Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

There are two kinds of traders in moments like this:

The first kind:

Retail panic selling at the lows, then chasing headlines back up, only to get smacked again minutes later.

☕ The second kind:

Sipping tea, watching trillions ping-pong, and quietly pocketing profit on open bearish swing trades.

Guess which one my traders & I were?

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Two Worlds Collide

Let’s talk about Monday’s glorious madness.

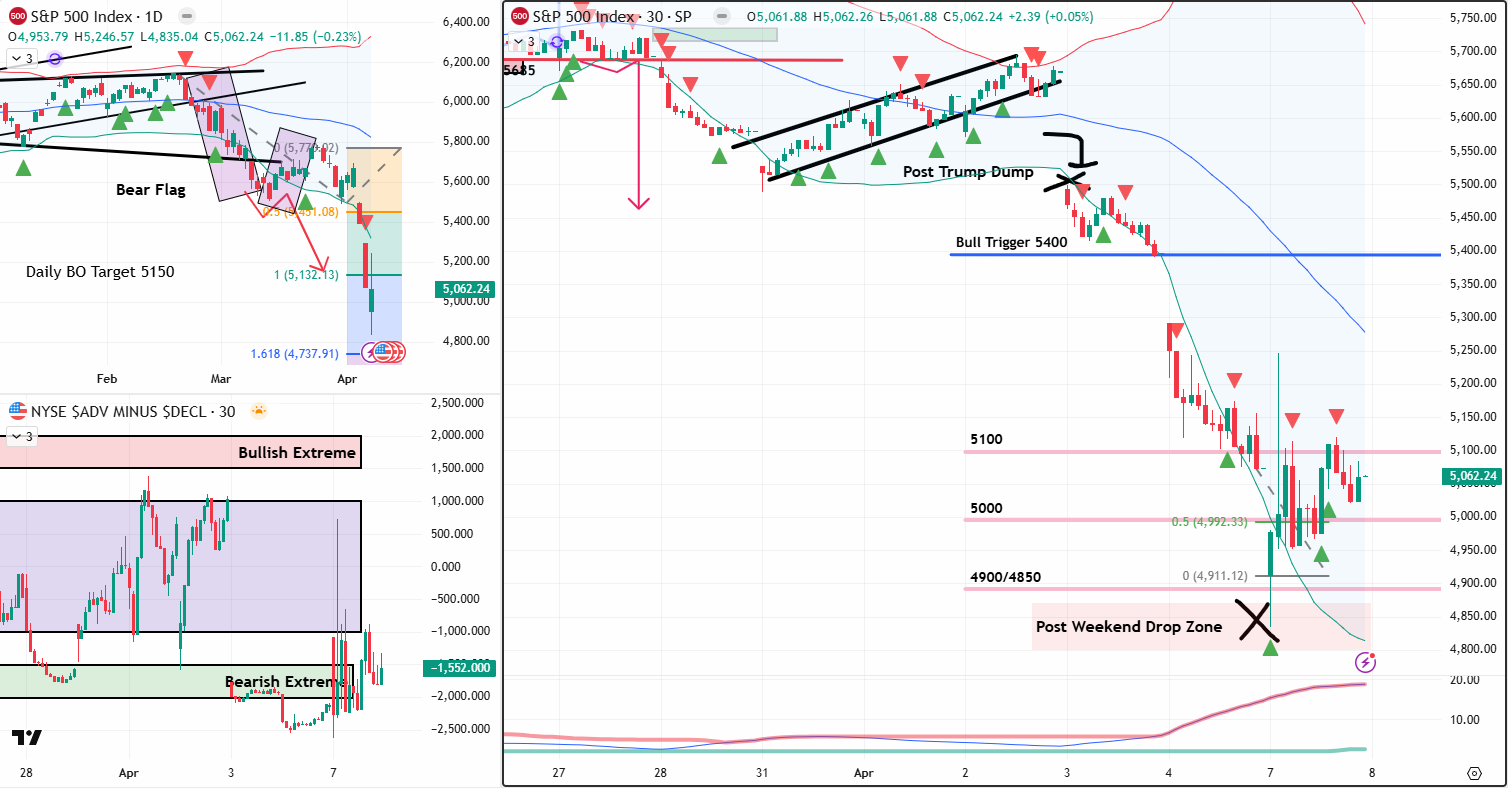

We labelled the post-weekend drop zone.

We warned about dead cat bounce behaviour.

We even joked about retail being the liquidity.

And boom – that’s exactly what played out.

Markets dropped. Retail panic sold.

And guess what?

That “smart panic” became liquidity for our bounce.

Boing. Boing.

Then came the headline whiplash that deserves its own Netflix docuseries…

- 10:10 AM: Rumour of a 90-day Trump tariff pause leaks.

- 10:15 AM: CNBC reports it. Markets spike.

- 10:18 AM: S&P up +$3 TRILLION in market cap.

- 10:25 AM: White House says “Huh?”

- ❌ 10:26 AM: CNBC retracts.

- 10:34 AM: White House confirms “Fake news.”

- 10:40 AM: S&P gives back -$2.5 TRILLION.

Net result?

A $6 trillion round-trip in 30 minutes.

You literally cannot make this up.

Credit to Kobeissai Letter for mapping out the morning

Meanwhile, back in the structured world…

- ✅ My bear swing trades? Still profitable.

- ✅ OTM. No stress.

- ✅ Daily target hit.

- ✅ Waiting for new setups, and watching for re-entries.

I’ve got 5400 tagged for bullish reassessment – that’s where the daily Bollinger band sits.

Until then, it’s bearish pulses, 10-min Tag ‘n Turn setups, and selling any relief rallies that dare poke their heads up.

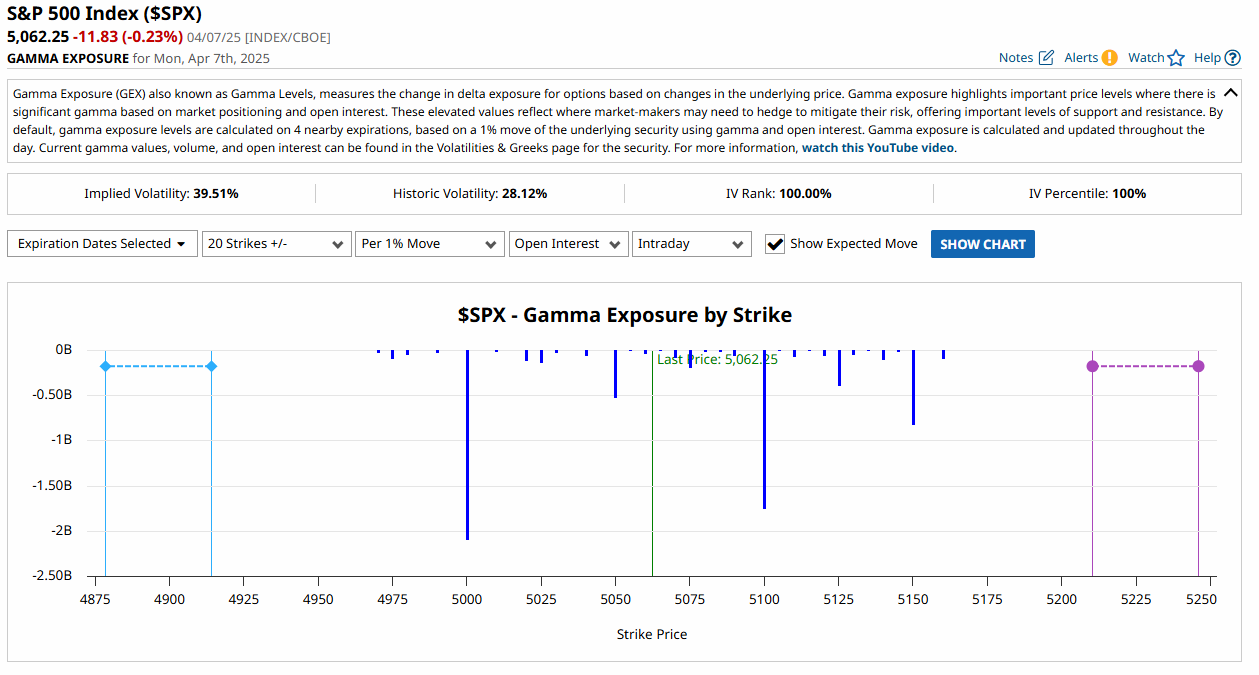

GEX Analysis Update

Expert Insights: Don’t Trade the News. Trade the Plan.

Mistake:

Reacting to headlines before price confirms.

Getting baited by news whiplash.

Fix:

Structure first. Headlines last.

If you don’t know your levels, you’ll trade their chaos.

If you’re using news as your entry trigger…

You’re not trading. You’re betting.

Fun Fact

In just 30 minutes, the S&P 500 swung over $6 trillion in market cap.

That’s the equivalent of losing the GDP of Japan, twice, and finding it behind the couch.

This is now officially the largest 30-minute swing in stock market history.

Thanks, fake tariff pause.

Video & Audio Podcast

No Talking Head Today

I’ve given the microphone and camera the day off.

But don’t worry – the markets are still screaming, and I’m still bearish.

Back soon with more face, more voice, and fewer filters.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12) – The Patterns that thrive on chaos

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% Off

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

Join today and I will personally hop on a quick start call with you to get setup and running in my system in less than 45-mins.

- Options 3: Join the Fast Forward Mentorship – 50% Off

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.