Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

You know that feeling when you wake up and wonder if you’re stuck in a time loop? Yeah, me too.

For what feels like the hundredth time, I’m reporting that the bear move is grinding lower. The difference? The profits keep stacking up—so I’m not complaining.

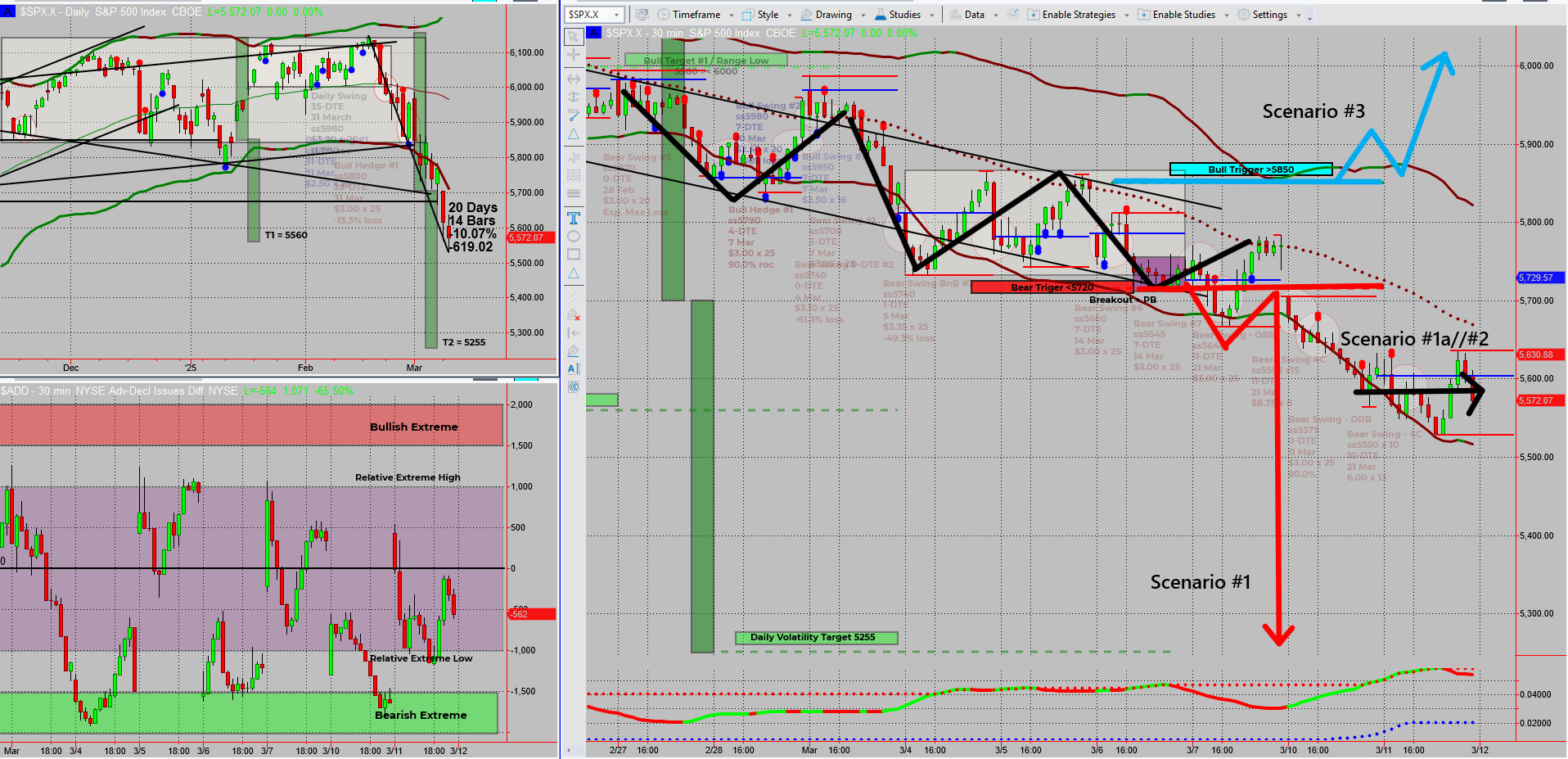

Yesterday’s rally was supposedly triggered by Canada pausing tariffs, but let’s be real—this market is looking for any excuse to bounce. Yet, the overall trend remains the same: a slow, stair-stepping drop. Based on this drop-pause-drop rhythm, I suspect we’re entering the next pause before another leg down.

My bear boots are full, my trade allocations are set, and I’m waiting for two tranches to exit profitably before considering any new plays. Until SPX clears 5850, the bullish setups stay on the shelf.

This is the good kind of waiting—the kind where the market moves for me instead of me chasing it.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Consistent Daily Income from the Stock Market – Without Guesswork!

Discover the SPX Income System – a proven, 100% rule-based trading method that lets you collect daily and weekly income checks in just minutes per day.

No trend chasing. No chart-watching all day. Just results.

Now It’s your turn – Click watch free training and start trading smarter today!

Deeper Dive Analysis:

If it feels like Groundhog Day, you’re not alone. The bearish grind continues, slowly pushing lower, delivering small but steady wins. Unlike a panic-driven crash, this move is unfolding in slow motion, keeping traders on edge, wondering if a rally is lurking around the corner.

A Market Looking for an Excuse to Bounce

Yesterday’s rally attempt was supposedly fueled by news that Canadian tariffs were being paused, but let’s be honest—this market is desperate for any reason to move higher. The reality? The larger bearish structure remains intact.

- Every bounce so far has been short-lived.

- The market keeps following a drop-pause-drop pattern.

- We’re likely entering the next “pause” phase before another move down.

My Trading Approach—Locked, Loaded, and Waiting

Right now, my bear boots are full, meaning I’m not adding new positions until my current tranches exit profitably.

- Two tranches are set to exit with profits by the end of the week.

- If we push lower or continue sideways, I’ll take my exits and reassess.

- Until SPX clears 5850, I won’t even think about bullish setups.

What’s Next? The Good Kind of Waiting

There’s no need to chase trades or force new entries. I’m simply letting my plan play out. If the market continues its slow-motion decline, I’ll collect my wins, reload selectively, and wait for the next prime setup.

For now, I sit back and enjoy the show—because this time, the market is working for me, not against me.

Fun Fact

Did you know? In 2008, Porsche trapped hedge funds in one of the greatest short squeezes in history, briefly making it the most valuable company in the world—all thanks to a secretive stock manoeuvre.

The Lesson? Markets don’t just move up and down—they can also turn traders inside out. The wrong bet at the wrong time can be devastating… unless, of course, you have a system that keeps you on the right side of the trade.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece