When the World’s Greatest Investor Stops Buying Stocks… Pay Attention

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

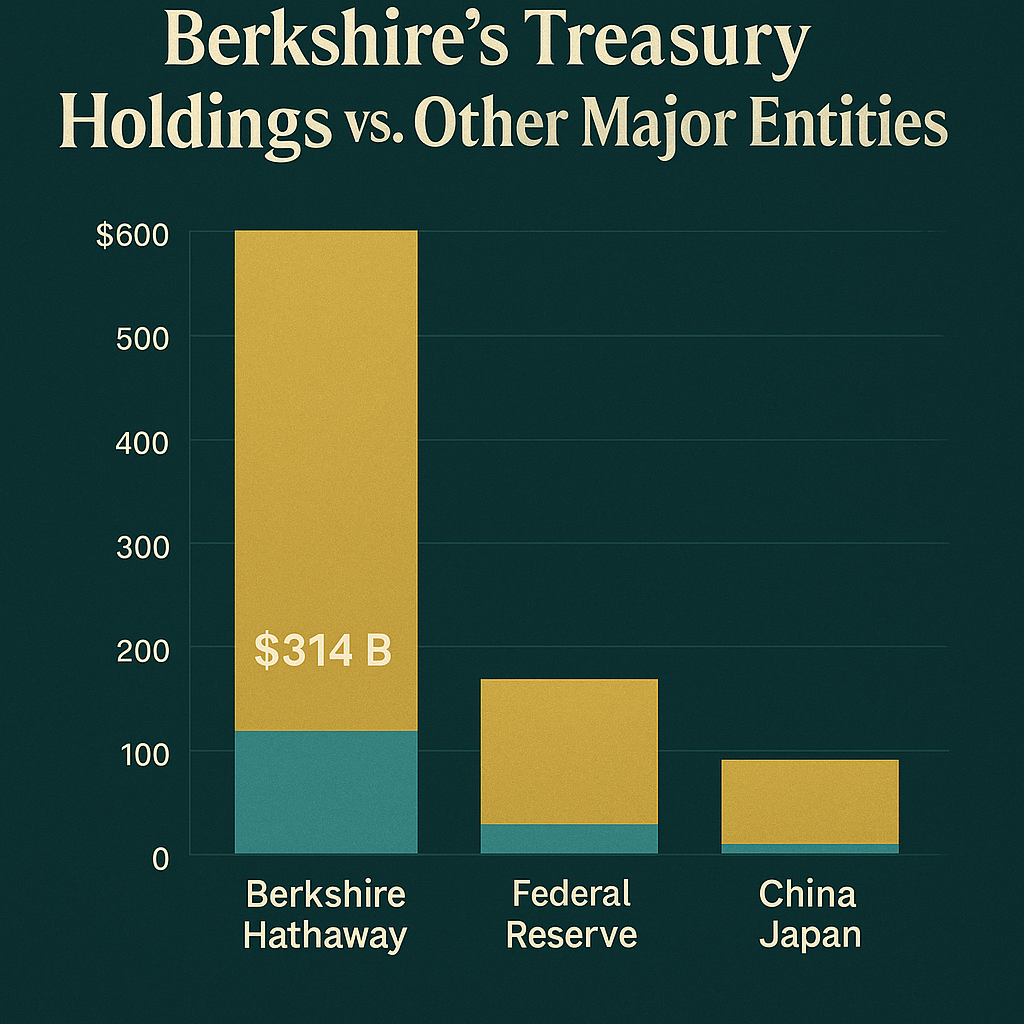

Berkshire Hathaway’s cash pile has swelled to record levels in early 2025. According to the company’s latest filings, Berkshire held about $328.0 billion in cash, cash equivalents and U.S. Treasury Bills as of March 31, 2025 berkshirehathaway.com. Analysts estimate roughly $314 billion of that is invested in short-term Treasury bills, an unprecedented hoard that amounts to ~5% of all outstanding U.S. T-bills moomoo.commoomoo.com. This makes Warren Buffett’s conglomerate the fourth-largest holder of T-bills worldwide – a stake larger than the Federal Reserve’s bill holdings and bigger than many countries’ reserves economictimes.indiatimes.com. Berkshire’s T-bill position has roughly doubled in the past year, rising from about $150 billion to over $300 billion moomoo.com. (For context, the entire U.S. T-bill market is ~$6.15 trillion as of March 2025 economictimes.indiatimes.com.)

Berkshire’s total cash on hand (inclusive of bank deposits and other cash equivalents) is similarly enormous. By the end of Q1 2025, Berkshire was sitting on $347.7 billion in cash and Treasury securities in aggregate – up from $334.2 billion at year-end 2024 apnews.com. This $13.5 billion quarterly increase came as Buffett continued to net-sell equities and reinvest the proceeds into safe instruments apnews.com. In Berkshire’s insurance and parent company accounts alone, about $305.5 billion was in T-bills and $36.9 billion in cash (with an additional ~$5.3 billion cash held in its railroad, utility & energy subsidiaries) blockchain.newsblockchain.news. The company’s SEC filings affirm Berkshire ended Q1 with over $300 billion in U.S. Treasury Bills (net of unsettled purchases) on the balance sheet berkshirehathaway.com. These figures underscore the sheer scale of liquidity Buffett has amassed. Key sources, including SEC 10-Q reports and financial news outlets (CNBC, Bloomberg, Financial Times, etc.), all point to Berkshire’s cash reserve hitting all-time highs in 2025 berkshirehathaway.commoomoo.com.

Expert Commentary and Institutional Reactions

Buffett’s cash hoarding has prompted extensive commentary on Wall Street. Many analysts see the surging cash pile as a strategic defensive stance. “People have so much conviction in Warren Buffett and his ability to deploy capital well in market downturns,” notes Brett Gardner, author of a Buffett investment study reuters.com. The view is that Berkshire’s $300+ billion liquidity acts as a “buffer” or war chest, ready to capitalize on bargains if markets tumble reuters.com. With T-bill yields near 5%, that cash is earning over $14 billion in annual interest at current rates reuters.com – providing solid income while Buffett waits for opportunities. This interest income further “reinforces Berkshire’s downside protection”, as some observers put it.

At the same time, Buffett’s caution is seen by some as a tacit market signal. Berkshire’s moves in 2024- 2025 – selling a net $134 billion in stocks in 2024 and halting buybacks – indicate Buffett found few attractive equities at prevailing prices businessinsider.combusinessinsider.com. “Berkshire continued to be a net seller of stocks… That contributed to the growing cash pile that’s more than double where it was a year ago,” said Edward Jones analyst Kyle Sanders, pointing to Buffett’s reluctance to chase an overvalued market apnews.com. Some strategists interpret this as a bearish omen for stocks or at least a statement that valuations are unappealing. Buffett himself told shareholders in May that he simply isn’t seeing “any attractive deals for companies [he] understands” right now apnews.com – a sober assessment that corporate prices are too rich, or risks too high, to justify big buys.

Not all experts see the cash buildup as a market-timing call. Buffett’s longstanding philosophy is that cash confers flexibility, not that he’s predicting a crash. “We will not repurchase our stock if it reduces our cash… below $30 billion. Financial strength and redundant liquidity will always be paramount,” Berkshire reiterates in its filings berkshirehathaway.com. Many fund managers applaud Buffett’s discipline: rather than force money into overpriced assets, he’s content to collect ~5% risk-free and wait tradealgo.com. This patience is often framed as a hedge – against both market downturns and inflation. By holding short-term T-bills, Berkshire is shielded from equity volatility and also positioned to redeploy quickly if a recession or bear market yields bargain opportunities. “Buffett prefers to sit on the sidelines until a rare and compelling opportunity presents itself… one that’s attractively priced,” observed one market commentary, noting his refusal to chase speculative trends tradealgo.comtradealgo.com. In essence, institutions view Buffett’s cash mountain as prudent risk management – a stance that could outperform if markets swoon, even if it lags during speculative booms.

Retail Sentiment and Social Media Buzz

On social media and Reddit forums, Buffett’s massive T-bill moves have become a hot topic. Many retail investors have reacted with a mix of admiration, humor, and debate. A number of viral tweets in March and April cheered Buffett’s timing in raising cash:

-

“Warren Buffett really sold the Apple top and stashed up $300 billion in T-bills before the worst drawdown in several years… GOAT,” one popular tweet quipped businessinsider.com, implying Buffett perfectly anticipated the 2025 market correction by rotating into cash. This tweet and others like it garnered thousands of likes, as traders marveled at the 94-year-old’s foresight.

-

Another user shared a meme of Buffett “sitting on $320 billion in cash”, likening him to a central bank printing press businessinsider.com. Jokes circulated that “Uncle Warren” has practically become the Fed, given Berkshire now funds a chunk of the U.S. government’s short-term debt.

-

Financial meme accounts also highlighted that over one-third of Berkshire’s $334B cash pile was accumulated just in 2024 before the S&P 500 slid into a correction businessinsider.com. Posts showed Buffett with a sly grin, “looking at $334B of cash and T-bills… as stocks head to a bear market,” emphasizing how his conservative stance paid off as equities sagged.

On Reddit, discussions have been lively. Threads on r/economy and r/investing noted that Berkshire now holds “nearly 1 in 20 of every T-bill dollars” in circulation – an astonishing fact that prompted both awe and some concern. Some Redditors argued this “Chad move” proved why Buffett is the GOAT (Greatest of All Time) at market timing, joking that “Buffett’s new hobby is printing money for the U.S. Treasury.” Others, however, had contrarian takes – suggesting that if retail investors are celebrating Buffett’s cash position, it might hint at overly bearish sentiment (a classic contrarian indicator). A few posters questioned, somewhat tongue-in-cheek, whether Berkshire’s T-bill binge could itself become a risk: “What happens if Buffett is the market for T-bills and he ever decides to sell?”

Overall, retail sentiment skews positive on Buffett’s prudence, with a dash of meme humor. Even among younger investors on forums, there’s an appreciation that earning ~5% safely is a smart play when stocks are wobbly. That said, there’s also FOMO (fear of missing out) in some comments – a worry that sitting in cash could mean missing big gains if the market suddenly rallies. This retail debate mirrors the wider conversation: Is Buffett brilliantly patient or overly cautious? On social media at least, the vibe is respect for Buffett’s discipline, sprinkled with reverence for how he “called” the current volatility by fortifying Berkshire’s cash just in time businessinsider.combusinessinsider.com.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

SPX Options = Cashflow Engine.

Bond Market Impact and Fed Policy Interpretation

Buffett’s huge Treasury bill purchases have not gone unnoticed in bond markets. Owning 5% of the T-bill market means Berkshire is a major participant in Treasury auctions. In fact, Buffett has been consistently buying bills in the government’s weekly auctions – often placing bids in $10 billion increments tradealgo.com. This steady demand from Berkshire (alongside money market funds and other investors) has likely added support to short-term Treasury auctions, helping the U.S. Treasury refinance debt at relatively low yields. With the Federal Reserve no longer buying T-bills (the Fed’s bill holdings are minimal at ~$195B economictimes.indiatimes.com), private buyers like Berkshire have effectively filled the void, soaking up new issuance. Treasury officials and auction desks have noted that demand for 3- and 6-month bills remains robust, and Buffett’s bids are a part of that strong demand fabric.

Despite Berkshire’s large footprint, there’s no evidence of Buffett’s buying “distorting” the yield curve in a disruptive way – the T-bill market is still ~$6 trillion, so even 5% ownership isn’t enough to singlehandedly skew rates. However, some analysts speculate Berkshire’s presence may be contributing to subtle effects, like slightly lower yields on the very short end than there otherwise would be. Short-term yields are predominantly driven by Federal Reserve policy, but heavy demand from investors (Buffett included) can keep yields from rising too high. As of May 2025, 1-month to 1-year T-bills yield around 4.5- 5%, down a bit from their 2023 peak but still attractive tradealgo.com. These yields remain closely tied to the Fed’s policy rate – which is by design. In fact, Buffett’s strategy of parking cash in T-bills aligns neatly with the Fed’s stance of keeping interest rates “higher for longer” to combat inflation. By buying T-bills, Buffett is effectively betting that rates will stay elevated in the near term, or at least that liquidity will be ample (since he can always roll over maturing bills).

Some commentators frame Berkshire’s T-bill binge as a vote of confidence in U.S. Treasuries at a time when other holders (like foreign central banks) have trimmed their positions. Berkshire now even holds more T-bills than many foreign governments – a dynamic that underscores how U.S. private demand is replacing official foreign demand for short-term Treasuries economictimes.indiatimes.com reuters.com. In global terms, Buffett is financing the U.S. government’s short-term borrowing to a significant degree, effectively acting as a liquidity provider. This has drawn interest from policy analysts: Buffett is doing, in a smaller way, what the Fed did during QE (buying government debt) – except Buffett earns a market yield and can’t “print” money, he must deploy existing cash.

In interpreting Fed policy, Buffett’s actions suggest he expects short rates to remain relatively high and sees better risk/reward in T-bills than in stretching for yield or taking duration risk. If Buffett anticipated the Fed would cut rates sharply soon, holding so many bills (which would then yield less) might be less appealing. Instead, Berkshire’s positioning implies an expectation that the Fed will keep rates elevated until inflation is tamed – which is indeed the Fed’s communicated stance in 2025. “Yields remain high enough for Berkshire to collect substantial interest income… T-bills now offer returns exceeding 4%, which translate into billions in annual income for Berkshire,” one analysis noted tradealgo.com. In that sense, Buffett’s treasury bet complements the Fed’s tightening: Berkshire is content to earn the fruits of Fed policy (high short-term yields) while avoiding riskier assets. Should the Fed pivot to rate cuts later, Buffett may then reassess and potentially deploy cash elsewhere. Until then, his strategy reads as confidence in the stability of U.S. government debt and patience for the Fed’s inflation fight.

Contrarian Opinions and Criticism

Not everyone agrees that Buffett’s cash-heavy approach is ideal. A few contrarian voices argue that Buffett is being too conservative and possibly missing out on lucrative opportunities – particularly in the high-growth tech sector. In the past year, much of the stock market’s gains have been driven by AI and tech companies, and critics point out that Berkshire has largely sat out this “AI-led” rally. Aside from its large (but recently trimmed) Apple stake, Berkshire has no exposure to big winners like NVIDIA, Microsoft, or other AI darlings reddit.com. As these stocks soared to record highs in late 2023, Berkshire’s decision to keep adding to T-bills prompted some observers to question if Buffett was “stuck in the past.” They argue that by eschewing cutting-edge tech investments, Buffett risked underperforming the broader market (especially if the AI boom continues). Indeed, Berkshire’s core equity holdings remain concentrated in value-oriented names – Apple, Bank of America, Coca-Cola, Chevron, etc. reddit.com – which don’t capture the full upside of the recent tech surge.

Some market commentators have explicitly wondered if Buffett is “missing the boat” on the next big growth wave. They note that Berkshire’s stock portfolio underweighted technology during the 2023- 2025 run-up (Apple aside), and Buffett’s own remarks at the 2025 meeting confirmed he’s staying away from trendy AI plays. This has led to debate about opportunity cost: while Buffett sits in cash, the NASDAQ and certain AI-related stocks have delivered outsized returns. For example, Nvidia’s stock price skyrocketed on AI demand, but Buffett admitted he didn’t fully grasp Nvidia’s long-term moat, so he passed on it (a stance some younger investors deem a rare Buffett blind spot). Critics in this camp suggest that Berkshire could be sacrificing potential returns by keeping so much powder dry. They also point to Berkshire’s own share performance: if low-risk T-bills are yielding ~5% and parts of the stock market are rising, will Berkshire’s ultra-cautious approach cause it to lag its benchmarks? In 2023, Berkshire’s stock did rise ~16% (outperforming a declining S&P 500) fool.co.uk, but that was during a choppy market – the question is how it will fare if a sustained bull market (led by tech) resumes.

Buffett’s response to such criticism is essentially “I won’t chase.” He has repeatedly said he refuses to invest in businesses he doesn’t fully understand, no matter how hot the trend reddit.com. At the 2025 shareholder meeting, he emphasized: “We’re ready to act – but we won’t chase,” in reference to sky-high valuations on tech companies reddit.comreddit.com. Buffett also famously quipped that investors should not confuse activity with progress – sometimes the best move is to do nothing until an obvious opportunity comes. His defenders note that Buffett has missed fads before and been proven right; for instance, he skipped the late-90s dot-com bubble entirely and was vindicated when it burst. From that perspective, steering clear of the euphoric AI trade could be wise if those stocks are overvalued. Berkshire’s priority, as Buffett often says, is to “not lose money” – and sitting in cash virtually guarantees capital preservation, whereas chasing a hyped rally could backfire if it ends.

Another vein of critique is that Buffett’s cash hoard is almost “too large to use” efficiently. Some analysts argue that holding $300+ billion in idle cash drags on Berkshire’s returns if suitable acquisitions never materialize. “Why not return more capital to shareholders via buybacks or dividends, if you can’t find investments?” is a common question from skeptics. Notably, Berkshire halted its stock repurchases in recent quarters berkshirehathaway.com, choosing to retain cash – a decision some activist-minded investors disagree with. They contend that Berkshire’s own stock could be the best investment Buffett can make (if he believes it’s undervalued), and that building an ever-higher cash pile may reflect overcaution. Buffett’s retort is that Berkshire will only buy back shares at a price “below intrinsic value”, and in his view shares have not been extremely cheap of late berkshirehathaway.com. Moreover, Buffett has said he keeps at least $30B as a safety buffer for Berkshire’s insurance operations at all times berkshirehathaway.com, meaning much of the cash isn’t truly “surplus” but rather a strategic reserve.

In sum, the contrarian critique is that Buffett might be playing it too safe in a world where certain sectors are booming. Voices in this camp argue that some measured risk-taking (even just heavier buybacks or a toe-hold in high-growth areas) could benefit Berkshire. Still, these critiques are relatively niche – Buffett’s long-term track record earns him the benefit of the doubt among most investors. And as of now, Buffett seems content to let the AI-fueled rally run without him; if it sputters, Berkshire will be ready with an enormous cash cannon. As Charlie Munger (Buffett’s right-hand man) famously said, “Warren and I are not insulted by not having our money invested [at all times].” They’d rather hold cash than do a bad deal. Time will tell whether this ultra-conservative stance is a brilliant waiting game or a costly missed opportunity – but Buffett, true to form, isn’t losing sleep either way.

Sources: SEC filings (Berkshire Hathaway 10-Q Q1 2025) berkshirehathaway.com, Berkshire Hathaway Annual Meeting commentary, CNBC moomoo.commoomoo.com, Yahoo Finance/Benzinga moomoo.commoomoo.com, Associated Press apnews.comapnews.com, Reuters reuters.com, Bloomberg, Financial Times, and other financial media reports from May 2025. All data current as of May 25, 2025.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.