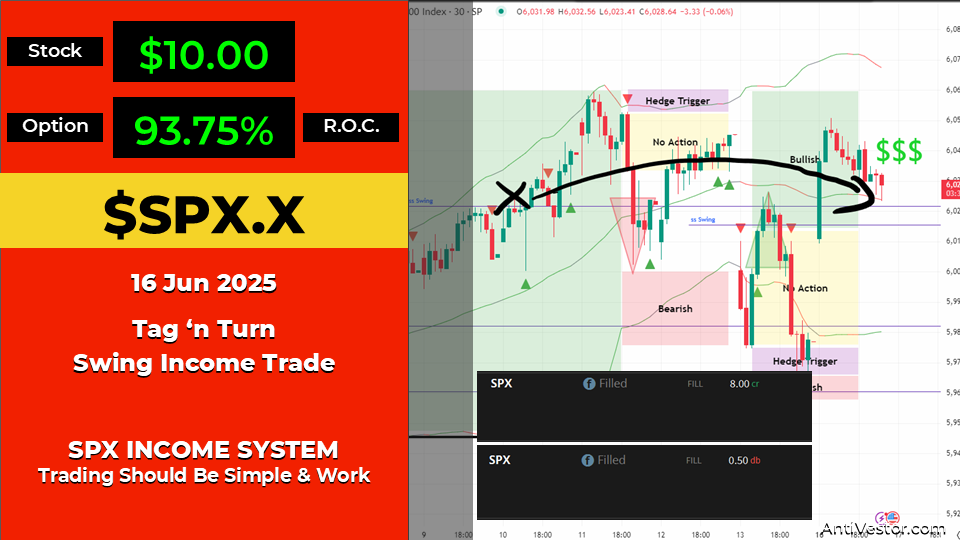

Collected $8, Closed at $0.50 – That’s a 93.75% Holiday Win

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Righty then folks, this one’s deliciously simple.

I touched down in sunny Costa Blanca last Sunday with one goal: chillax. Now I didn’t intend to trade – just keep half an eye on the markets to ensure nothing went pear-shaped (unless there were rum cherries and a pineapple involved, of course).

There are trades you grind for – and trades that just drip theta while you nap.

SPX Doesn’t Need You To Be Right. Just Consistent.

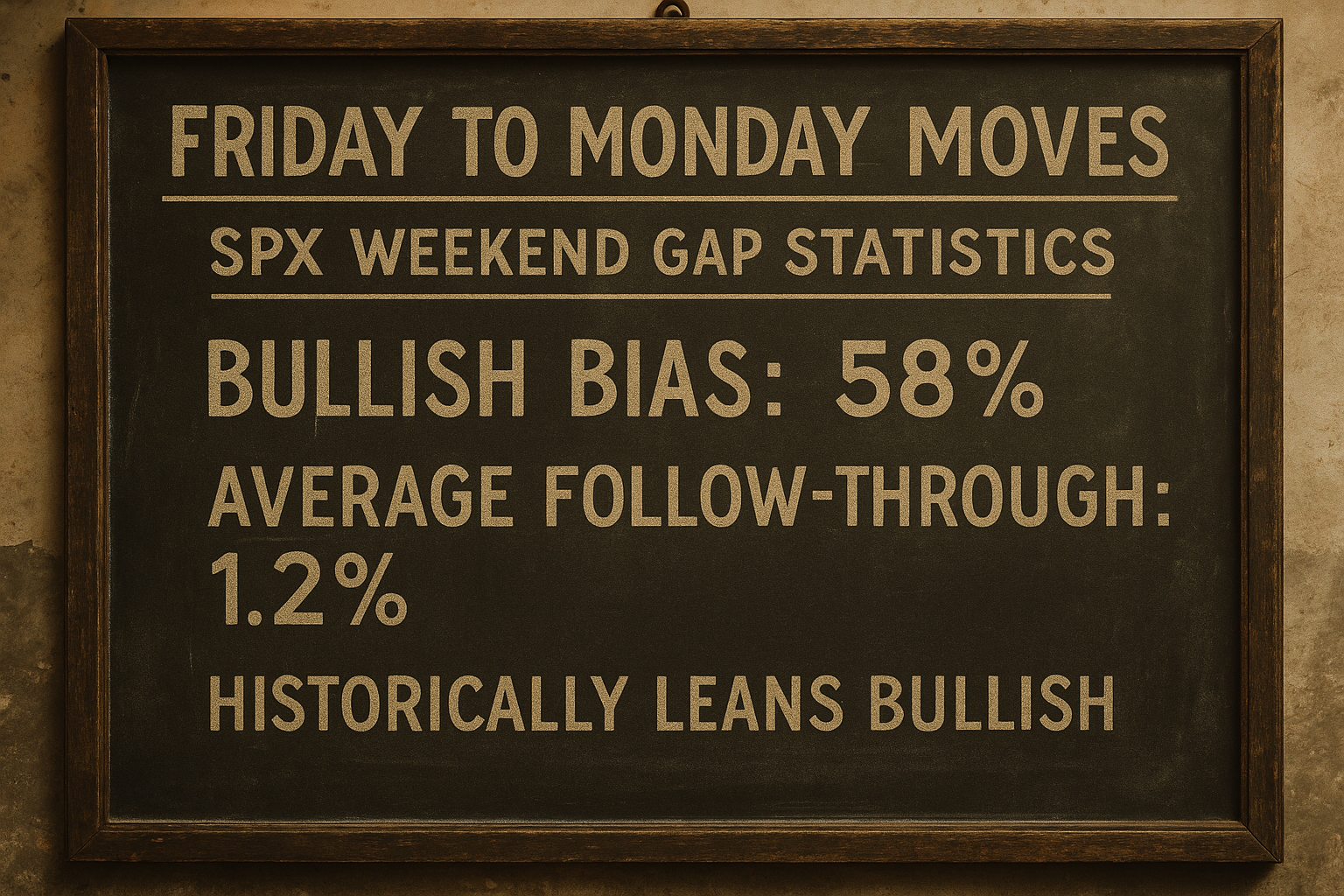

Pulse bar tells you when. Credit spreads handle the rest.

SPX De-Briefing

So here’s what went down while I was horizontal:

On arrival, one of my existing swing trades closed profitably, and with the bullish bias intact, I made a no-fuss decision to reload the swing. Then, another closed Tuesday – also profitably – both for 98%+ return, and neither needed more than a single glance from me.

The final trade? Collected $8 in premium, bought it back for $0.50, banking a no-stress $7.50 win or 93.75% return. The kicker? I barely managed it. Just let it do its thing over the week.

Total?

✅ 3 trades

✅ 3 wins

✅ 0 stress

✅ 1 crispy tan

This wasn’t luck. It was system simplicity meeting market structure. Theta did the work – I just showed up with a plan.

Expert Insights:

Common Trading Mistake: Overtrading while on holiday or during low focus periods

How to Avoid It:

Set and forget using pre-structured swing setups and definitive trigger rules. Don’t chase trades while distracted. Let the structure do the lifting.

Rumour Has It…

Local Spanish bartender now offers a drink called “The AntiVestor” – ingredients unknown, but it’s said to work best if you don’t touch it for five days and check the balance later.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact

Meme of the Day

“Made $7.50 while my ice melted – theta is a vibe.”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.