Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

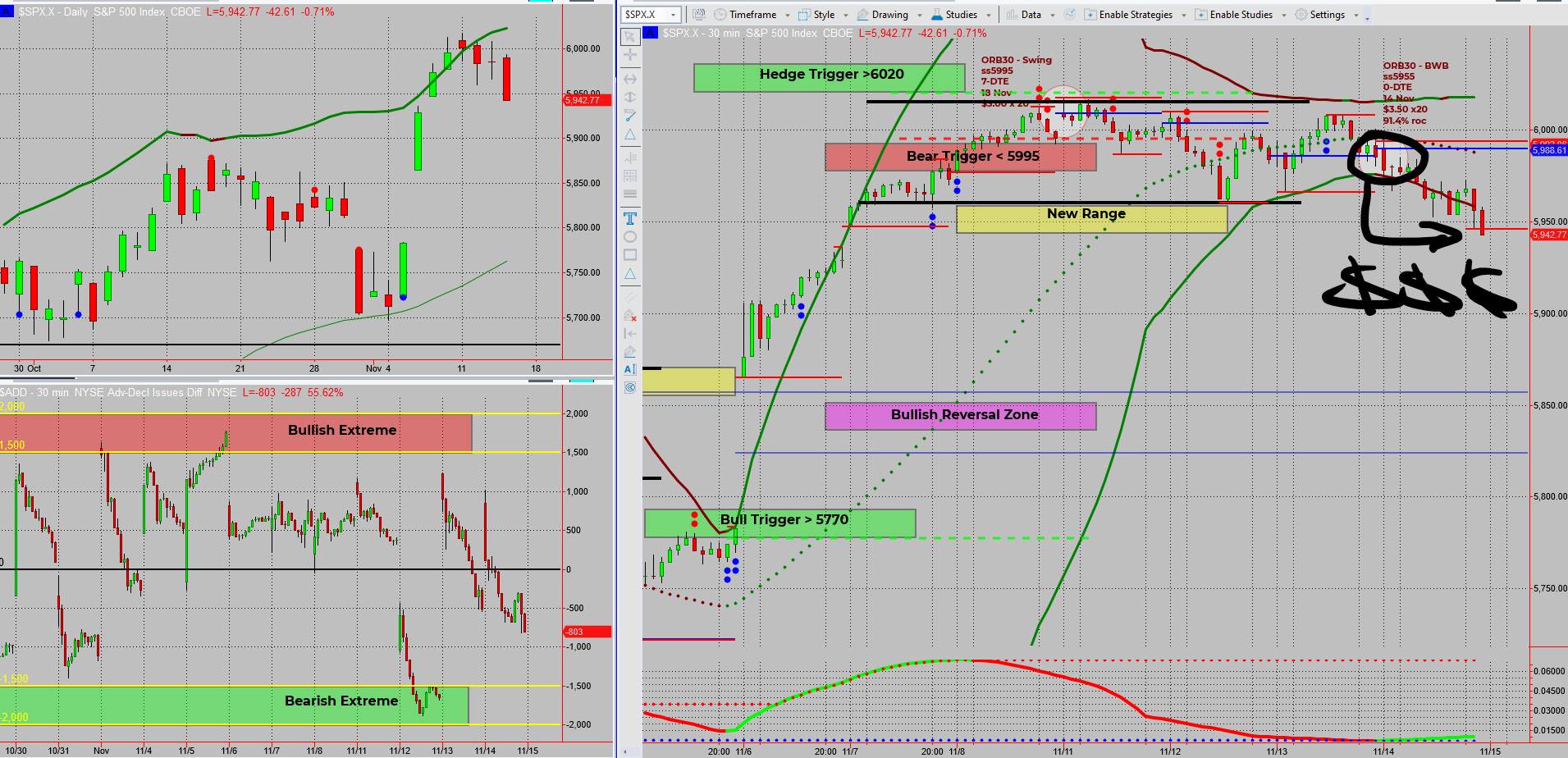

Today’s market may have been as thrilling as watching paint dry, but it didn’t stop us from locking in a solid 91.4% return! While the SPX confirmed its range earlier in the week with those pinching Bollinger bands, I focused on four of my six money-making patterns for range trading.

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX opened up to one of the most yawn-worthy trading days on record, but hidden within that calm was an opportunity. With $ADD jumping to a bullish extreme at a prior turning point and SPX nearing the top of its range, the odds pointed to a bearish move. (Sell range highs one of my 6 money making patterns)

- Trading Plan: Initiated a broken wing butterfly trade to capitalize on a move to the lower range by day’s end.

- Outcome: Collected $3.50 in income, bought back at $0.30, resulting in a swift 91.4% return.

- Time Spent? Minimal. About 10 minutes at the desk, then it was all StarGate and relaxation with Mrs. N. as we enjoyed a pyjama day.

This shows that even the flattest days can yield hefty returns with the right system and a keen eye on the setup. And now, we wait patiently for our bear swing to gear up for more action.

Fun Fact

The S&P 500 isn’t just a financial index—it’s also a predictive tool. Historically, when the S&P 500 has a positive return in January (known as the “January Barometer”), the market ends the year up about 75% of the time.

This market lore dates back to 1972 and suggests that how the S&P 500 performs in January sets the tone for the entire year. While it’s not foolproof, it’s enough to give traders and investors an extra reason to watch those first 31 days closely. Even though it has exceptions, many find it an intriguing measure of market sentiment heading into the new year.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece