Discretion + Pattern = Scrapbook-Worthy Swing

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

This one’s for the scrapbook.

Wednesday’s Fast Forward group session had a clear standout – a tight premarket range on ES that screamed for a liquidity grab.

We watched it together.

We mapped the sweep zones.

We knew what was coming.

Overnight high? Dinged.

Premarket low? Swept.

ADD? Low.

That’s not just noise. That’s a trigger.

The pattern was there – and it gave me enough conviction to go early.

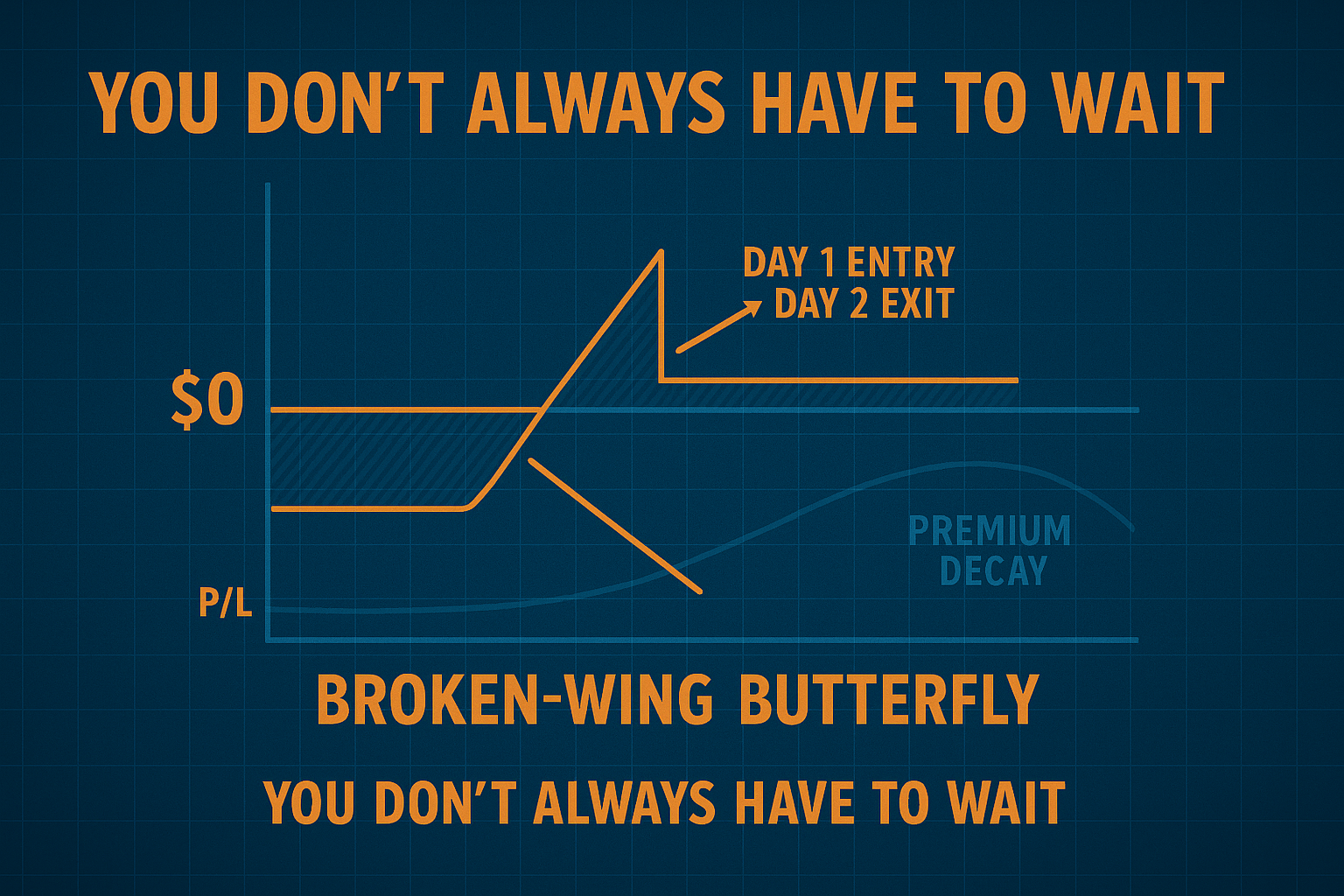

1-DTE Broken Wing Butterfly.

Collected $7.

Bought back at $0.30.

95.7% return – all before lunch the next day.

SPX Is Rigged… In Your Favour (If You Know This).

The markets move. You get paid. No stress. No surprises.

SPX De-Briefing

Here’s what we looked at:

-

Premarket range was narrow.

-

Overnight futures took out the highs.

-

Price dipped post-open to clear the range lows.

-

Relative ADD stayed low – not a full market flush.

That gave us context.

Not chaos.

Not confusion.

Context.

From there, the trade was simple:

-

Place the structure.

-

Sell the premium.

-

Let the move unfold.

No heroism. Just execution.

When we swept both sides of the range, I dropped the 1-DTE Broken Wing Butterfly. $7 premium collected.

It moved fast.

The next morning, the exit was hit at $0.30.

This was technically a discretionary trade – but it was anything but random.

The setup? Repeatable.

The pattern? Familiar.

The result? Another day, another ROC.

Expert Insights: The Sweep Is the Setup

Some traders see a sweep and panic.

We see a sweep and act.

That’s the difference between guessing and knowing what you’re looking at.

Here’s what we watch for:

-

Sweep high = clear early bulls

-

Sweep low = stop bulls, trap bears

-

Reversal back into trend = trigger

When both sides get dinged, we go hunting.

This setup didn’t need a pulse bar. It was loud and clear.

ADD gave us conviction.

The structure gave us timing.

The process gave us profit.

Rumour Has It…

Hazel called the sweep “a vibe shift.”

Wallie insisted this was a “quadruple indecision bracket squeeze.”

(He’s still annotating the chart with 14 different fib levels.)

Kash had a leftover order on an expired straddle.

He claims he meant to. We’re skeptical.

And Peanut?

Peanut drew a butterfly on the whiteboard and ate the red marker.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact: Pattern Over Guesswork

This wasn’t a guess.

It was a price behaviour repeat I’ve seen hundreds of times.

When the range is tight…

When the sweeps fire…

When structure shows up…

You don’t need to wait for a pulse bar.

You just need to know what you’re looking at.

One day to expiry.

One trade setup.

One 95.7% win.

That’s how you scrapbook a trade.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.