Futures Point 25 Lower – Watch 5825/5850 for Bias Flip

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Markets gapped hard on Monday… and then promptly went to sleep.

While news traders were busy chasing headlines, we sat tight. And in typical post-gap fashion, the day gave us nothing but a lunchtime wiggle and a late-day tease. Let’s unpack what that means heading into today.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

SPX Market Briefing

Monday opened with a bang – driven by the US-China weekend truce – but beyond one moderate push around lunch, the rest of the day was flatter than a risk disclaimer.

That “wait and see” call? It aged like fine wine.

Late in the session, a bearish Tag ‘n Turn setup did try to form… and then voided itself almost immediately. The kind of fakeout that would’ve meant scrambling to hedge had I taken it. No trade was the best trade.

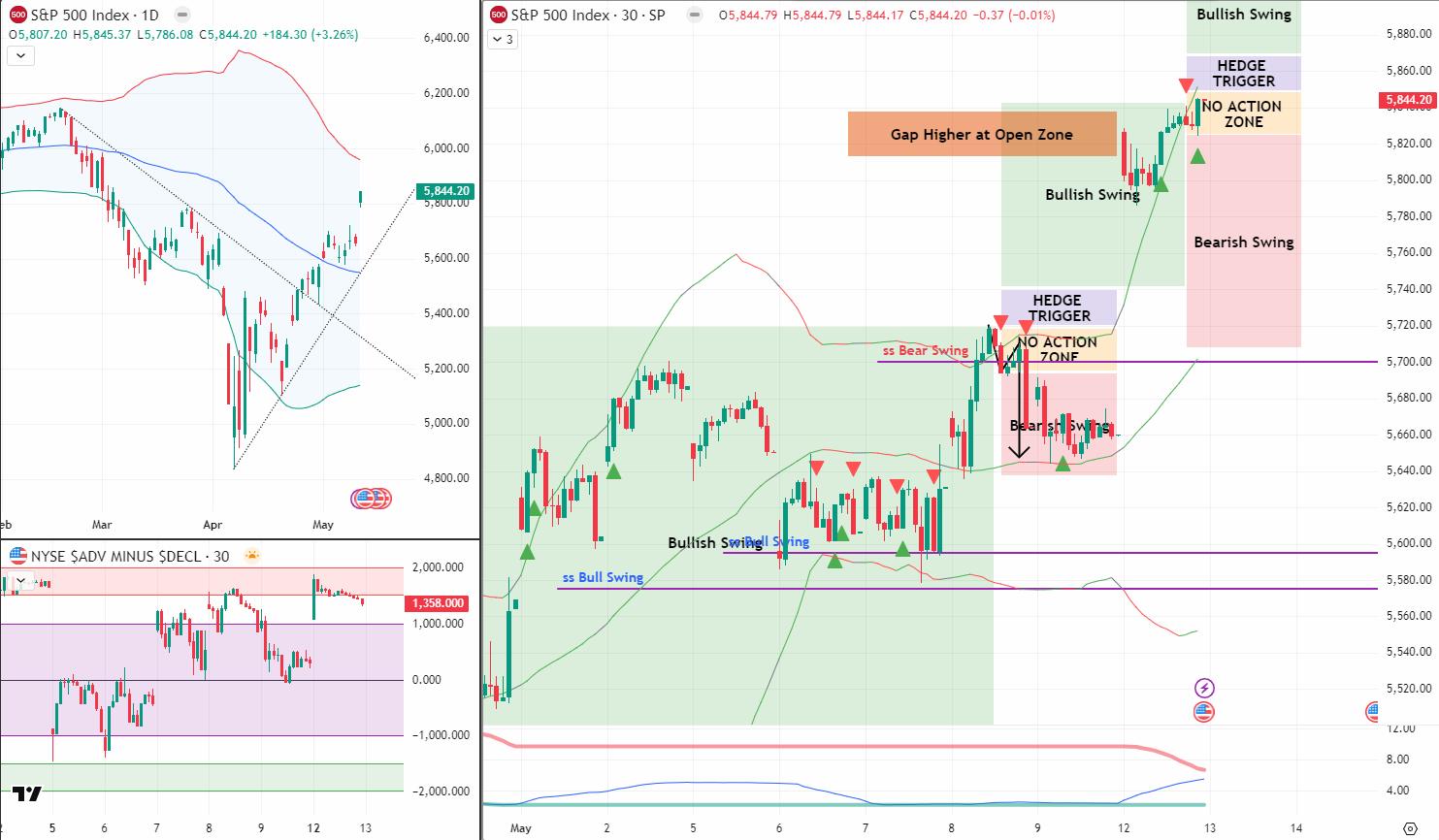

Heading into Tuesday, futures are currently pointing about 25 points lower. If that level holds, we’ll open with a small gap down.

Here’s how I’m viewing today’s structure:

-

Bearish bias below 5825

-

Resume bullish mode above 5850, possibly hedging if needed

Also worth noting – the last of my bull income swings should cash out today. That leaves me flat and nimble heading into the new session. No baggage. No bias. Ready to strike clean when the system says go.

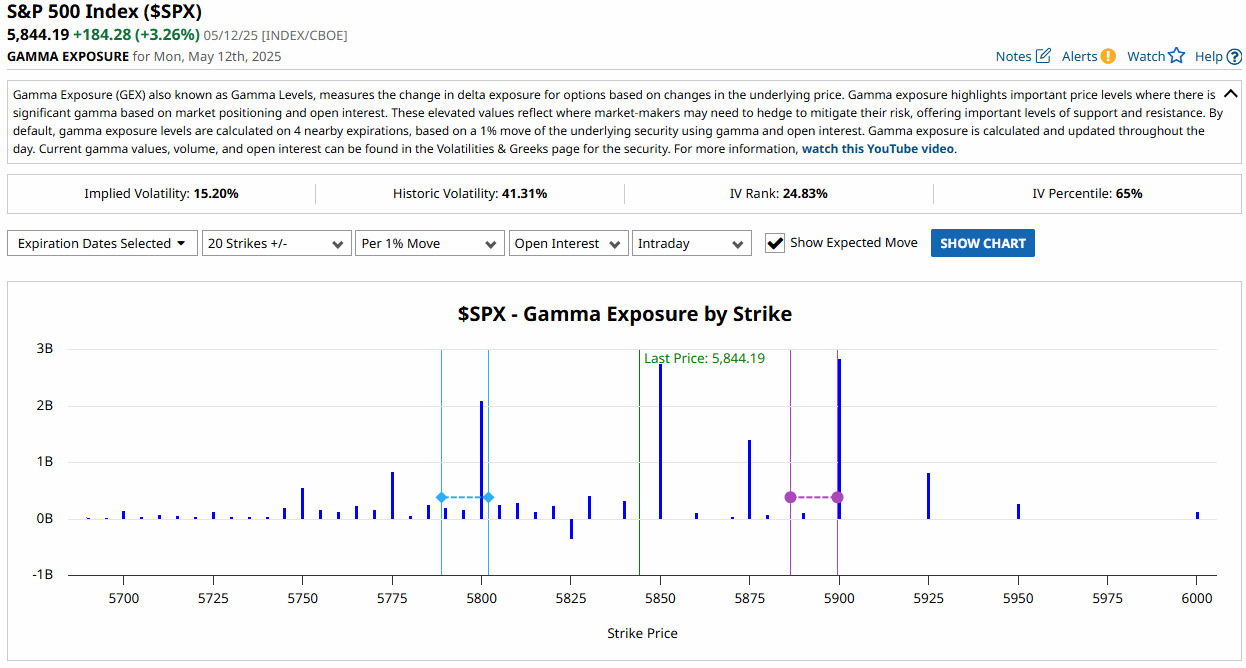

GEX Analysis Update

- 5850/5800

Expert Insights:

Mistake: Acting on gap hype without confirmation

Fix: Wait for structured signals – gaps often overpromise and underdeliver

Mistake: Taking every setup without verifying follow-through

Fix: Tag ‘n Turn needs confirmation – ignore half-baked entries

Mistake: Holding positions too long for “one more move”

Fix: Clean exits reset your psychology. Flat is power.

Rumour Has It…

Dead Market Blamed on Missing Algo Intern

A senior Citadel exec admitted the market’s lack of Monday activity was due to an intern failing to hit “Go” on their volatility algo.

“We were all at lunch,” said one quant, “and honestly, nobody noticed.”

Trading volume plummeted as the intern was last seen arguing with ChatGPT over whether markets can “vibe sideways.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact

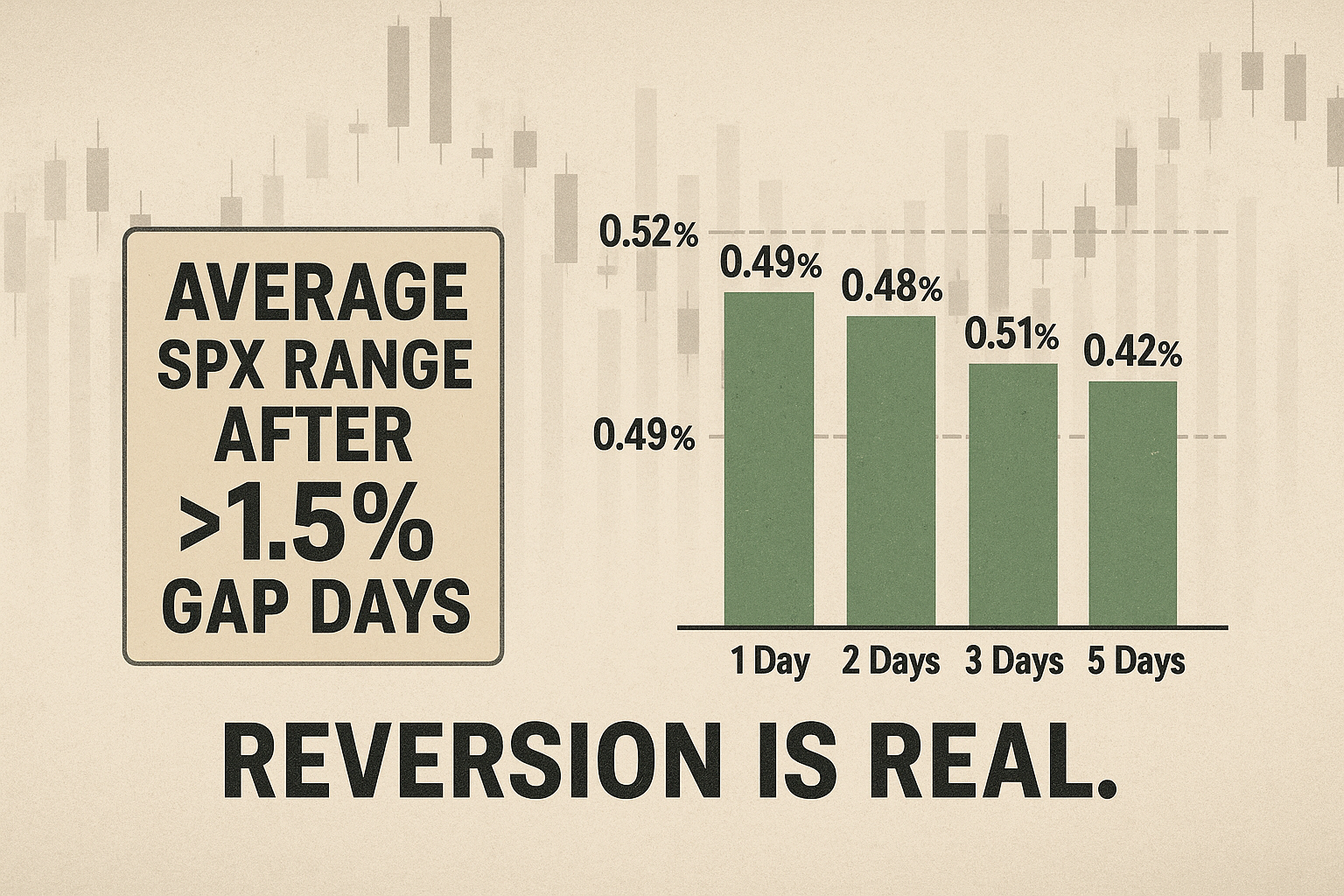

Post-gap sessions have a tendency to revert to the mean. In fact, over the last 7 years, the SPX has averaged less than 0.4% of total intraday range on the day after a gap of 1.5% or more.

Translation? Most people waste a ton of energy chasing ghosts the day after a breakout.

We didn’t. And we won’t.

Meme of the Day

“Biggest nothing burger I’ve seen since 2022.”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.