Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

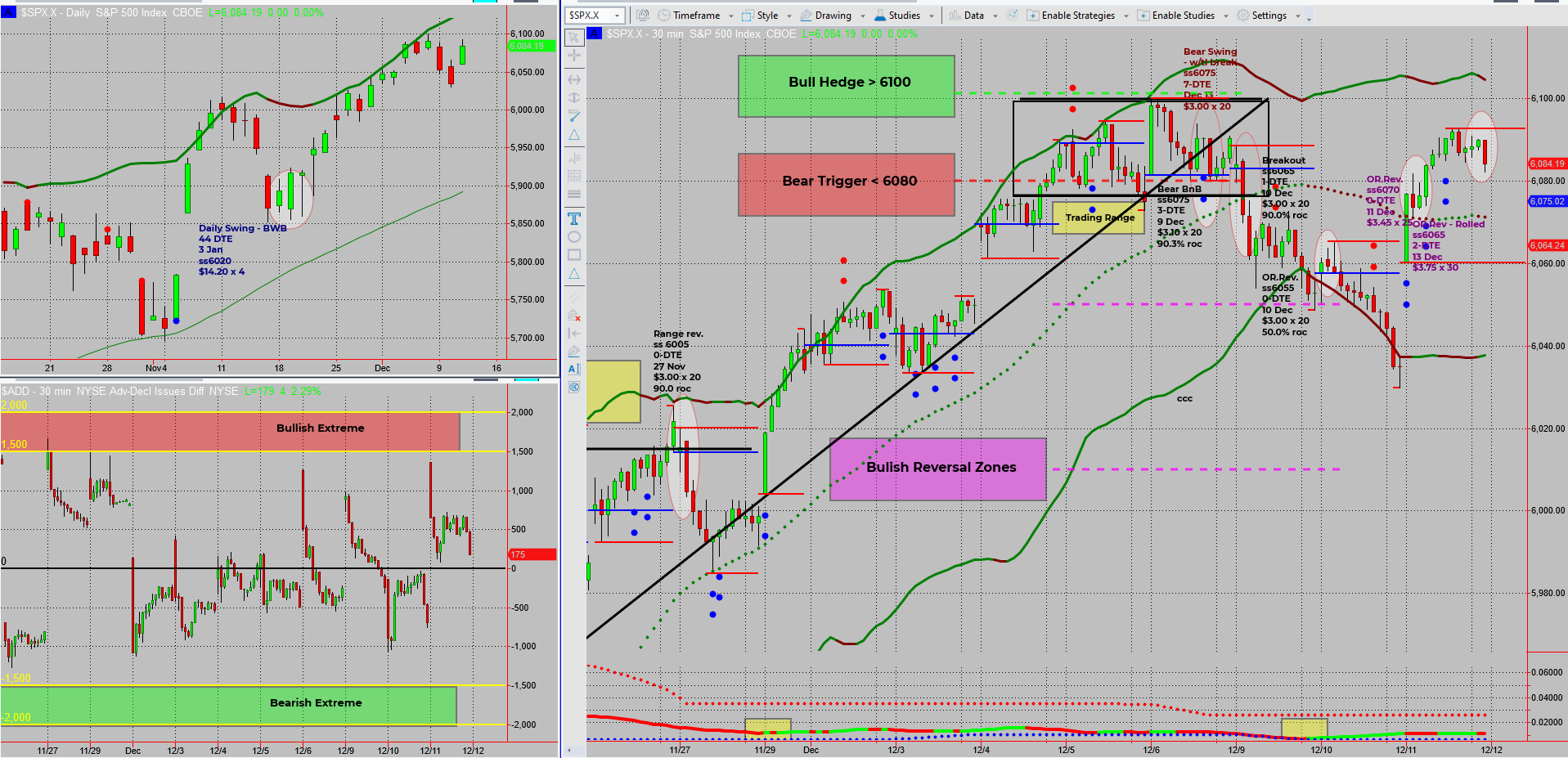

It’s a tale of two indexes: SPX stalls in consolidation, while DJX does the heavy lifting (or falling). The Dow nailed the bearish move we anticipated, while SPX dances indecisively. Thankfully, income trades continue to shine, proving profits matter more than perfect predictions. Let’s dive in!

SPX

DJX

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

It’s a trader’s paradox – right on the call, but for the wrong index. The bearish move we expected on SPX decided to show up on DJX instead.

- SPX Analysis:

- SPX remains stuck in a dithering phase, lacking clear direction.

- Price hovers around a developing consolidation zone, still unconfirmed.

- A dip back to 6050 would set the stage for bullish opportunities.

- DJX Steals the Show:

- The Dow performed the expected bearish move from Monday through Wednesday.

- It’s now just shy of hitting its breakout target.

Despite the mismatch, income trades continue to hit their marks. This week’s bearish trades yield steady profits, demonstrating the power of the SPX Income System. As traders, we know profits trump being “right” every time.

Looking Ahead:

- Short-term bearish bias continues for SPX until bullish pulse bars develop.

- Anticipating a push lower to 6050, where the last bearish trades will unwind.

- Long-term bullish setups remain the primary focus heading into the next trend.

Fun Fact:

The Dow Jones Industrial Average (DJX) once included a company that made bicycles! The American Bicycle Company was part of the index in 1899 but was removed in 1901 as the market evolved.

The Dow has seen a fascinating evolution since its inception in 1896. Originally composed of just 12 stocks, including utilities and railroads, its composition reflects the changing tides of American industry. A bicycle manufacturer’s inclusion in 1899 highlights how different the industrial landscape was back then. Today, tech and financial giants dominate the index, a far cry from its humble, pedal-powered beginnings.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece