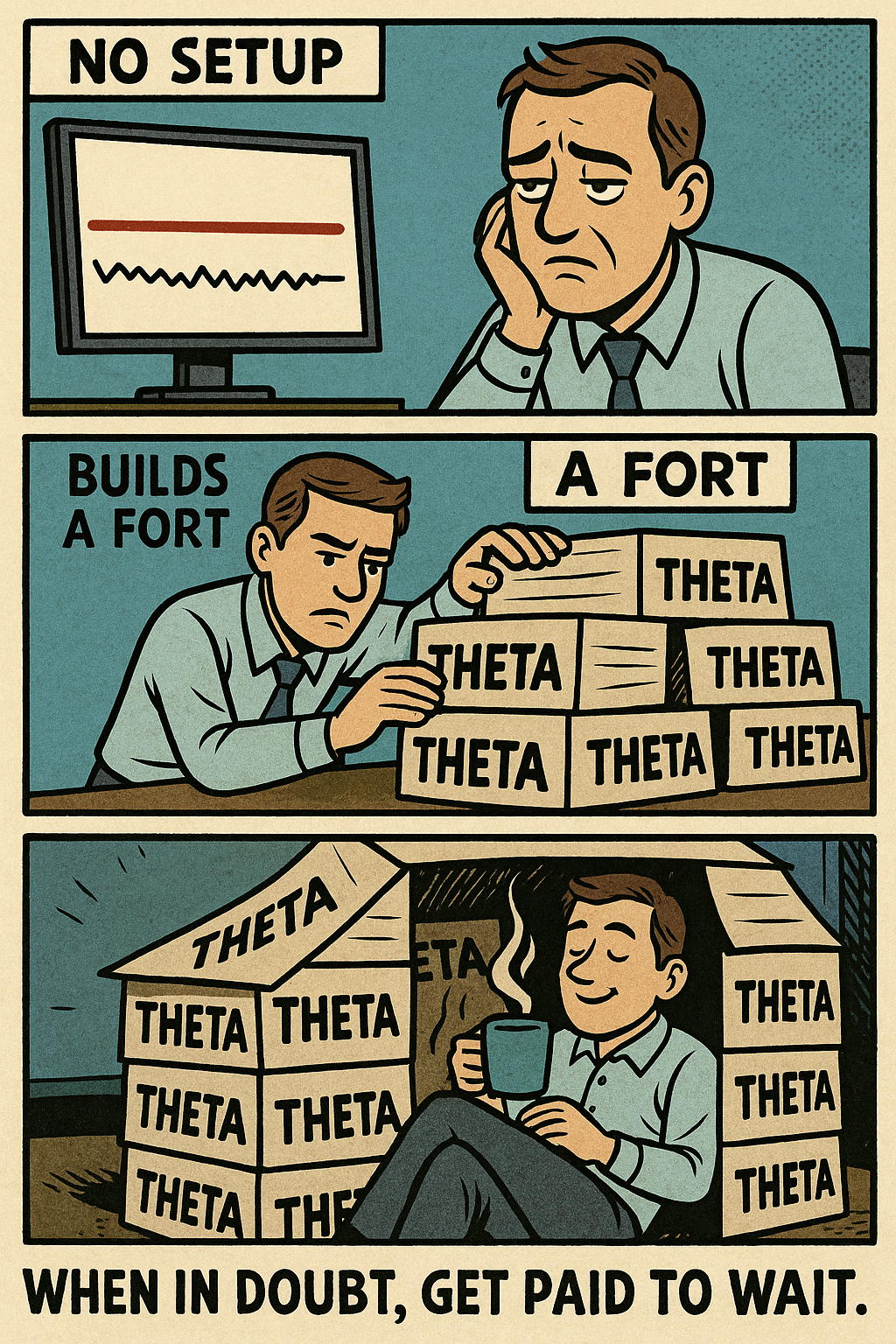

But until we breach the range, the game is theta collection and system patience.

Stay focused. Stay mechanical.

And yes – it’s still a good day for income trades.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

SPX Market View

If you blinked Monday, you missed it.

Not because there was a sudden spike or flash crash, but because absolutely nothing happened.

No pulse bar. No structure. No progression.

Just… sideways.

And that’s worth paying attention to.

Because while we sat out (or holidayed like true AntiVestors), price consolidated, and the Bollinger Bands began their silent squeeze.

That’s your warning shot.

This kind of setup often acts as a prelude to expansion – but only once price breaks out of the compression range. And right now, that’s boxed between 5600 and 5700.

That 100-point zone is your battlefield.

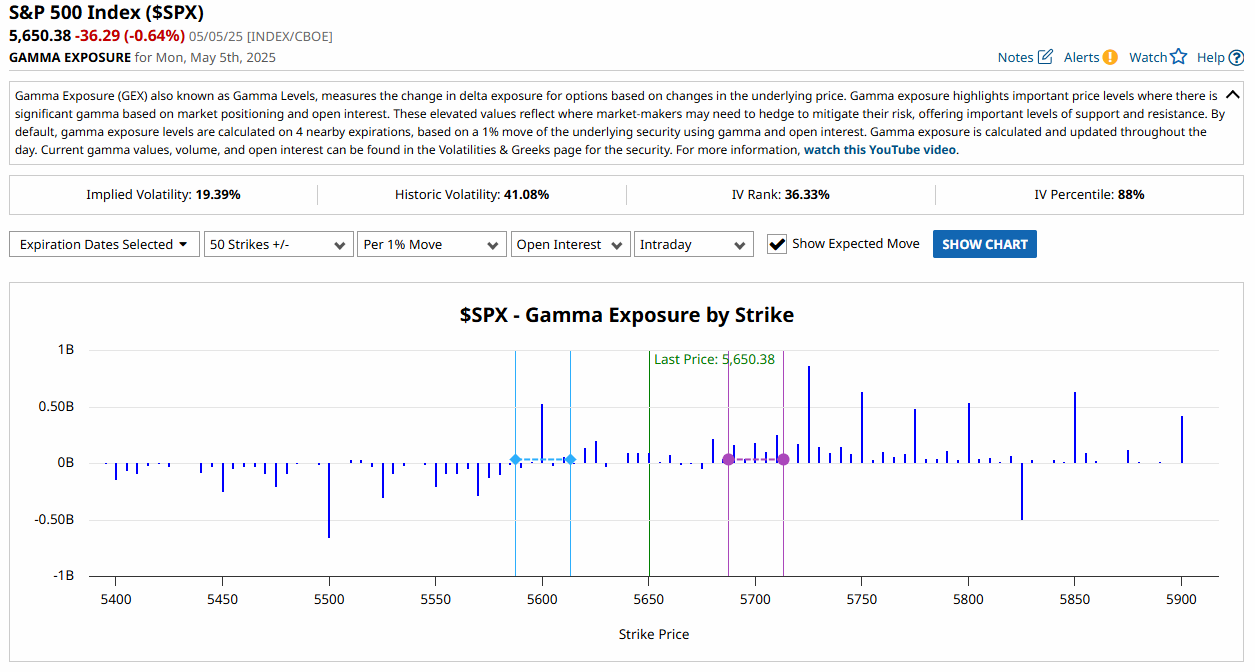

We’ve also got GEX confirming these levels – with clear dealer gamma boundaries holding things in place.

Translation?

Until something breaks – nothing will.

So we stick to what works:

✅ Stay mechanical

✅ Don’t force setups

✅ Let the premium stack while others overtrade

A little news today might spice things up. But unless we get price + structure, we wait.

And that, my friend, is how traders win during “boring” markets.

GEX Analysis Update

- 5600/5700

Expert Insights:

Common Mistake: Mistaking “Quiet” for “Wrong”

One of the most common errors in mechanical trading is getting antsy during chop.

No signal doesn’t mean no system.

You’re not wrong – you’re just early

Sideways is a valid phase

Compression leads to expansion

Fix:

When in doubt, zoom out. Reframe.

If price is between your system’s tags and the bands are tightening, it’s a waiting game, not a guessing game.

Rumour Has It…

BREAKING: SPX Traders Demand Entertainment During Low Vol

Wall Street traders have filed an official petition requesting the Fed inject “just a little bit of chaos” into today’s news release. The goal?

“Something… anything… to break this range,” one trader wept, clutching a Bollinger Band stress ball.

Meanwhile, a rogue algo named “ThetaVampire” has reportedly collected 7% in passive income while never placing a trade. SEC calls it: “Too efficient. Possibly Canadian.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact

The Bollinger Band Diet

Fun stat: Since 1983, markets have entered compressive Bollinger Band squeezes before every major volatility expansion. Think of it as the market’s version of holding its breath before a scream.

And here’s the kicker:

The tighter the bands, the more violent the eventual breakout. It’s like shaking a can of Coke – but you don’t know when someone’s going to open it.

Lesson?

Don’t anticipate. Just watch for the crack.

Meme of the Day

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.