Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

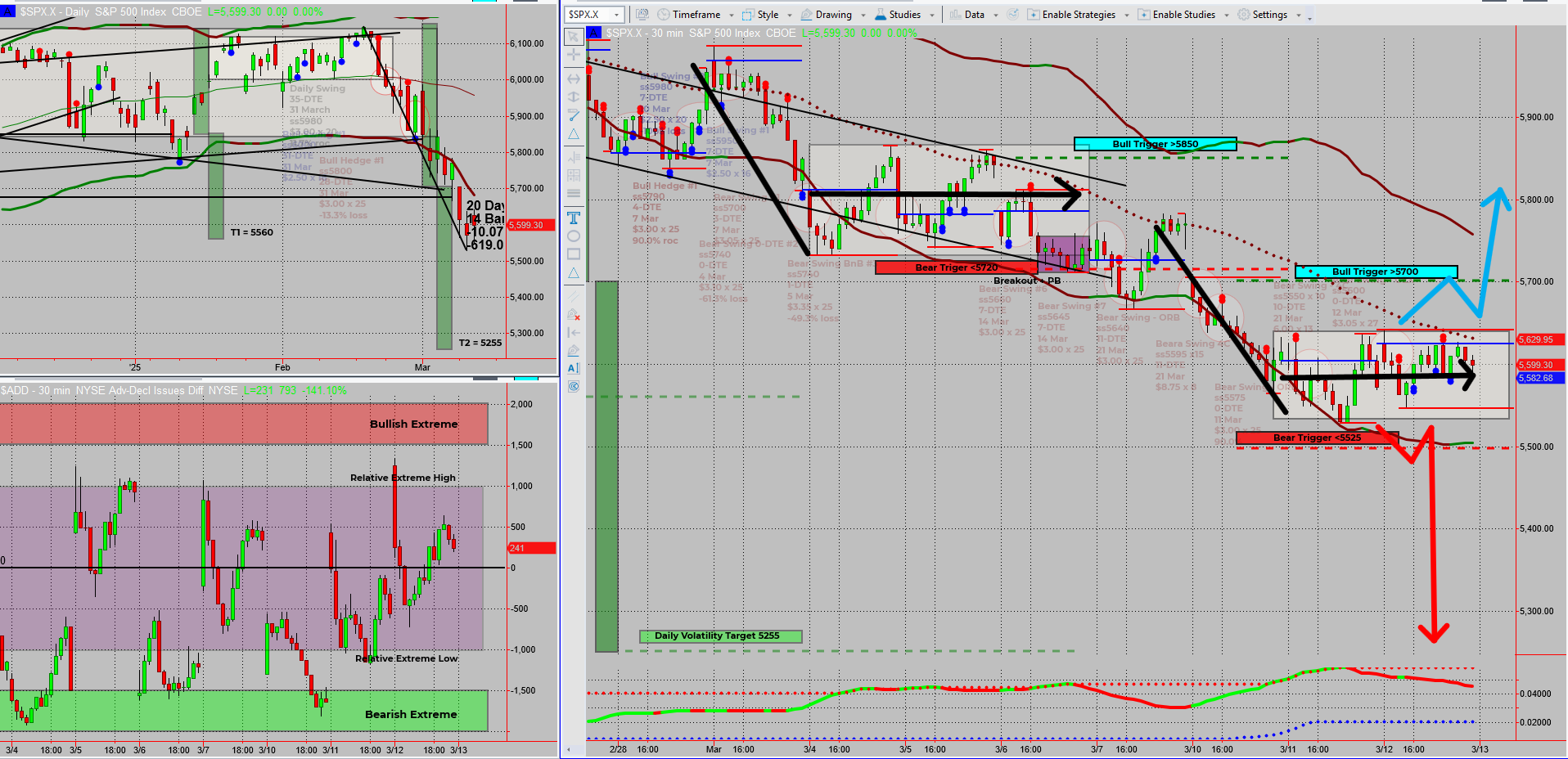

The market is stuck on repeat, playing the same song over and over. Drop, pause, drop, pause—sideways, down, sideways, down. This looks very much like a bearish Darvas box pattern.

And guess what? We nailed it (yesterday).

SPX continues to stair-step lower, just as we anticipated.

5650 remains a rock-solid resistance level—confirmed by Gamma Exposure.

On Monday, we expected a sideways stall—and we got exactly that.

With this predictable rhythm, we locked in another live zero-day trade during the Fast Forward Mentorship call, hitting max profit by the end of the day.

Until a breakout forces a change, I’ll keep stacking bearish trades, watching pulse bars, and waiting for the next clean setup.

Viva la profits!

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Consistent Daily Income from the Stock Market – Without Guesswork!

Discover the SPX Income System – a proven, 100% rule-based trading method that lets you collect daily and weekly income checks in just minutes per day.

No trend chasing. No chart-watching all day. Just results.

Now It’s your turn – Click watch free training and start trading smarter today!

Deeper Dive Analysis:

At this point, the market feels like it’s reading from a script—stair-step down, stall, stair-step down again.

And frankly? I’m not complaining.

The Setup – Another Day, Another Bearish Move

From Monday’s analysis, we expected this exact movement—SPX meandering sideways after a drop, before setting up the next move.

- 5650 remains resistance, confirmed by Gamma Exposure.

- 5700 is the key level before I even think about bullish setups.

- If we break lower, 5255 is still the daily breakdown target.

The Trade – Zero-Day Profits, Executed to Perfection

With the market following our expected pattern, I took full advantage:

- ✅ Live zero-day trade executed during my Fast Forward Mentorship call.

- ✅ Plan was simple—sell premium at the range high, let the market do the work.

- ✅ Expired at max profit by the end of the day.

This is what happens when you trade with structure—no guessing, no chasing, just following the game plan and letting the market pay you.

What’s Next? Playing the Game Until It Changes

Until SPX decides to break out, I’ll continue to:

- Look for bearish entries, pulse bars, and breakouts.

- Delay bullish plays until we clear 5700.

- Stay patient and let the profits stack up.

Because when you have a system that works, you don’t need to force the market—just follow its lead.

Viva la profits!

Fun Fact

Did you know? The Darvas Box Trading Strategy was created in the 1950s by a professional ballroom dancer who turned $25,000 into $2.25 million in 18 months—all while travelling the world.

The Lesson? Sometimes, the best traders aren’t even traders at first—but they know how to follow a system that works.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece