Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

You know what’s better than nailing a trade?

Not having to flip, flop, hedge, unhedge, reverse, scalp, and do the full Hokey Cokey just to survive.

Today was one of those days – the kind where the plan just works.

Futures? Wild.

Down 143, up 188, then back to flat – all before most traders finished their first sip of coffee.

But while price whipsaws, I’m not chasing shadows.

I’ve got my line out.

My bear swing is on.

And I’m just waiting for the exit alert to ding.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Let’s break down what happened:

Yesterday’s tariff chaos acted like a Mr. Miyagi market prank.

“Tariff on.”

“Wait, just kidding.”

“Tariff off.”

The move up?

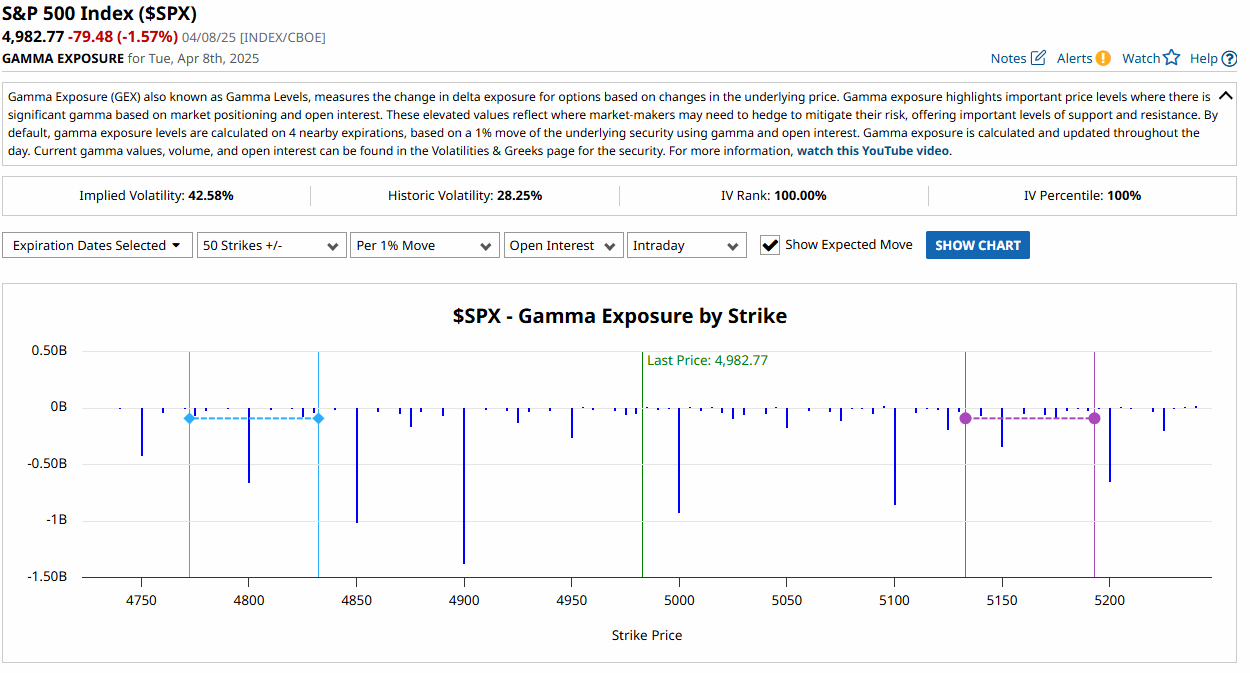

Landed exactly at Monday’s news spike and the days 5250 gamma flip level – which we had marked and mapped.

Perfect resistance.

Retest. Rejection.

Bear pulse bars triggered.

And now the swing is on.

- Trade location: Dialled in.

- Directional bias: still bearish under 5400.

- Execution: GEX levels + pulse bar structure.

Retests, Not Reversals

Tuesdays action also gave us something sneaky:

An intraday retest of the recent lows.

Now, if you’ve been around since the 2020 V-turn era, you’ve seen this before.

Panic sell.

Sharp bounce.

Retest the low to check for real conviction.

Then make the real move.

This retest could be the prelude to a bull thesis – but not yet.

Structure comes first. Bias second.

Until we break clean above 5400, I stay bear-biased.

GEX Analysis Update

- GEX levels remain relatively unchanged. I will check today’s intraday levels when the markets open.

Expert Insights: Don’t Trade Like You’re in a Dance-Off

The Mistake:

Overtrading volatility. Flipping bias every 15 minutes. Trading like it’s a talent show.

The Fix:

Pick your structure. Define your invalidation.

Enter once, scale in if needed, and let it play out.

No need to “turn around and shake it all about.”

Leave the Hokey Cokey for weddings.

Fun Fact

During the 2015–2020 bull run, the average false breakout-to-retest cycle happened within 3 sessions after a panic reversal.

Translation?

Markets often retest panic lows before deciding the next big move.

This isn’t new. It’s just noisy. And totally tradable.

…Another fun fact

Did you know?

The 104% tariff imposed by the U.S. on Chinese imports is among the highest in modern history, reminiscent of protectionist measures not seen since the early 20th century.

Video & Audio Podcast

Podcast Episode Cancelled Due to Volatility… (Not Really)

Truth is, I just didn’t fancy talking today.

But rest assured: charts are still charting, setups are still setting,

and I’m still glaring at the SPX like it owes me money.

New video coming soon – once the caffeine kicks in.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% Off

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

Join today and I will personally hop on a quick start call with you to get setup and running in my system in less than 45-mins.

- Options 3: Join the Fast Forward Mentorship – 50% Off

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.