Trade In. Walk Away. ORB60 Setup Delivers Near Max ROC

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Some trades make you feel clever.

Others just make you money.

Monday’s SPX setup did both – a perfect example of why the ORB60 0-DTE strategy sits at the core of the SPX Income System. No indicator. No second-guessing. Just a clean range, a defined edge, and reliable decay.

“Hold your champagne – the trapdoor’s right under the profit chart.”

SPX Pays Daily. If You Know This One Setup.

Pulse bar + credit spread = reliable income. It’s that simple.

SPX DeBriefing:

ORB60 0-DTE Setup – No Drama, Just Decay

Today’s income trade came from one of our most elegant 0-DTE variations – the Opening Range Breakout (ORB60).

⚙️ Trade Setup Breakdown

-

Setup Type: ORB60 (Opening Range Breakout)

-

Strategy Logic:

-

Marked the high and low of the first 60 minutes

-

Waited for a clean break of range

-

No pulse bar confirmation required

-

-

Position: Bear Call Spread

-

Strikes: OTM

-

Premium Collected: $5.00

-

Exit Price: $0.10

-

Time in Trade: ~5 hours

-

ROC: 98.0%

-

Management Required: Minimal

-

Stress Level: Near-zero

What Actually Happened

SPX opened and gave traders a full hour of indecision. Once the 60-minute range was locked, price failed to reclaim the highs and broke lower.

We deployed a bear call spread, collecting a clean $5 credit – far enough out-of-the-money to ride natural decay, but close enough to benefit from a directional edge (should we get one).

There was no retest of the strike, no drama, and no heat.

This was a “place the trade, let it bake” kind of session.

We closed for $0.10 about an hour before the bell, but expiration was just as viable.

System Insights

This ORB60 twist is a pure breakout setup – no indicators, no second-guessing.

-

No pulse bar required

-

No need for strong directional follow-through

-

Just: range → break → decay → payout.

It’s a workhorse pattern with a historical win rate of 84.9%, and one of the smoothest equity curves in the entire SPX Income arsenal.

The AntiVestor Truth

“You don’t need a market meltdown to get paid. You just need a range that breaks, and time on your side.”

Strategy Reminder: ORB60 Cheat Sheet

-

Step 1: Mark first hour high/low

-

Step 2: Wait for breakout (no pulse bar needed)

-

Step 3: Enter OTM spread

-

Step 4: Hold to expiration or near-max profit

Expert Insights:

“Fade the noise. Trade the breakout.”

ORB60 breakouts have a cleaner directional edge.

Add this layer when scanning setups.

[Source: AntiVestor – “SPX ORB Setup Primer”]

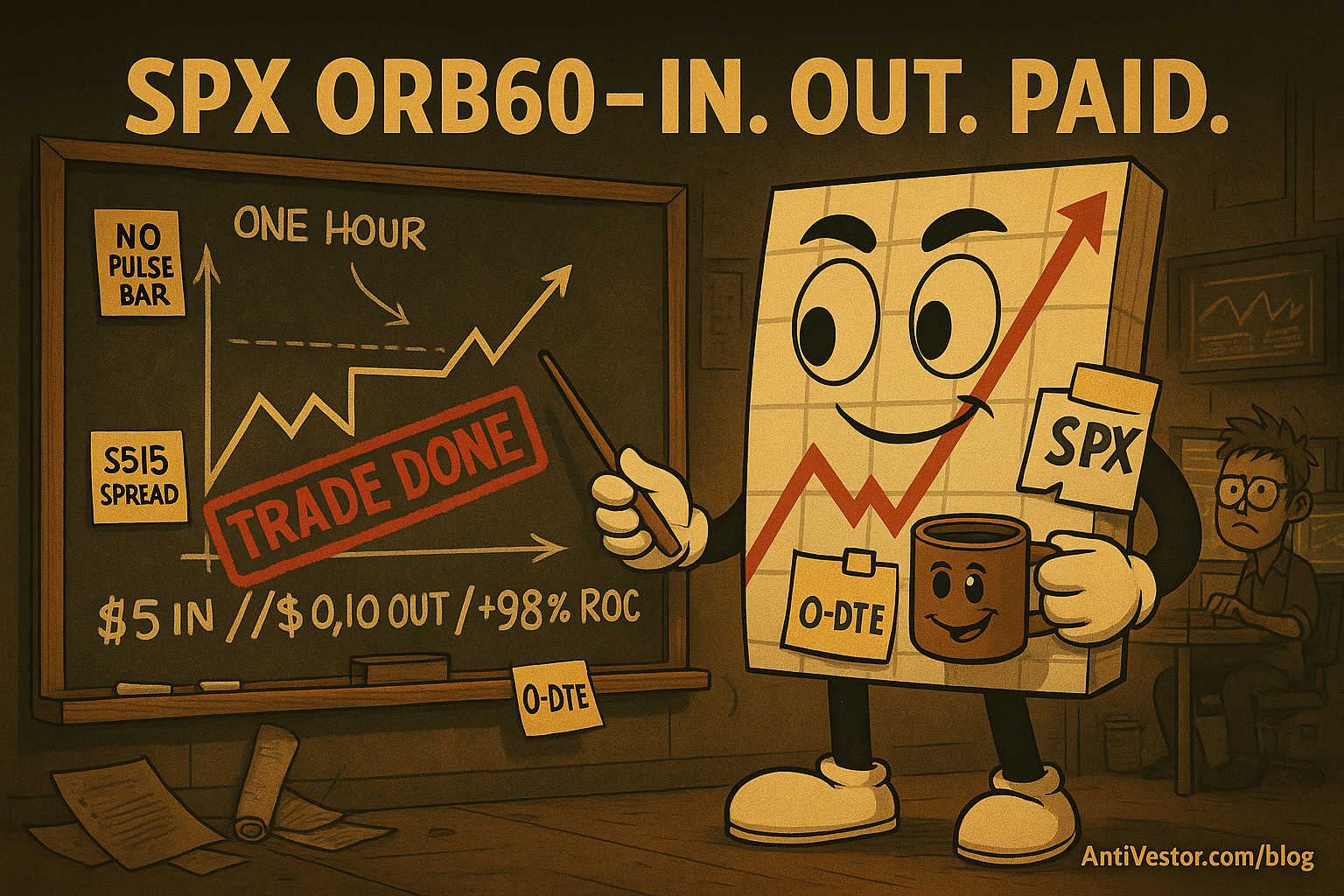

Meme of the Day:

ORB60: Because sometimes you want the profit without the pulse.

IMAGE HERE

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.