Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

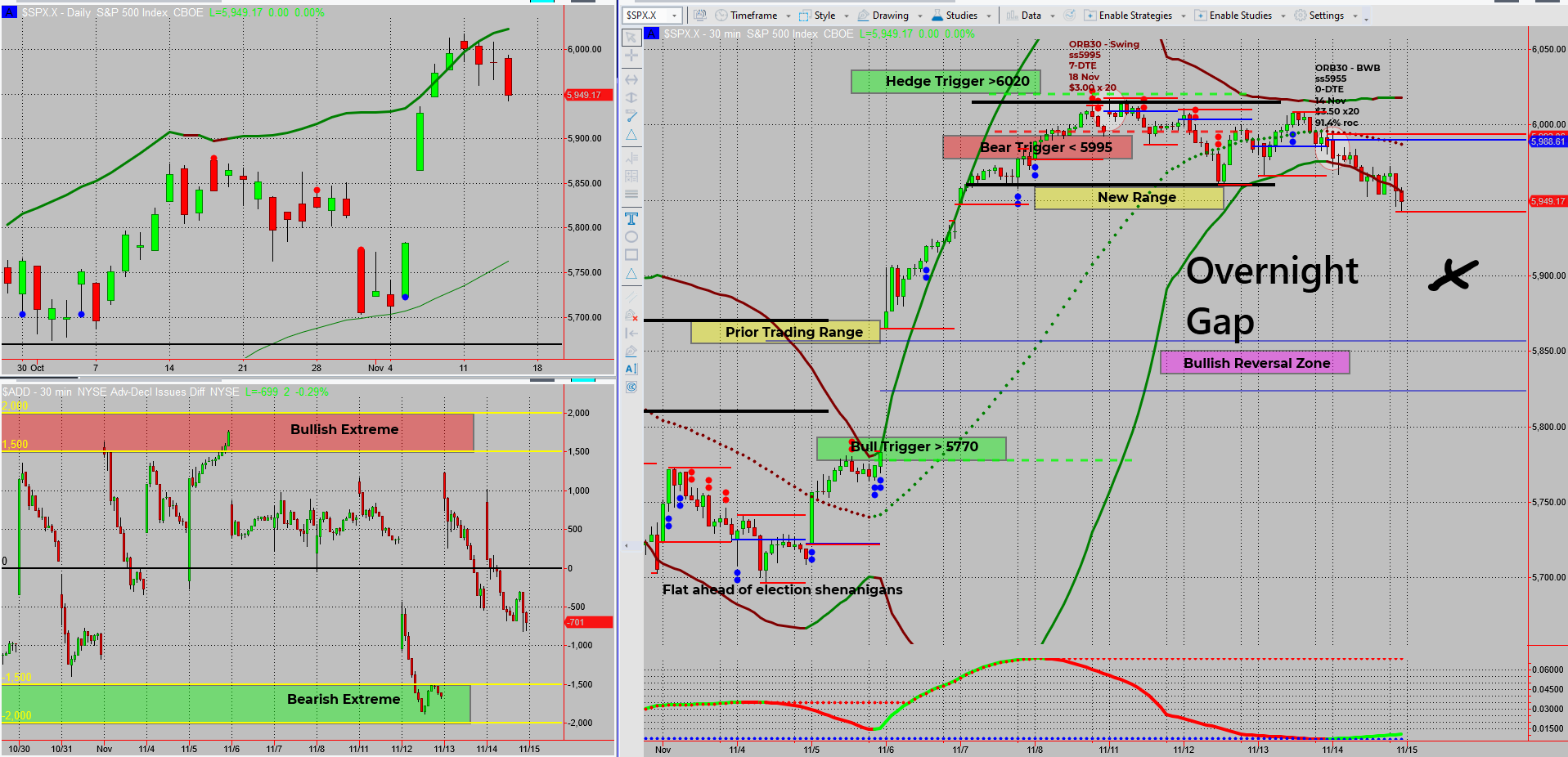

The bear bias continues to pay off as we ride the downward wave with another winning trade in the books. But will we finally reach the bullish reversal zone and switch gears? Let’s dive into today’s market moves and what’s on the horizon!

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

The bearish sentiment has been serving us well this week, and today might just be the cherry on top. Overnight futures are down 30/40 points, pointing to a gap down at the open for the main indexes. This aligns perfectly with the bear income swing we’ve been riding and confirms our overall bearish bias.

- Held a bear bias all week, proving profitable.

- Overnight futures are down 30/40 points, signalling a potential market gap down.

- Anticipating cashing out on a successful bear swing today.

The real excitement lies in whether prices will touch the bullish reversal zone. I’ve been hoping for it, and now, it’s close enough to get my attention. If this plays out, it could be a prime setup for a bullish pivot.

Plan for the Day:

- Cash out on bear swing profits.

- Look for bullish opportunities based on seasonal and cyclical market patterns.

Stay tuned for updates as we navigate this potential shift from bearish gains to bullish plays. ➡️

Fun Fact

Did you know that the SPX (S&P 500) has an average annual return of about 10% since its inception in 1926? Despite recessions, bear markets, and global crises, this steady growth shows why it’s often called a benchmark of economic health.

The S&P 500, representing the 500 largest publicly traded companies in the U.S., has weathered storms from the Great Depression to the 2008 financial crisis. Its consistent growth highlights resilience and the importance of long-term investing strategies. Even with short-term volatility, the market’s upward trend over decades is a testament to the power of diversification and economic progress.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece