Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

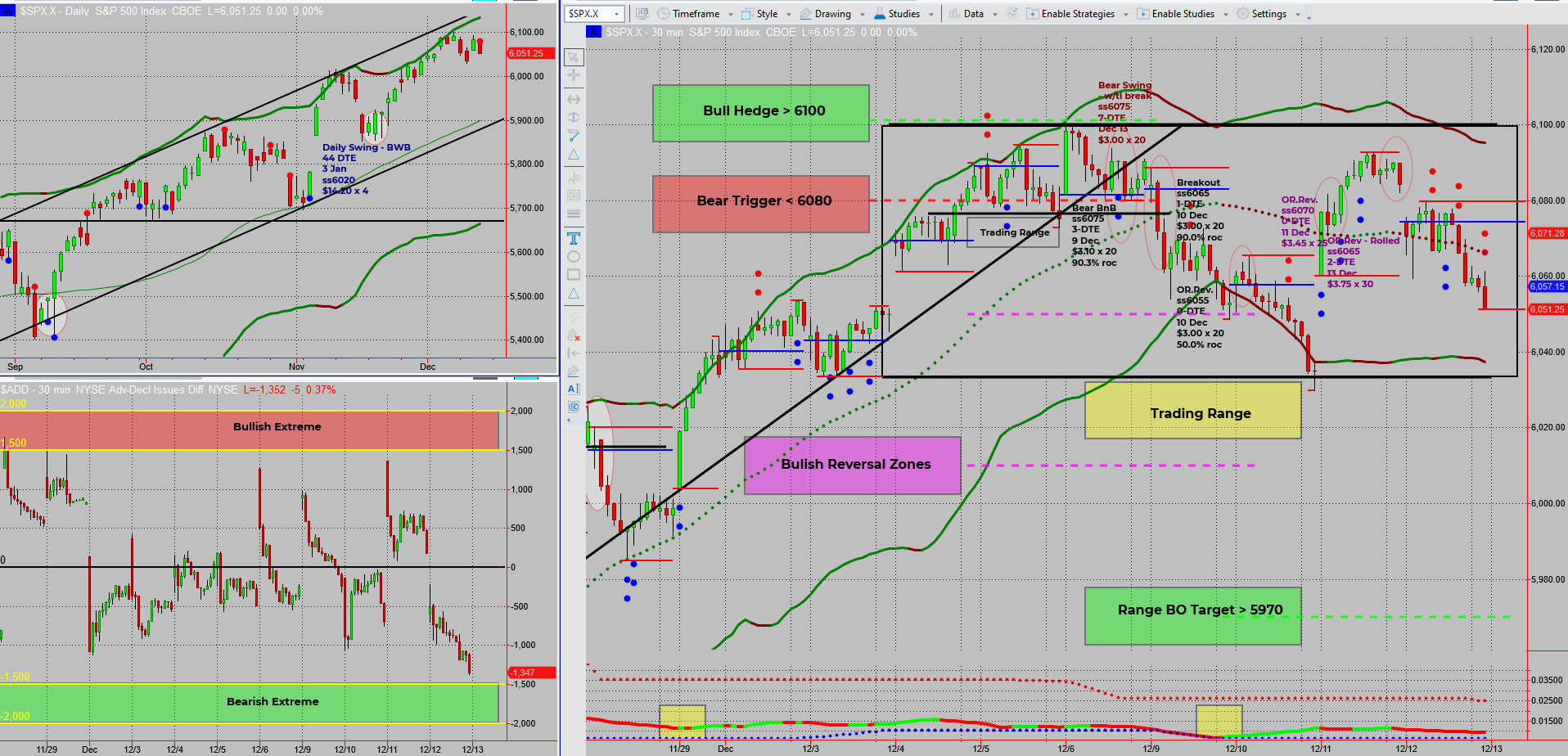

Bollinger Bands are flatlining, ranges are defined, and SPX is finally showing some bearish action! With the market offering clear opportunities, let’s dive into the latest setups and key levels to watch. Meanwhile, the bulls are warming up for their comeback—stay tuned!

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX has finally started its move south, albeit a little later than expected. The market has now defined a clear trading range, with Bollinger Bands forming a textbook “pinch point.” This provides excellent guidance for range-boundaries & trades.

- Range Reversals: Look for setups at the range highs and lows.

- Bear Breakouts: Target moves beyond 6000 for potential dips to 5970.

The SPX Income System allows me to adapt seamlessly, leveraging four of my six money-making patterns: reversals at range highs/lows and breakouts of those same levels.

Key Levels to Watch:

- Range Low: ~6000

- Bear Breakout Target: ~5970

The bears remain in play, but I still plan to shift bullish into the year-end rally once clear entry signals appear. For now, my focus is on wrapping up the last of my bearish income swings profitably – just in time to kick back and recharge at some Poland Xmas marekts!

Fun Fact:

Did you know? In 2023, the S&P 500 had 30 trading days with moves of less than 0.1%—the lowest volatility in a decade!

Low-volatility periods often signal market indecision or preparation for major moves. While they may seem dull, they’re goldmines for range-bound trading strategies like the SPX Income System. These quiet days can quietly stack up profits without needing massive market swings.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece