Bullish But Bored: Price Stalls With No Pulse

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

It’s the last day of the trading month and, as tradition suggests, the last Friday of May rarely comes in swinging. After Thursday’s teeter-totter of a session – up, then down, then nowhere – expectations for a directional breakout are lower than the caffeine level in a recycled K-cup.

Still, the plan stays the same: rules over reactions. No signals, no action. And frankly, if today turns into one of those “meh” market days, so be it. There’s always Monday.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

SPX Market Briefing

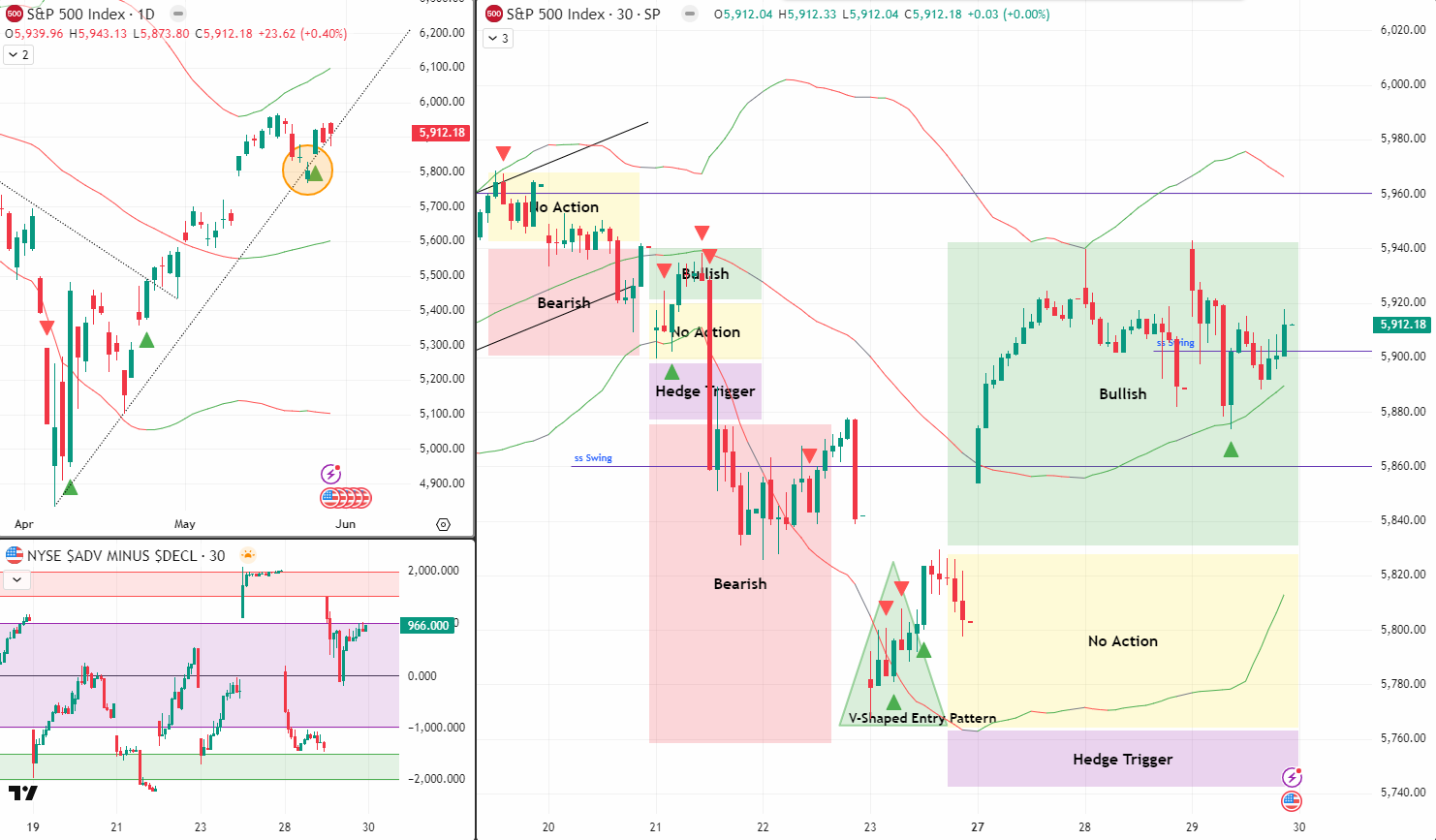

As mentioned in recent training: “We’re bullish until we’re bearish.”

That stance still holds. The system flipped bullish last Friday, and while price flirted with the upper Bollinger Band midweek, it didn’t quite touch it – no tag, no reversal. So the bullish bias remains intact.

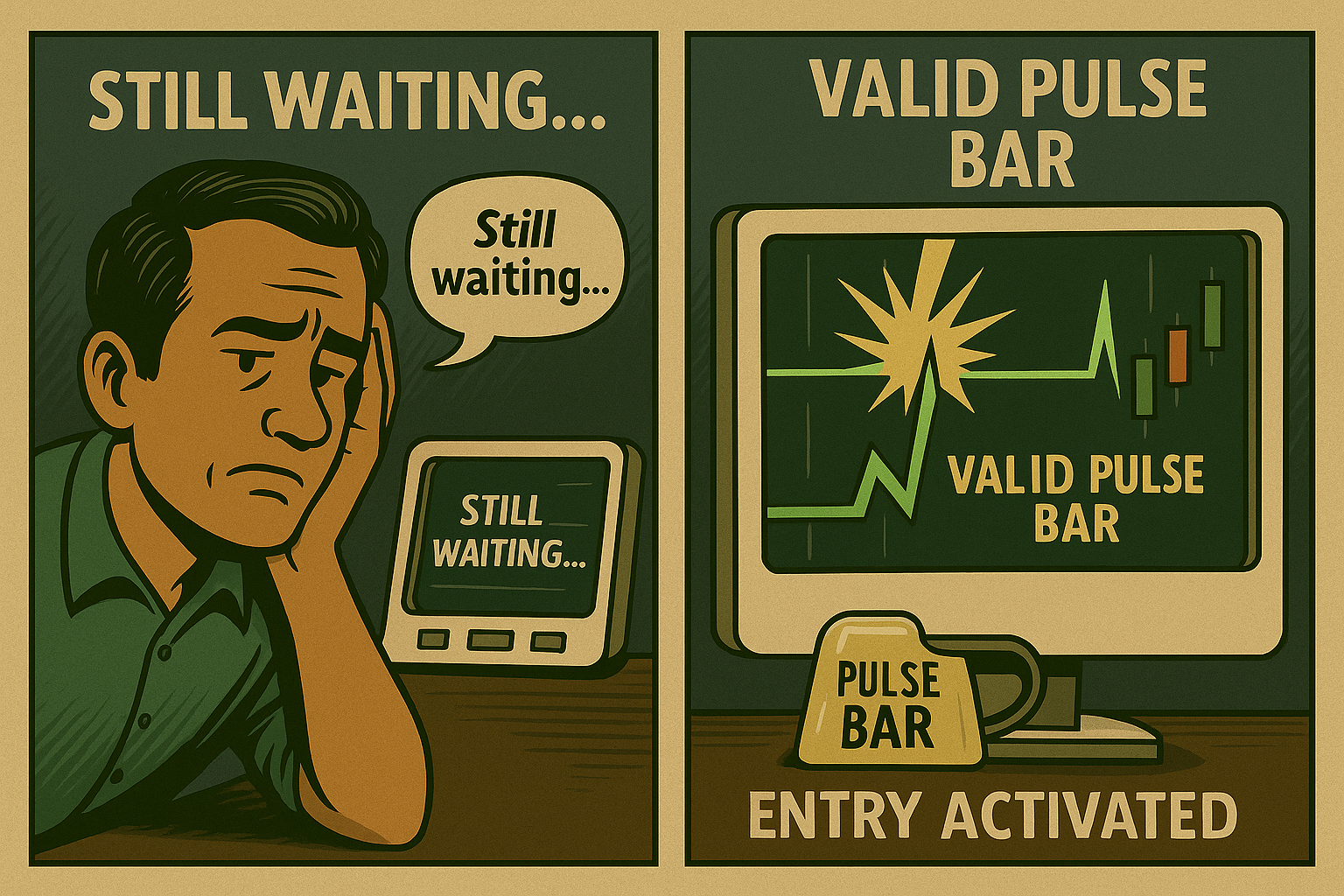

Yet despite that bias, it’s been a week of sitting tight. No valid pulse bars, no trigger to adjust the play. The visual zones continue to keep things clear: we’re nowhere near a Tag-n-Turn to go short, nor have we seen the price action necessary to ignite a fresh hedge.

In short: the plan is working, even if it means doing nothing.

Overnight ES futures have added some excitement, but the regular sessions, not so much. These end-of-month Fridays are often sleepy. If it drifts sideways, we’ll live. If it wakes up, we’ll respond.

Until then, the week winds down with low expectations, awaiting the pulse to quicken! [ badum tsch!] , and eyes already turning toward June.

Expert Insights:

-

Mistake: Forcing trades on quiet days just to feel productive

-

Fix: Let the system breathe. If there’s no signal, do nothing.

-

Mistake: Misinterpreting near-miss setups like a 5.4% bar as valid

-

Fix: Precision matters. A “close-enough” attitude is how rules erode.

-

Mistake: Forgetting market rhythm around month-end chop

-

Fix: Time filters matter. Some days are meant to be ignored.

Rumour Has It…

“Is It Dead… or Just Resting?”

Financial News Room Chaos erupted this morning as anchors waved green “Island Confirmed” flags in celebration, only for lightning to strike a bearish chart behind them. A spilled coffee incident forced one intern to unplug the ADD meter after it flashed “Bearish Extreme” for the third time this week.

Hazel Ledger sighed live on air:

“Technically we’re in a bullish setup, but emotionally I’m in a flatline.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact

Pulse Bars: The Gatekeepers of Discipline

In the 1960s, a trader’s seminar once described high-range bars as having “legs” – a phrase still echoed today. But here’s the rub: not every legged bar gets to dance.

Our system requires a clear 5% move to qualify. A 5.4% bar feels like it should count… but only if it happens in the right context. Not all movement is equal. That’s the whole point.

Today’s reminder?

Precision isn’t picky – it’s protective.

Meme of the Day

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.