Clean 14‑Day Swing Trade Closes at 80% Profit – No Surprises

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Some trades are fast. Others take their time. This one took just over two weeks – and delivered right on cue.

It was a textbook move from setup to close, built on one of the 6 patterns I keep going back to for a reason. Let’s break it down.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Most Trade SPX Blind. You’ll Trade It Like You Designed It.

Pulse bars flip the lights on. You see it. Trade it. Bank it.

SPX Post Trade Debrief

This trade was opened on 28 April 2025 – a little longer than the typical 7-day hold, but well within expectations for a pattern-based swing.

The setup was clean: bullish breakout forming on both the daily and the 30-minute charts, one of my core money-making patterns. That alignment alone gives the trade a high-quality profile.

The premarket analysis confirmed the bias – and the trigger was clear. The position was opened mechanically, collecting $2.50 in credit.

Two weeks later, with a favourable gap higher, we closed the position for just $0.05. That’s an 80% return on capital for a trade that followed the rules from top to tail.

The only thing different about this trade? The duration.

Everything else? Pure system. No chasing. No fiddling. No discretionary tinkering.

The post-trade question remains the same:

Did I do everything I said I would do before, during, and after the trade?

Yes. Yes. And yes.

Expert Insights:

Mistake: Trying to close trades too early out of boredom

Fix: Let duration be defined by the system, not your emotions

Mistake: Over-managing during slower trades

Fix: If your setup was sound, trust the process – not every win is fast

Mistake: Ignoring setups on longer-duration patterns

Fix: They can be just as mechanical – and often more profitable

IMAGE HERE

Rumour Has It…

Trader Finishes Trade Early, Gets Bored, Launches New Crypto

One anonymous trader closed a swing position early after a 20% gain, citing “general boredom.” Sources say he immediately launched a crypto token named “Premature Exit.”

It dropped 90% within 12 hours, then inexplicably rallied 400% after a tweet from an AI-generated influencer named “ExitBot3000.”

The SEC has refused comment.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact

Most of my SPX income trades are structured to last around 7 days – but that’s not a magic number, it’s just what works best most of the time.

The sweet spot? It’s not about duration – it’s about when the market gives you the setup. Some trades wrap in 3 days. Others take 10.

The real edge isn’t in duration – it’s in following the system. You don’t need to predict how long a trade will last. You just need to know what to do when the system says “go” – and more importantly, when it says “get out.”

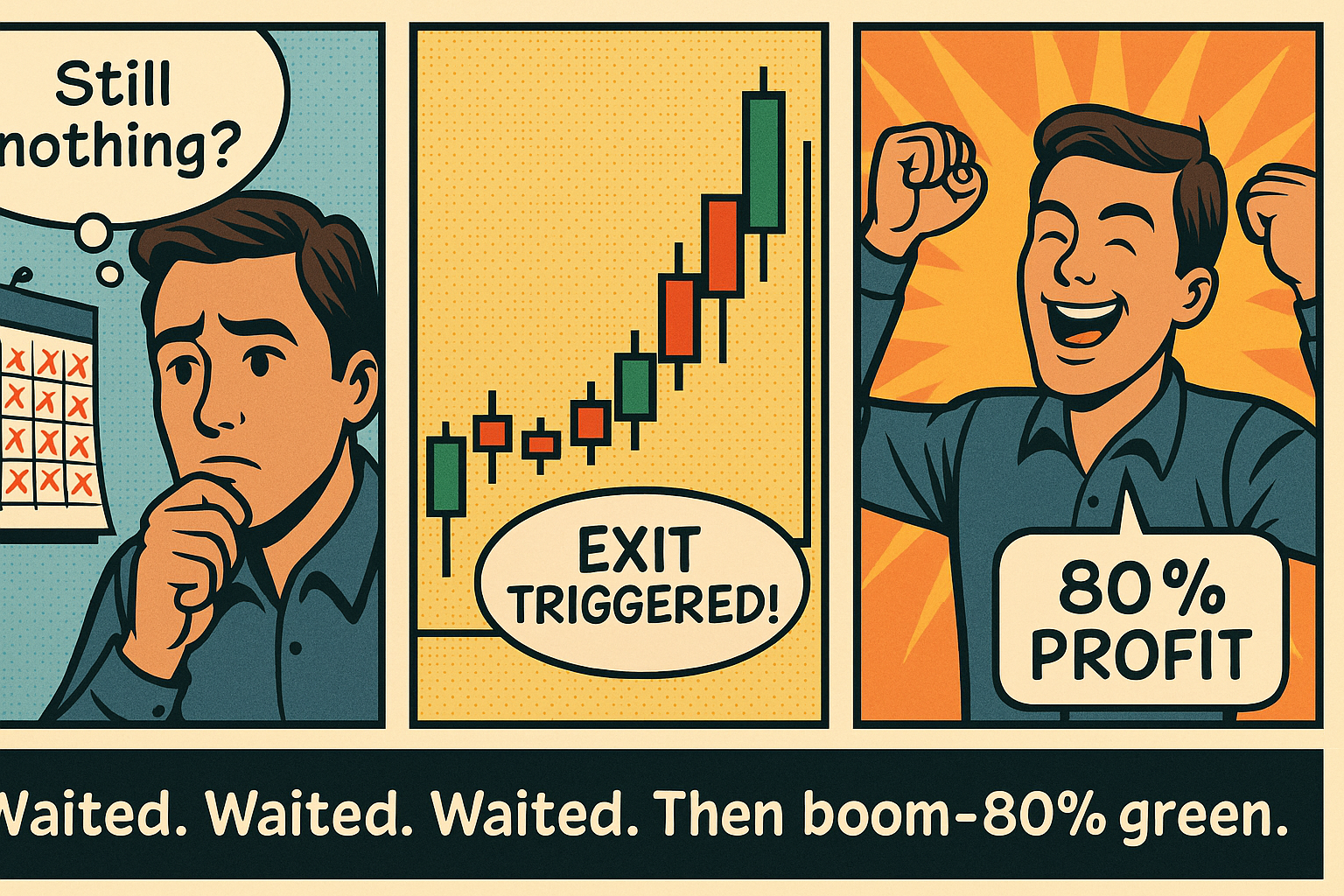

Meme of the Day

“Waited. Waited. Waited. Then boom – 80% green.”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.