Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

What happens when a trade doesn’t go to plan? You adapt, stay patient, and let time work in your favour. This week, a tricky SPX trade tested my resolve, but with some creative adjustments, it ended up in the profit column. Let’s dive in!

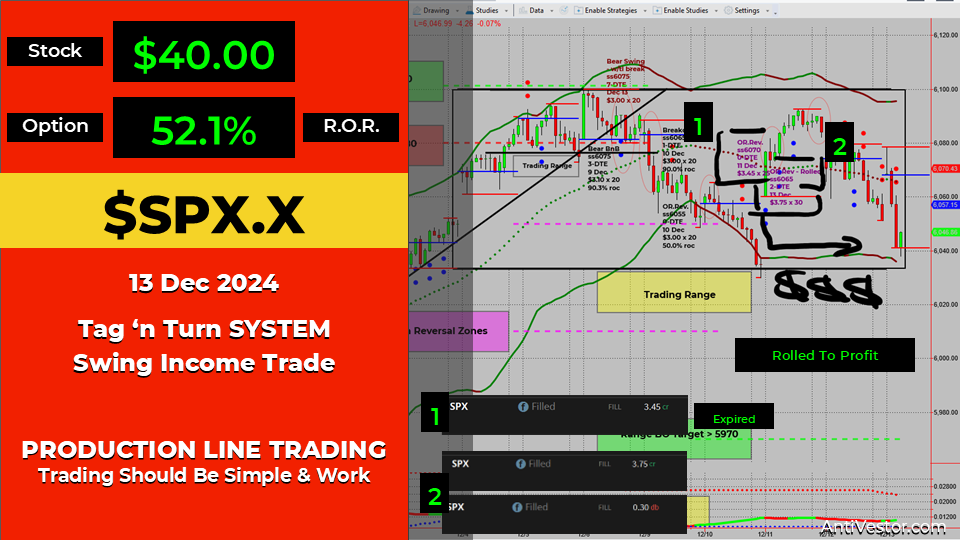

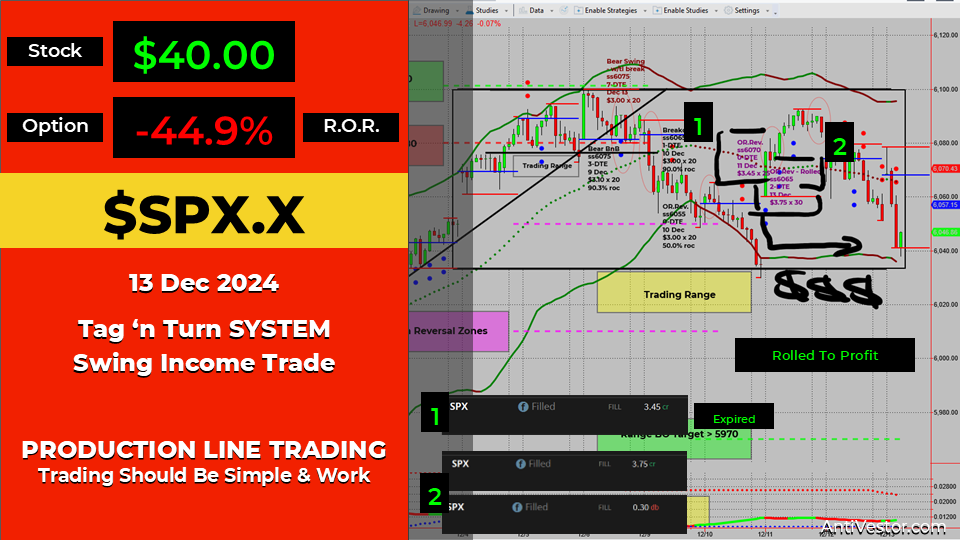

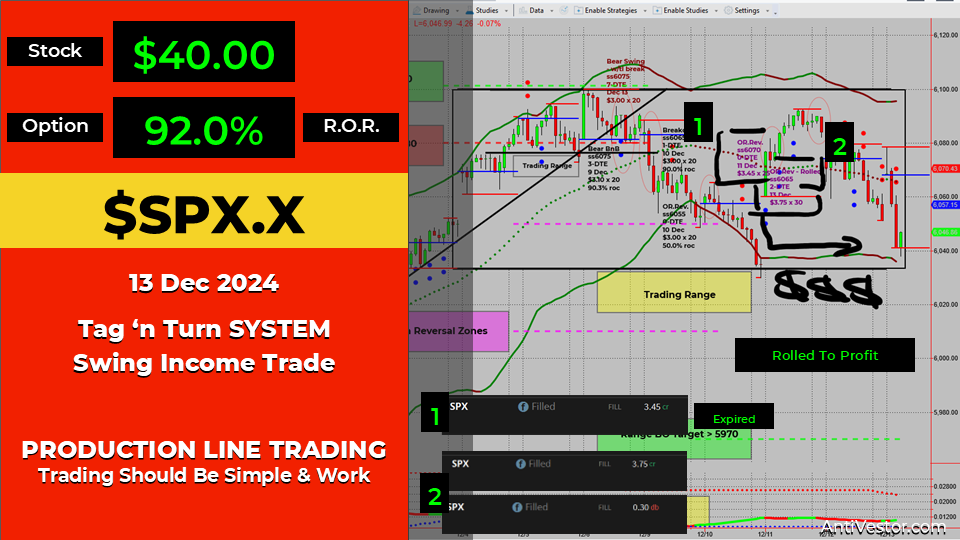

Trade 1 – 1 x regular position size

Trade 2 – 1.5 x regular position size

Both trades 1 & 2 had same dollar risk.

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

Wednesday started with an Opening Range Reversal trade during a live mentorship call. The Dow behaved as anticipated with a bearish move, but SPX nudged higher, challenging the initial 0-DTE trade.

Faced with two options – accept the loss or keep the trade alive – I chose the latter. Here’s how it unfolded:

- Step 1: Let the initial trade expire. Closing it would provide no extra benefit.

- Step 2: Open a new position at the same strikes, slightly deeper in the money (ITM), for a greater credit.

- Step 3: Adjust position size to maintain the same overall trade risk.

The second trade gave me until Friday to let time decay work its magic. By lunchtime Friday, the position not only recovered the initial loss but delivered a strong profit, turning a tricky start into a successful outcome.

Key Takeaways:

- Be flexible when trades challenge your original thesis.

- Understand when to adjust versus exit.

- Patience and strategy can turn losses into gains.

Fun Fact:

Did you know? The S&P 500 once dropped 20.47% in a single day during the infamous “Black Monday” crash of October 19, 1987. It’s still the largest single-day percentage drop in U.S. market history!

Backstory: The crash was triggered by a combination of computerized trading, overvalued stocks, and investor panic. Despite the turmoil, markets recovered within two years—a testament to resilience.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece