Overnight Swing Holds Strong – Lunch Exit Likely

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Luverly Jubberly!

We came into Tuesday like a heat-seeking missile.

Strong open. Big gap. Clean launch above 6060 – the very range top we’ve been stalking. And price didn’t hesitate. It held. Then ran straight to 6100.

Just like last time… it paid to wait.

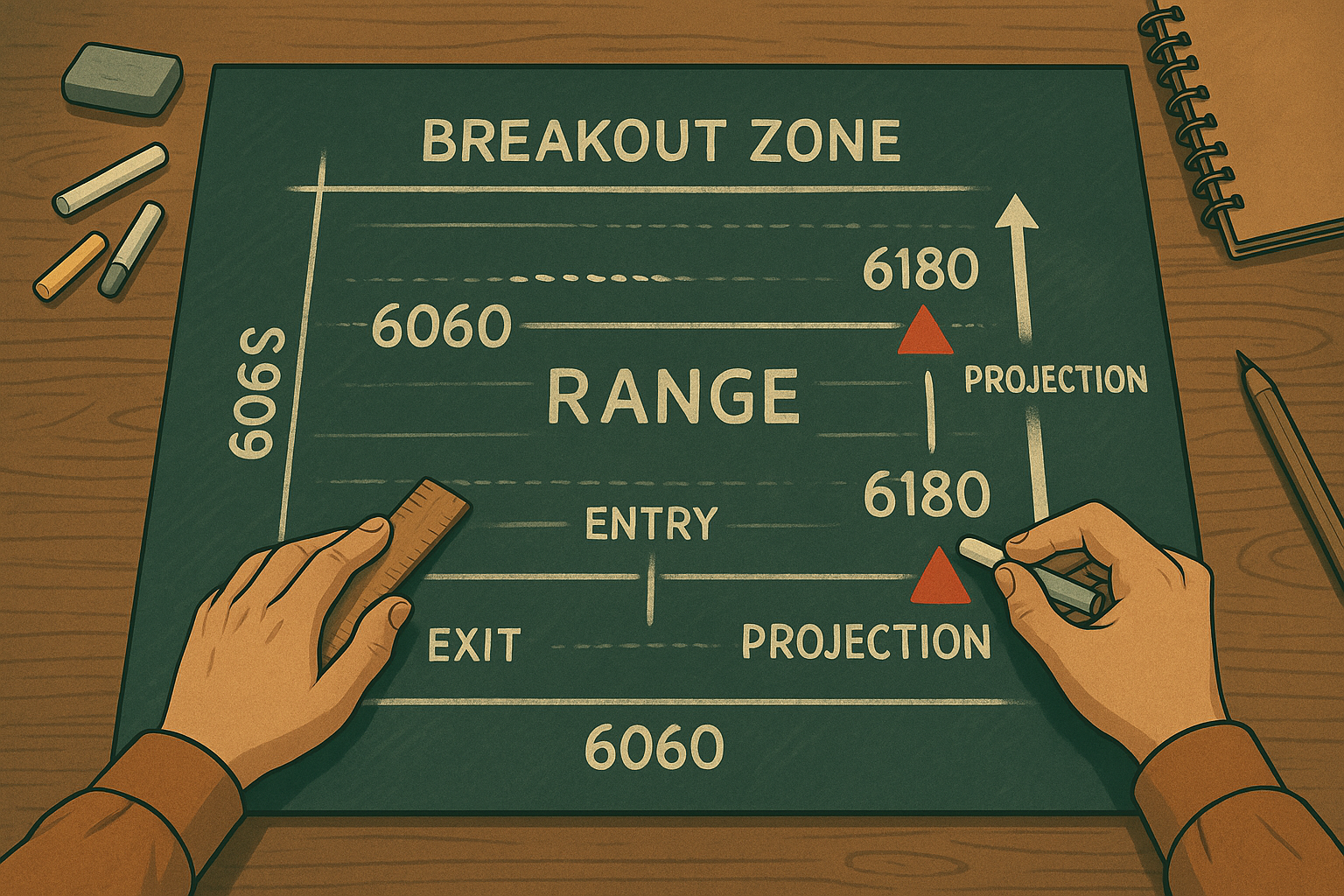

This is one of my 6 money making patterns – I spent 12 years drilling this in the Forex pits. When we break a defined price action range, we project the range height for a clean target. That puts us now on a mission to 6180.

Missed the move? Don’t worry, we log receipts – keep going.

SPX Isn’t Random. It’s a Paycheque Waiting to Be Claimed.

Zero-day options + pulse bar = fast cash, low stress.

SPX Market Briefing – Breakout Logic and Reversal Plan

Let’s unpack it:

-

We had a clean, multi-day range. Top was 6060.

-

Price gapped above it, confirmed with intraday hold and rally.

-

Range height = ~120 points. Add that to 6060 = 6180 target.

That’s the current game board.

I’ll stay bullish above 6060 into that target. That’s my compounding zone – adding to the swing, letting momentum do the work.

But.

Drop back into the range (below 6060)? That’s a red triangle reversal. That’s the “Break-In” trade – opposite side of the pattern. Defined. Mechanical. Familiar.

And don’t forget the bigger picture…

In Other News…

Cool Oil, Warm Yields, Mixed Tech

Futures firm, curve flattens further

First pulse – energy unwind: Brent’s three-dollar retreat clipped XLE 1.2 percent after Monday’s 4 percent burst, while refiners gained on bullish inventory math. Travel stocks recouped half of yesterday’s fuel-sprain losses.

But wait – tech divergence: Nvidia’s Malaysia splash pushed semis 0.7 percent, yet handset assemblers slipped on weak Taiwan export orders. The SOX-NDX spread remains a chasm as investors cherry-pick AI winners.

Next twist – rates chatter: The 10-year rose four basis points to 4.49 percent on Powell’s hawkish hint, taking banks with it even as the curve flattened. Utilities retreated, gold eased $11 to $3 385 on a firmer dollar.

Closing setup – catalysts: Powell’s Q&A plus a 13:30 ET Trump rally headline could add tape whiplash. Quants note a gamma hump at 5 590 on the S&P; a break could chase vol sellers into the closing bell.

Expert Insights:

Zooming out…

The inverted head & shoulders on the daily chart just broke back above its neckline. Again.

This validates the 7000 long-term swing projection I’ve had in play for weeks.

Yes, it may chop.

Yes, it may fake.

But while this structure holds, the upside play is clean and high probability.

And yes – I’m still in that swing.

After a dead-as-a-dodo (yet somehow profitable) week last week, we’re now back to compounding, managing green trades, and watching the next price zone.

Futures? Still holding highs.

That overnight swing? Likely ready for exit near lunch today if these levels stay strong.

Stay sharp. Stay systematic.

Rumour Has It…

Hazel screamed “WAR!”

Peanut chewed through Kash’s breakout cable.

Wallie quoted a Fib level upside down.

Again.

But inside the SPX Command Pod…

calm.

cool.

pulse bar confirmation glowing.

They’re out there trading chaos.

We’re in here trading structure.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

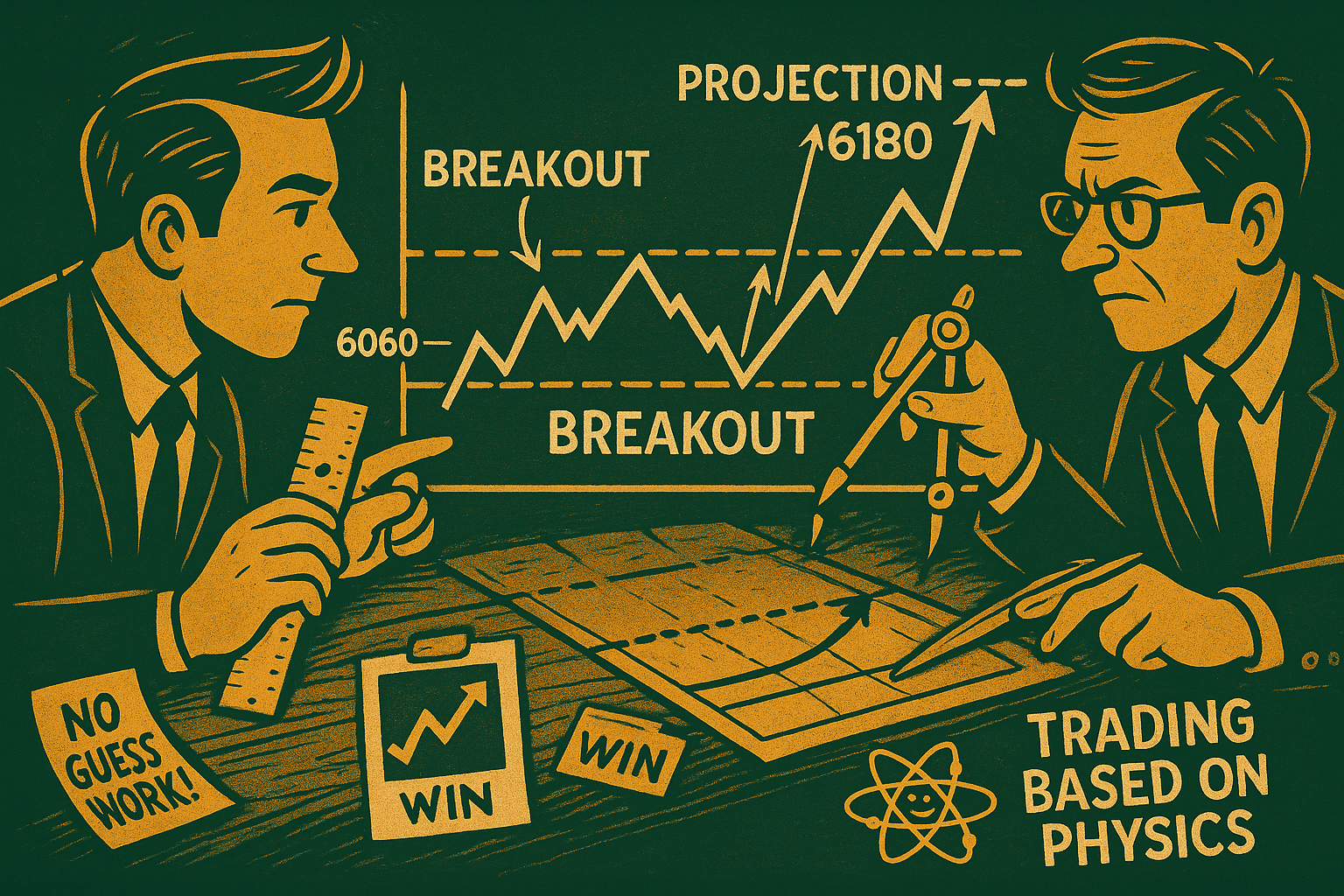

Fun Fact – Why 6180 Matters

The most overlooked move in trading?

The second leg.

The measured move.

The breakout follow-through.

Price action ranges don’t just break out for fun.

They carry momentum. And structure.

6060 was the range top.

The height of the range projected to 6180.

It’s simple math. But simple isn’t easy.

Most traders are still trying to guess direction.

We’re over here trading physics.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.