Fast Forward Unlocks Early Confidence Trade Before Pulse

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Sometimes, the system gives you the signal.

Other times – you read the tape.

That was the case yesterday.

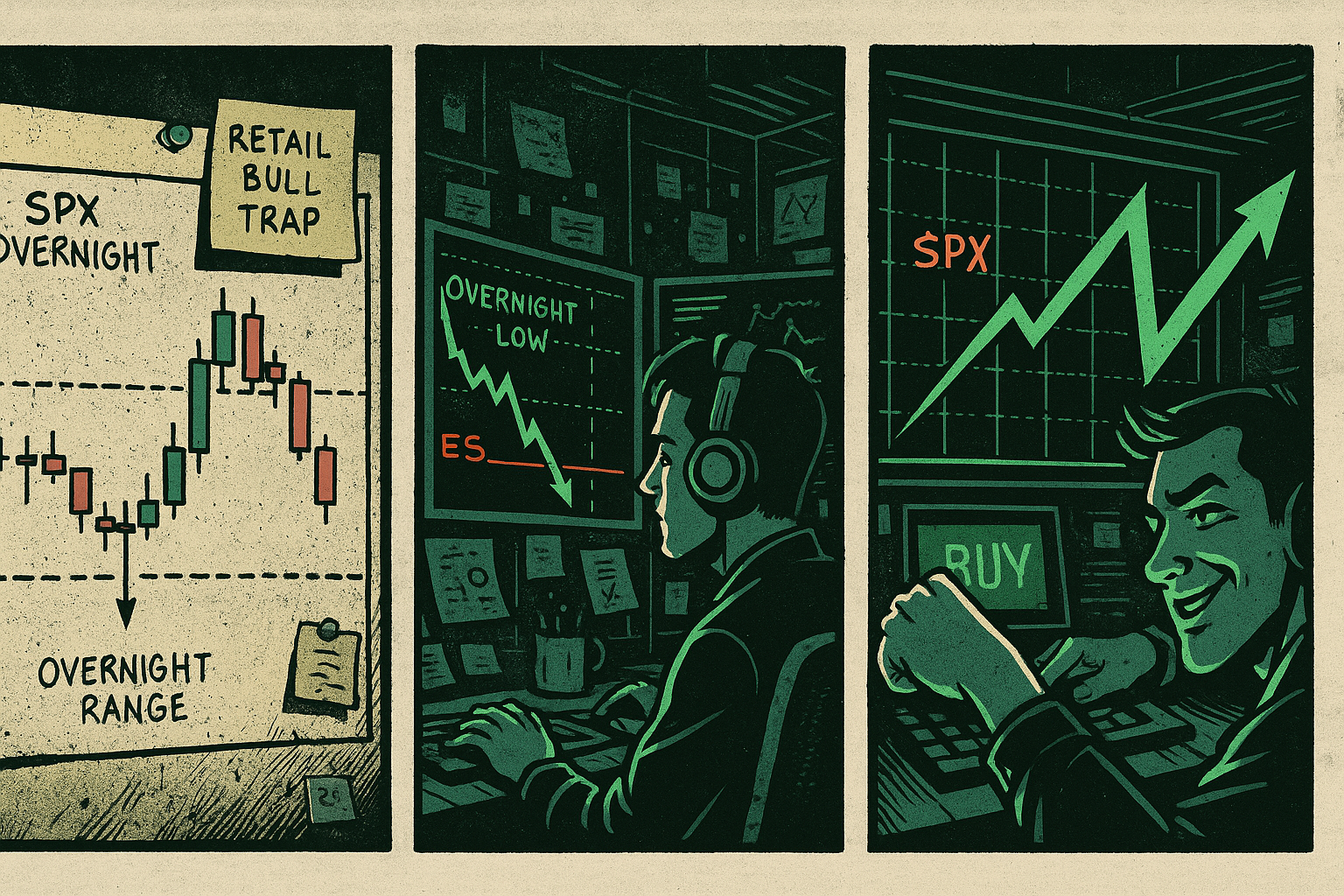

During our Fast Forward mentorship session, we walked through something many traders overlook:

- Liquidity grabs.

- Stop hunts.

- Overnight range behaviour.

The overnight high got tagged early.

Then the overnight low.

Textbook sweep.

That gave me confidence to take a discretionary bullish trade – before any pulse bar confirmation.

No guessing. No gambling.

Just years of pattern recognition kicking in.

Let’s zoom in on the price structure – and how I used it.

SPX Is Rigged… In Your Favour (If You Know This).

The markets move. You get paid. No stress. No surprises.

SPX Market Briefing – Structure First, Signal Second

Here’s what unfolded:

-

The overnight high was dinged just after the opening bell

-

That’s usually enough to shake out weak shorts

-

But then? The low of the overnight range also got tagged

-

This creates what I call a liquidity trap zone – a sweep of both sides

Now most traders?

They sit there asking, “Wait, what now?”

Me?

I know that setup.

I’ve seen it over and over in Forex, Futures, and now SPX.

It was enough to take the trade without waiting for a fresh pulse bar.

The conviction was there.

The levels were clean.

The context was king.

Coming into today?

SPX futures are already printing +20 above yesterday’s close.

Momentum’s alive.

Structure’s intact.

We’re still above 6060 – so the breakout logic holds.

Target? Still 6180.

Keep it simple.

Follow the plan.

When you know the game board, you don’t need a second guess.

In Other News…

Dollar Dumps, Oil Pumps, AI Dominates

SPX edges up as hedges mount

Opening lift: S&P futures rose 0.4 % on the greenback’s slide. A weaker dollar boosted multinationals, while gold crept higher and energy markets caught a tailwind from crude inventory prints.

Sector scorecard: Energy stayed bid as EIA data showed firm summer demand. Materials and industrials followed, while consumer staples lagged on inflation chatter. Tech outperformed on Nvidia strength, offsetting small-cap softness.

Hedge flow: Put option volume rose 30 % overnight, with Goldman flagging sustained volatility premia. Positioning suggests investors are prepping for chop ahead of Friday’s PCE and July catalysts.

Watch zone: SPX 5 620 marks today’s gamma cluster. A Powell soundbite or curve steepener could yank volatility in either direction into the close.

Expert Insights: When Discretion Beats Automation

AntiVestor Playbook Reminder:

✅ You don’t need a pulse bar to enter – if you’ve got:

-

Clean levels

-

Full overnight sweeps

-

Strong contextual reasoning

-

Confirmed directional bias

⚠️ But don’t overuse discretion.

This was a textbook example.

You earn the right to trade early only if you can read the story in price.

Rumour Has It…

Hazel insisted the double overnight sweep meant we were “trapped in a quantum liquidity inversion.”

Wallie nodded solemnly – then reversed three trades in 10 minutes.

Kash missed the breakout because he was too busy backtesting straddles from 2014.

And Peanut?

Peanut just sat on the buy button and whispered,

“Sweep complete. Target acquired.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

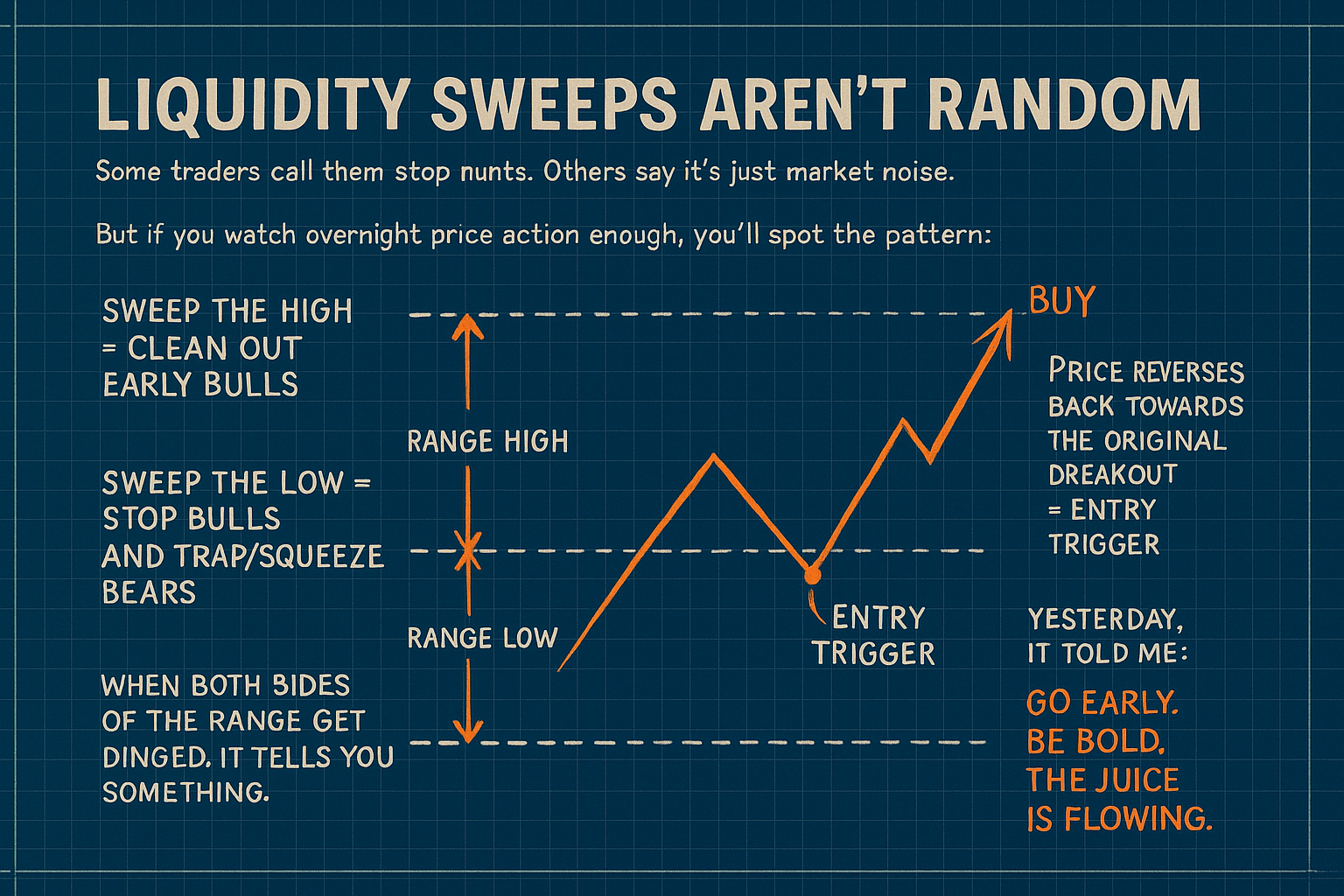

Fun Fact: Liquidity Sweeps Aren’t Random

Some traders call them stop hunts.

Others say it’s just market noise.

But if you watch overnight price action enough, you’ll spot the pattern:

-

Sweep the high = clean out early Bulls

-

Sweep the low = Stop bulls and trap/squeeze bears

-

Price reverses back towards the original breakout direction = entry trigger

When both sides of the range get dinged, it tells you something.

Yesterday, it told me:

Go early. Be bold. The juice is flowing.

Meme of the Day

Most stare at sweeps. We step in.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.