One Rule, One Edge, One Setup Worth Waiting For

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Monday gave us another rate day stallout.

No pulse bar. No 5% close. No theta drip. No trade.

And you know what?

That’s a textbook AntiVestor win.

Because when the system says wait – we wait.

Let’s zoom in on the setup that didn’t show… and why that’s exactly what we wanted.

Most Trade SPX Blind. You’ll Trade It Like You Designed It.

Pulse bars flip the lights on. You see it. Trade it. Bank it.

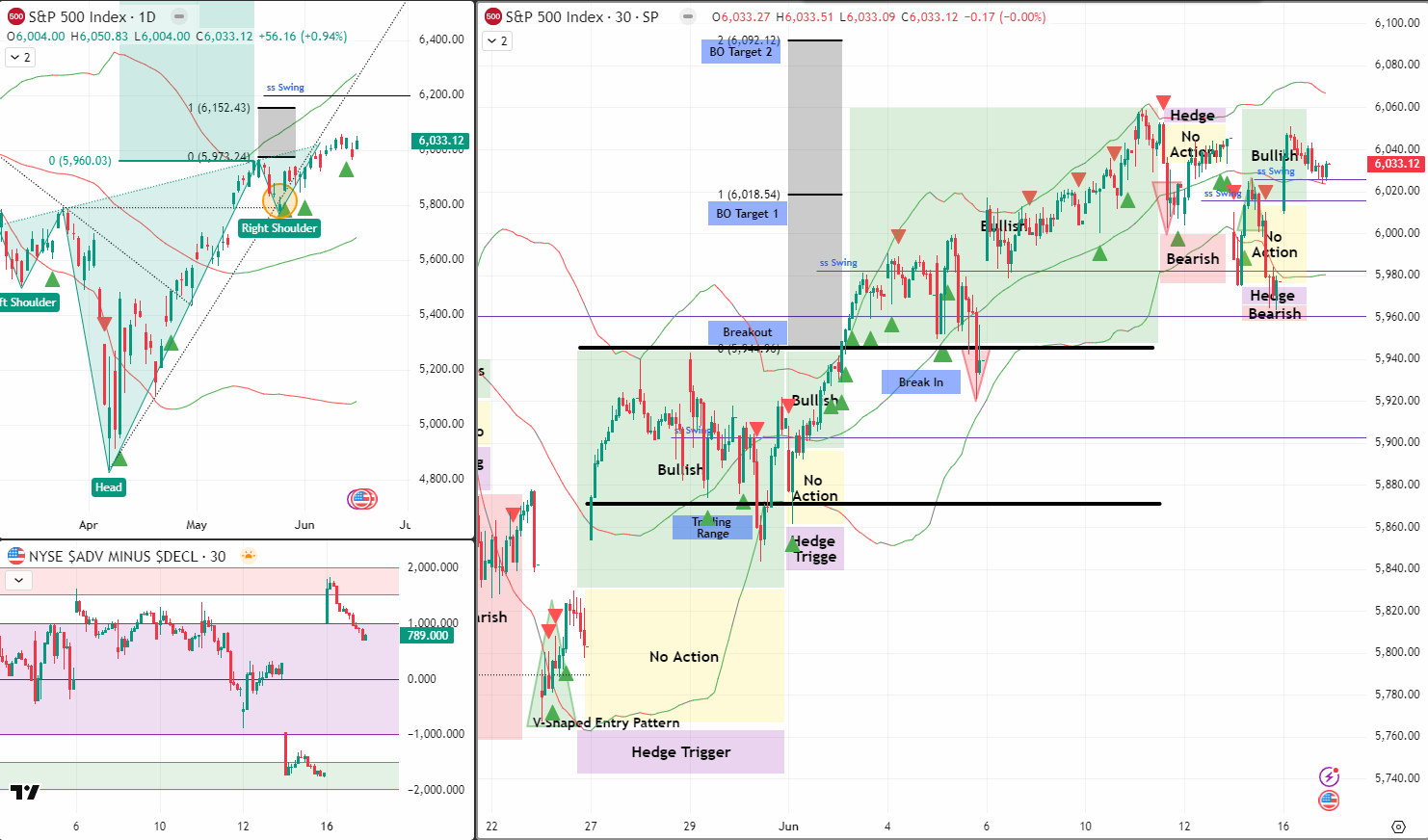

SPX Market Briefing

Morning folks – Monday was a lesson in patience.

Another rate day with no pulse bars that hit my 5% rule.

Nothing set up clean, so I did nothing.

That’s harder than it sounds.

There’s always a desire to “want to trade” – especially coming off a weekend.

Or, in my case, a vacation.

But if the system says to sit tight, we sit tight.

THAT is the importance of a rule-based trading system.

We don’t guess. We don’t “feel it.”

We sure as hell don’t wish upon a star and hope this green candle works out.

We have a defined and proven mechanical process – and we stick to it.

Yes, I’m bullish.

But that does not mean I’m tapping “confirm and send” on every uptick.

We wait… and wait… and wait some more.

For as long as it takes to get the setup we want.

It reminds me of when I first went full-time.

I was nervous. I was trading 100% my own money.

And I was desperate for a setup that would be worthy of the book:

“How Phil Trades” – Page 1, Trade 1.

So I waited.

And I waited.

Two months went by.

Then it happened.

My first perfect setup.

Bazinga.

The rest, as they say, is history.

And here we are again.

Still bullish.

Still waiting.

“Here I go again on my own…” – Whitesnake was right.

Expert Insights:

Common Trading Mistake:

Wanting to force a trade after a break or absence.

Why It Happens:

-

Emotional pressure to “get back on track”

-

Internal guilt loop: “I missed moves, now I must act”

-

Subtle FOMO: Watching others take impulsive trades

✅ How to Fix It:

-

Revisit your entry rules (5% pulse bar = trade)

-

Use a clean checklist to validate every trade

-

Remember: no trade is better than a bad trade

Rumour Has It…

“Wall Street AI Desk Hires GPT-9 to Handle Mondays”

After Monday’s total stallout, a major fund’s AI division has announced a new hiring initiative: replacing the Monday desk with GPT-9.

Early results?

-

100% rejection of trades with no edge

-

3-hour coffee breaks with zero FOMO

-

A Slackbot that replies “Still no setup, champ” every 15 minutes

Financial chaos may be incoming… but the bot remains zen.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

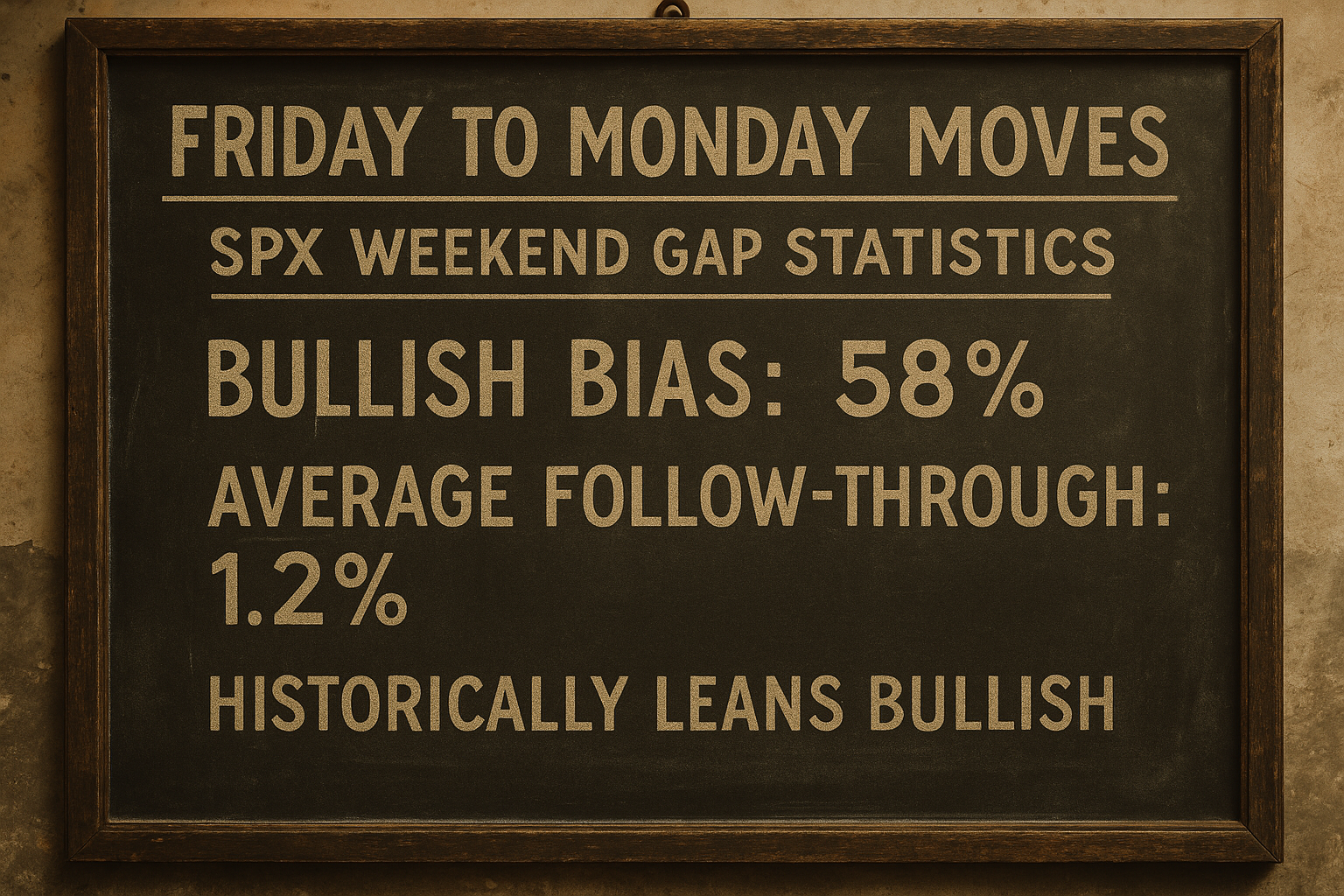

Fun Fact – SPX Weekend Gaps

Did you know…

The average SPX swing from Friday’s close to Monday’s open leans bullish 58% of the time, with an average follow-through of 1.2%.

Perfect for patient swing traders who let theta do the work.

But here’s the key:

Even when the stats favor us… we don’t front-run.

We wait for confirmation. Every time.

Meme of the Day

“Not every green bar is an invitation.”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.