“Badabada-Bing” into Friday as Plan Pays Again

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

TGIF.

This week, the muffins rose, the theta flowed, and we didn’t get “flip flopped” out.

Last week’s sideways chop made us sit tight.

This week? We capitalised.

And that’s the power of the system.

You don’t feel your way through the week.

You follow.

“Be bullish until we’re bearish.”

That’s it.

No need to guess.

No need to force flips.

We avoided one potential bear flip/flop midweek – and that’s not just a win… it’s a headache avoided.

Most Trade SPX Blind. You’ll Trade It Like You Designed It.

Pulse bars flip the lights on. You see it. Trade it. Bank it.

SPX Market Briefing: The Plan Didn’t Change (Because It Didn’t Have To)

From the Fast Forward group to the morning maps, everything aligned:

-

No bear confirmation below 6060

-

Breakout swing triggered above

-

6180 remains the projected measured move

-

Bollinger Band width is now contracting – that’s your clue a pause or sideways drift may follow

We’ve already:

-

Scaled out of early swings

-

Reloaded on the breakout

-

Hit targets overnight with theta-rich structures

And today?

Friday’s plan = chill and hold structure.

There’s no need to guess the next move until we get the pause or reversal confirmation.

Until then?

Enjoy the song:

“Collect dat theta… badabada-bing.”

(Yes, that’s a Sean Paul remix if you squint hard enough.)

In Other News: Global Bull Buzz Meets Macro Calm

Mixed signals under market optimism

Opening note: Asia’s rally and a weaker dollar buoyed U.S. futures. The S&P edged +0.2%; Nasdaq ticked +0.3%.

Bridge sectors: Energy reversed early gains on the oil drop, while materials and industrials held modest strength. Export-linked names gained ground on FX tailwinds.

Next line: Tech stayed resilient-some chip names rebounded as AI momentum continued—while financials languished amid rising rate‑cut chatter. Gold miners slumped 1.2%.

Closing setup: Volatility remains restrained but poised. Investors await the core PCE data and Powell appearance next week. Key SPX level is 5,640 gamma. A break above could trigger a spring rally; a miss may prompt month-end rebalancing.

Expert Insights: Don’t Let a Pause Confuse You

You’ve heard me say it:

“Just because the market slows… doesn’t mean you need to.”

A narrowing Bollinger Band often signals a pending pause.

But that’s not a trade signal in itself.

It’s context.

And when you combine:

-

A directional breakout that hasn’t failed

-

A slow drift with no clear counter-structure

-

Profit in hand and premium collected

…then your job is done until price gives you a new signal.

This is how you avoid premature flips, emotional swings, and overtrading.

Read the tempo.

Don’t invent one.

Rumour Has It…

Hazel was caught whispering to the Bollinger Bands.

Wallie sketched “recoil spike probabilities” using a muffin tray.

(It was chocolate chip. Naturally.)

Kash tried to fade the theta drip.

He’s now manually tracking time decay using a sun dial.

And Peanut?

He’s been parked on the keyboard all morning…

…which oddly aligns with our best week this month.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

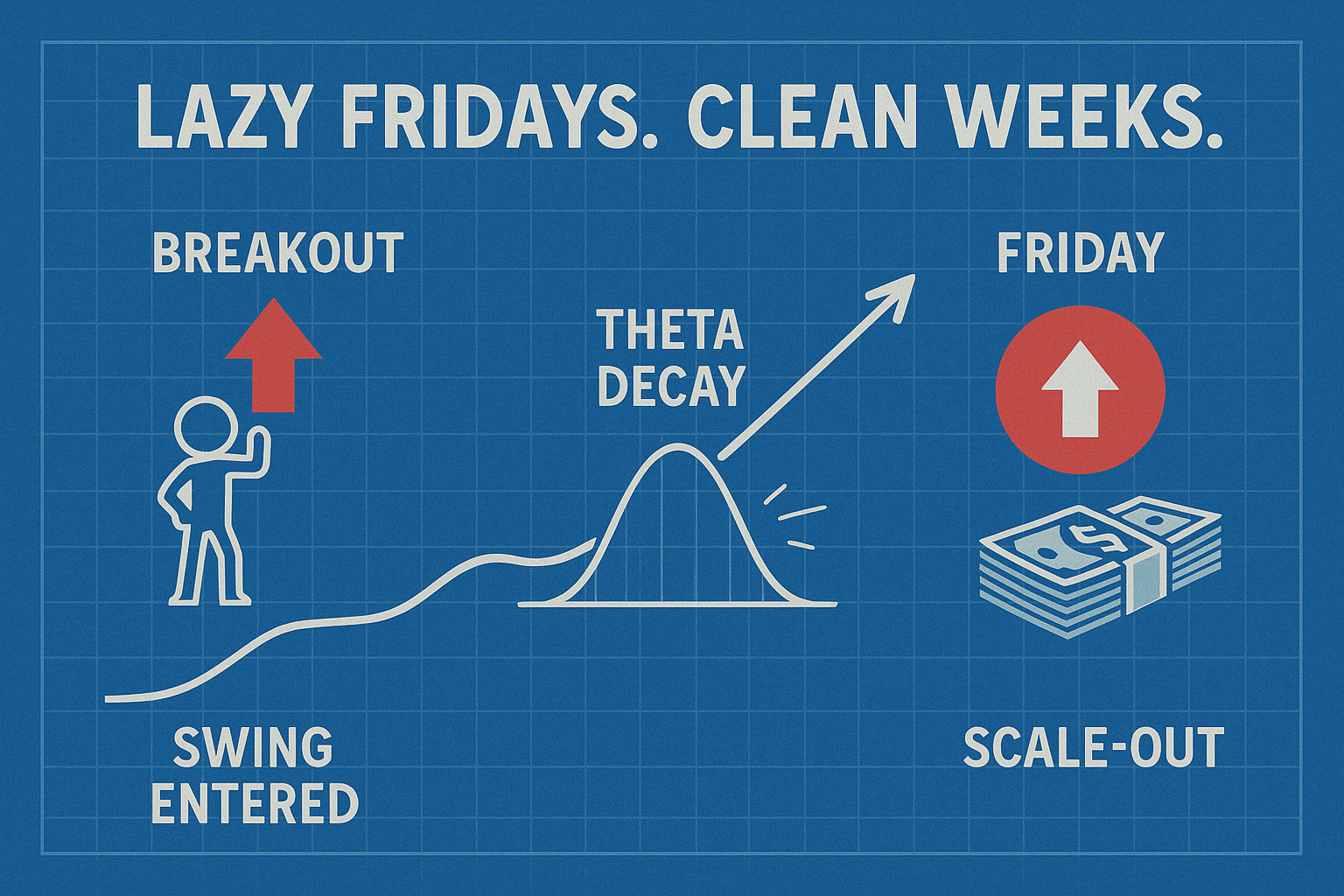

Fun Fact: Lazy Friday ROC

A strong week doesn’t require a strong Friday.

In fact – strong Fridays usually come from not overtrading them.

This week we’ve already:

-

Cashed out overnight wins

-

Held breakout swing structures

-

Avoided chop

-

Preserved edge

Theta’s dripping.

The trade’s done the work.

So if you feel like today’s setup is “boring”?

Good.

That means the plan is working.

Meme of the Day

“The market’s chill. So are we.”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.