5600 Held. Then It Ran.

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Ever watch a trade unfold like a well-written sequel?

That was today.

We opened yesterday’s chapter with a clean premarket playbook: bullish above 5600, cautious of late bear signals, but committed to structure. The FOMC delivered nothing but background noise, and the real signal? That came when price respected the band, held the floor, and drifted up just like we laid out.

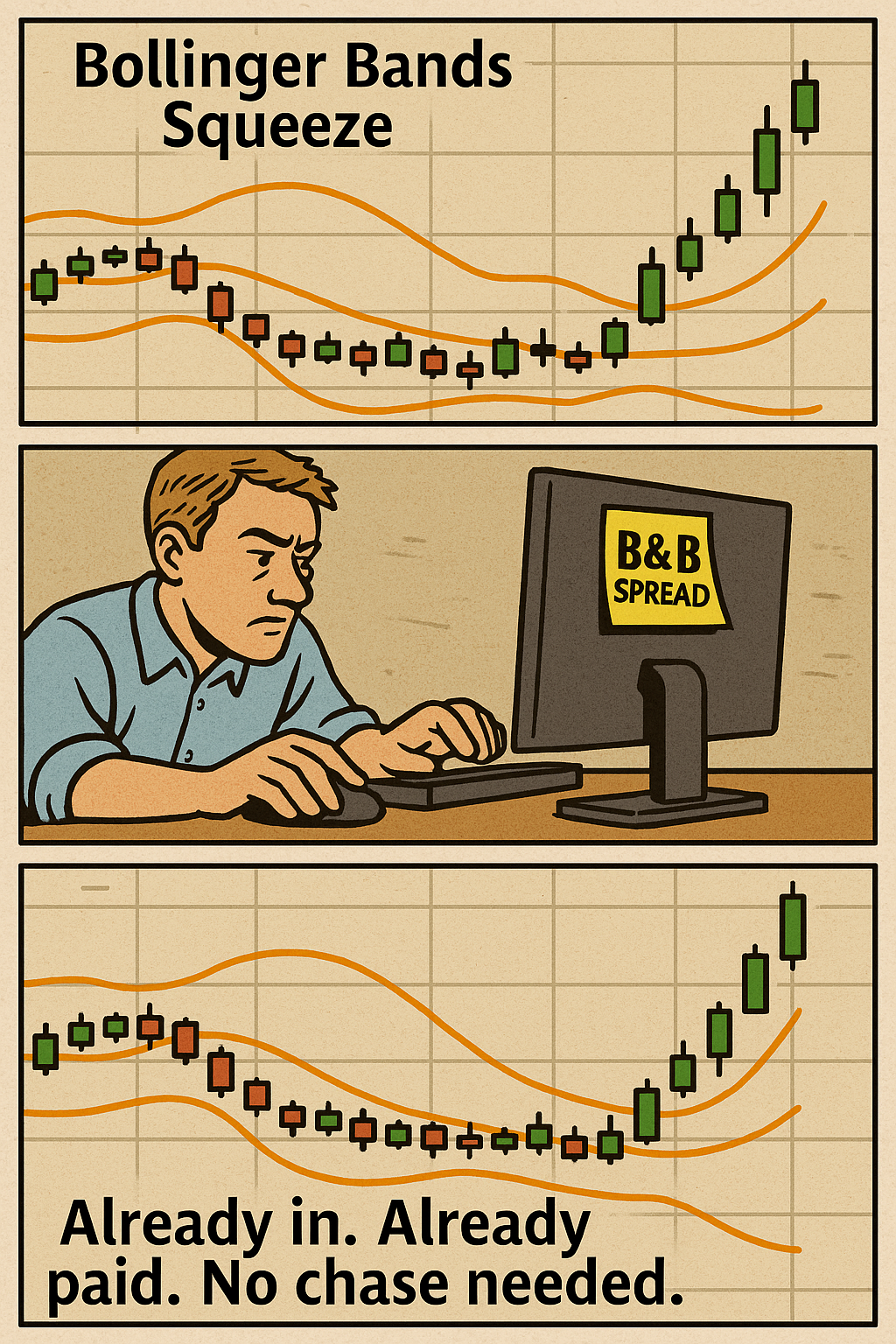

By this afternoon, it was textbook: gap-and-go to the upper Bollinger Band – breakout from compression, just as we forecasted, looks to be the next setup.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

SPX Options = Cashflow Engine.

With this setup? It’s practically an ATM with a checklist.

This trade was all about discipline over drama.

Heading into Wednesday, we were still riding the bullish swing bias from 5600. The lower BB pinch point had held, and a late-arriving bearish tag-n-turn setup didn’t earn our trust. So we held the line.

FOMC came. FOMC went.

Zero fireworks. Zero fear. Just the dullness we predicted.

With the existing swing trade already approaching target, I added a B&B credit spread thinking we might either grind sideways or get a slow drift higher.

Then the market did what the system said it might:

• Gap higher on the open

• Hold those gains

• Break out clean into the upper Bollinger Band

Entry: $5.45 credit

Exit: $0.10 post-lunch the following day

ROC: 98.2%

Stress: 0.0%

No recovery. No hedging. No watching the clock.

Just letting the system trade the plan – again.

Now with SPX perched at breakout levels, we’ve got new opportunities building into the nest session and week. But for today, this one’s already bagged and banked.

Expert Insights:

-

Overreacting to late bear signals – trust the setup, not the noise.

-

Forcing entries pre-FOMC – play the edge, not the headline.

-

Ignoring the pinch pattern – compression breakouts reward patience.

-

Over-managing a clean trade – let it run to the plan.

-

Fading the gap blindly – structure said bullish. Follow it.

Rumour Has It…

Sources suggest the Fed’s latest statement was so uneventful that ChatGPT refused to summarise it. Apparently, even the robots were bored. Meanwhile, one junior trader was hospitalised after overdosing on espresso while waiting for a breakout that had already happened.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact

Meme of the Day

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.