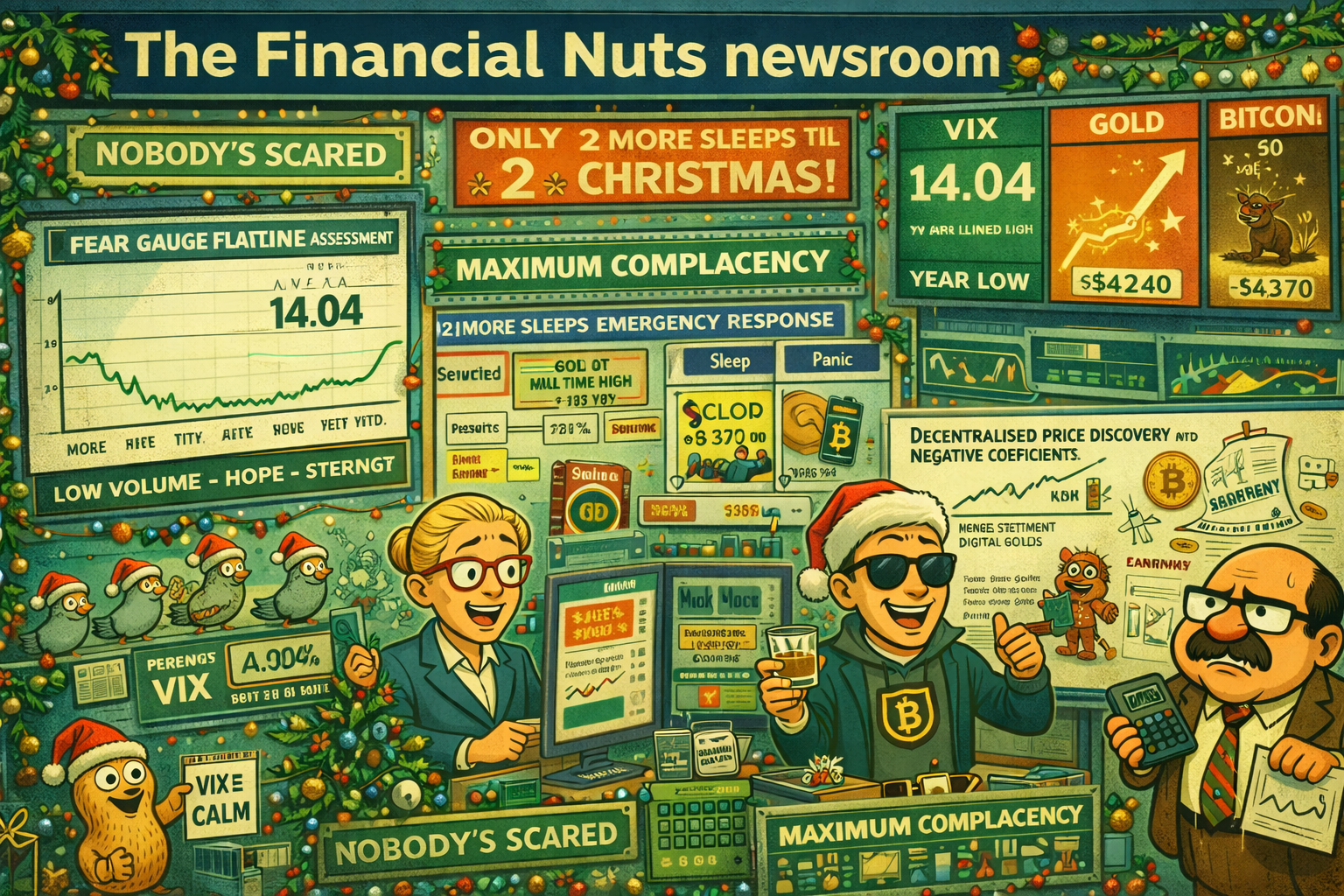

VIX Hits Lowest Reading Of The Year – Fear Gauge Says Nobody’s Scared Maximum Complacency Reached – Crash Probability Minimal (Or At Least The Fear Of One)

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

2 more sleeps!

A quick look at the VIX and you can see we are at the lowest reading this year. Maximum complacency has been reached. Chances of a crash are minimal – or at least the fear of one.

Anyway, moving on.

Very little has changed (again) on the indexes.

Gold is cranking on a new all-time high while Bitcoin continues to demonstrate its importance as a store of wealth.

Let’s see if we get something popping at the open for a little Xmas cheer.

Keep scrolling for what a VIX below 15 actually tells us…

While the fear gauge flatlines, systematic traders just follow the process.

Market Briefing:

Current Multi-Market Status:

- SPX: 6,878.48 – Bull TnT – Bullish Above 6800.08, PFZ 6720.43, Target 6863.21 ✅

- RUT: 2,558.78 – Bull TnT – Bullish Above 2526.78, PFZ 2487.97, Target 2544.16 ✅

- ES: 6,934.00

- NQ: 25,717.00

- YM: 48,706

- RTY: 2,573.7

- VIX: 14.04 (Year Low!)

- GC: 4,514.7 (NEW ATH!)

- CL: 58.01 / 55.12

- BTC: 93,161 / 87,371 (Still bleeding)

VIX Year Low – What Does It Mean?

At 14.04, the VIX is at its lowest reading of 2025.

For context, the long-term VIX average is around 19-20. Anything below 15 is considered “extreme calm” – basically the market saying “nothing to see here, move along.”

Does low VIX mean we’re safe? Not exactly.

Low VIX = low fear. Low fear = complacency. Complacency = vulnerability to shocks.

But it also means: no immediate expectation of a crash. The options market isn’t hedging. Nobody’s buying insurance.

The Tale Of Two Assets

Gold: New all-time high at 4,514.7. The real store of wealth doing its thing.

Bitcoin: Down from 100K+ to 87K area. The “digital gold” demonstrating exactly how digital it is during a risk-off period.

Just saying.

The Indexes

Very little has changed. Both swings bullish. Both past their targets. Same range. Different day.

At this point, we’re just waiting for something to pop – either direction.

Calendar

- Today (Tue 23): Prelim GDP q/q 8:30am (Forecast 3.2%, Previous 3.8%)

- Wed 24: Unemployment Claims 8:30am (Forecast 220K)

- Thu 25: Christmas Day

- Fri 26: Boxing Day vibes

Expert Insights:

VIX at year lows – maximum complacency, minimal crash fear. What does this actually mean?

A VIX reading around 14-15 corresponds to roughly 14-15% implied volatility on S&P 500 options over the next 30 days.

Historically, this is well below the long-term average of 19-20. When the VIX is this low, several things are happening: the options market is pricing in calm conditions, traders aren’t hedging aggressively, and put/call skew typically flattens. But here’s the key insight – low VIX doesn’t mean “safe.” It means complacency.

When the VIX collapses to structural lows, forward returns often weaken and the probability of pullbacks increases. Importantly though, the VIX can stay low for months during strong uptrends. It’s not a timing tool – it simply tells us that right now, nobody’s scared. And sometimes, that’s exactly when you should be paying attention.

[Source: TradingView VIX Analysis]

In Other News…

0.3% From Record: Markets Celebrate Almost Being There

Three-day streak eyes all-time high. Gold hits 50th record of year. China shipment “plans” reignite AI trade.

S&P sits 0.3% from record high ahead of GDP, PCE, Consumer Confidence “data gauntlet”—markets treating proximity to achievement as achievement whilst waiting for numbers that could prevent actual achievement. Nvidia gained 1.5% on H200 China shipment “plans” proving intention to maybe ship eventually equals bullish catalyst. Gold marked 50th record of 2025 at $4,480 because apparently setting records weekly makes them routine not remarkable.

When “Data Gauntlet” Hits Holiday Week

Tuesday brings Q3 GDP (expected 3.2%), Core PCE (expected 2.9%), Consumer Confidence (expected 91) during Christmas week when nobody’s watching. Markets confident about fresh records whilst acknowledging data arriving today could change everything. Early close Wednesday, closed Thursday meaning three reports compressed into low-volume environment where any surprise moves markets violently.

AI Trade “Reignites” on Shipment Plans

Nvidia +1.5% on H200 China shipment plans—not actual shipments, not confirmed sales, just plans to maybe ship eventually pending regulatory approval. Micron +4%, Oracle +3% following because apparently one company’s shipping intentions validate entire sector. AI trade “reigniting” based on China hopes whilst previous month spent worrying about China restrictions.

Gold’s 50th Record: Routine Not Remarkable

Gold above $4,480 marks 50th record of 2025—setting new highs so frequently it becomes background noise rather than signal. Silver at $69 (+134% YTD) alongside creates precious metals dominance nobody questioning. Oil steady $57.84 suggesting either metals correct or everything else crashes.

☕ Hazel’s Take

0.3% from record, 50th gold high, China shipment “plans,” data gauntlet during holiday week. When proximity celebration meets routine records and intentions equal catalysts, probably acknowledging Tuesday’s data determines whether confidence justified or delusional.

—Hazel, FinNuts

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was spotted training his pigeons in “Year Low VIX Recognition Protocols” whilst explaining that maximum complacency required “Fear Gauge Flatline Assessment with Christmas Countdown Integration.”

Hazel immediately updated her crisis flowcharts to include “2 More Sleeps Emergency Response Procedures” alongside “Gold ATH vs Bitcoin Carnage Comparison Contingencies.”

Mac raised his morning whisky and declared, “When the fear gauge hits year lows and gold hits all-time highs whilst Bitcoin demonstrates its store of wealth status, the proper response is obviously an eye roll and another dram!”

Kash attempted to explain that “Bitcoin isn’t crashing, it’s just demonstrating decentralised price discovery with negative sentiment coefficients” before getting distracted by gold’s ATH celebration.

Wallie grumbled that in his day, “gold was real money, Bitcoin didn’t exist, and the VIX wasn’t something people checked every five minutes whilst counting sleeps until Christmas!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

VIX At Year Lows: The Complacency Paradox

VIX at 14.04 = lowest reading of 2025. Long-term average = 19-20. Translation: nobody’s scared. Which is precisely when to stay alert.

Here’s the beautiful paradox of the fear gauge – when it’s low, everyone feels safe, which is exactly when you shouldn’t get too comfortable!

The VIX at 14.04 is the market’s way of saying “nothing bad is going to happen.”

The options market isn’t hedging.

Nobody’s buying protection.

Traders are maximally complacent.

Meanwhile, gold just hit an all-time high at 4,514 because apparently the ancient shiny rock that humans have valued for 5,000 years still works.

And Bitcoin? The “digital gold” that was supposed to replace actual gold? Down to 87K whilst regular gold makes new highs. You literally cannot make this up. So we’ve got year-low VIX, all-time high gold, and Bitcoin demonstrating its “store of wealth” properties by storing approximately 13% less wealth than a few weeks ago.

Happy Christmas indeed!

[Source: St. Louis Fed FRED VIX Data]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.