Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

Some trades fight you every step of the way—requiring adjustments, hedging, or a battle of nerves.

And then there are trades like today’s. The kind where you set it up, let it play out, and casually collect your profits—no stress, no second-guessing, just pure execution.

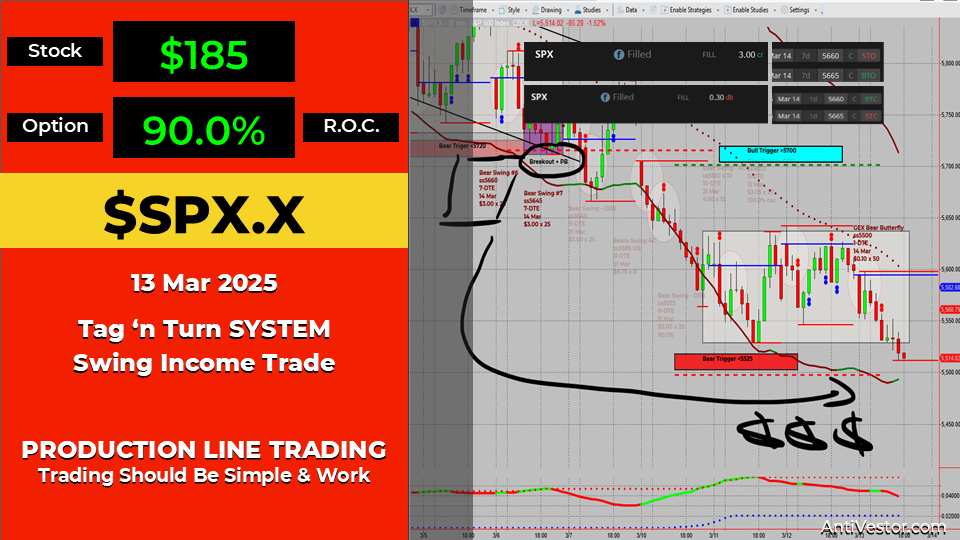

- Classic breakout-pullback entry—one of my favourite money-making patterns.

- $3.00 collected on entry, no adjustments needed.

- Closed for $0.30, locking in a 90% return.

That’s the beauty of trading a system that works—you don’t have to chase trades or overthink every move. When the setup is right, the market does the work for you.

Cha-ching!

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Consistent Daily Income from the Stock Market – Without Guesswork!

Discover the SPX Income System – a proven, 100% rule-based trading method that lets you collect daily and weekly income checks in just minutes per day.

No trend chasing. No chart-watching all day. Just results.

Now It’s your turn – Click watch free training and start trading smarter today!

Deeper Dive Analysis:

If only all trades were this easy.

Some setups require careful management—adjustments, hedging, rolling. Others? You set the trade, wait, and get paid.

This was one of those trades.

The Setup – A Textbook Breakout-Pullback Entry

This trade followed one of my favourite money-making patterns, a breakout-pullback entry through the small range low identified in our daily analysis.

- The second leg of the lazy bear swing was already paying out.

- This move has now entered the third leg of the bear swing.

- We discussed the setup in depth during one of my Fast Forward Mentorship call.

The Execution – Set It & Forget It

The best part? No trade management was needed.

- ✅ $3.00 in premium collected on entry.

- ✅ Closed for $0.30, locking in a 90% return.

- ✅ A mix of directional movement & time decay did all the work.

Why This Trade Worked So Well

- 1️⃣ Patience paid off—I didn’t chase, I waited for the right setup.

- 2️⃣ Directional movement helped, but the structure of the trade meant I didn’t need a big move.

- 3️⃣ No stress, no forced adjustments, no overtrading.

The Takeaway – This is How Trading Should Be

When you follow a structured, repeatable approach, trading becomes effortless.

- No gambling. No guessing. Just well-placed trades that do the work for you.

- Not all trades are this easy—but when they are, you enjoy them.

- Trade on, wait, profit. That’s how real traders win.

Cha-ching!

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece