America Just Got Its Third Credit Downgrade – Here’s What That Really Means

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

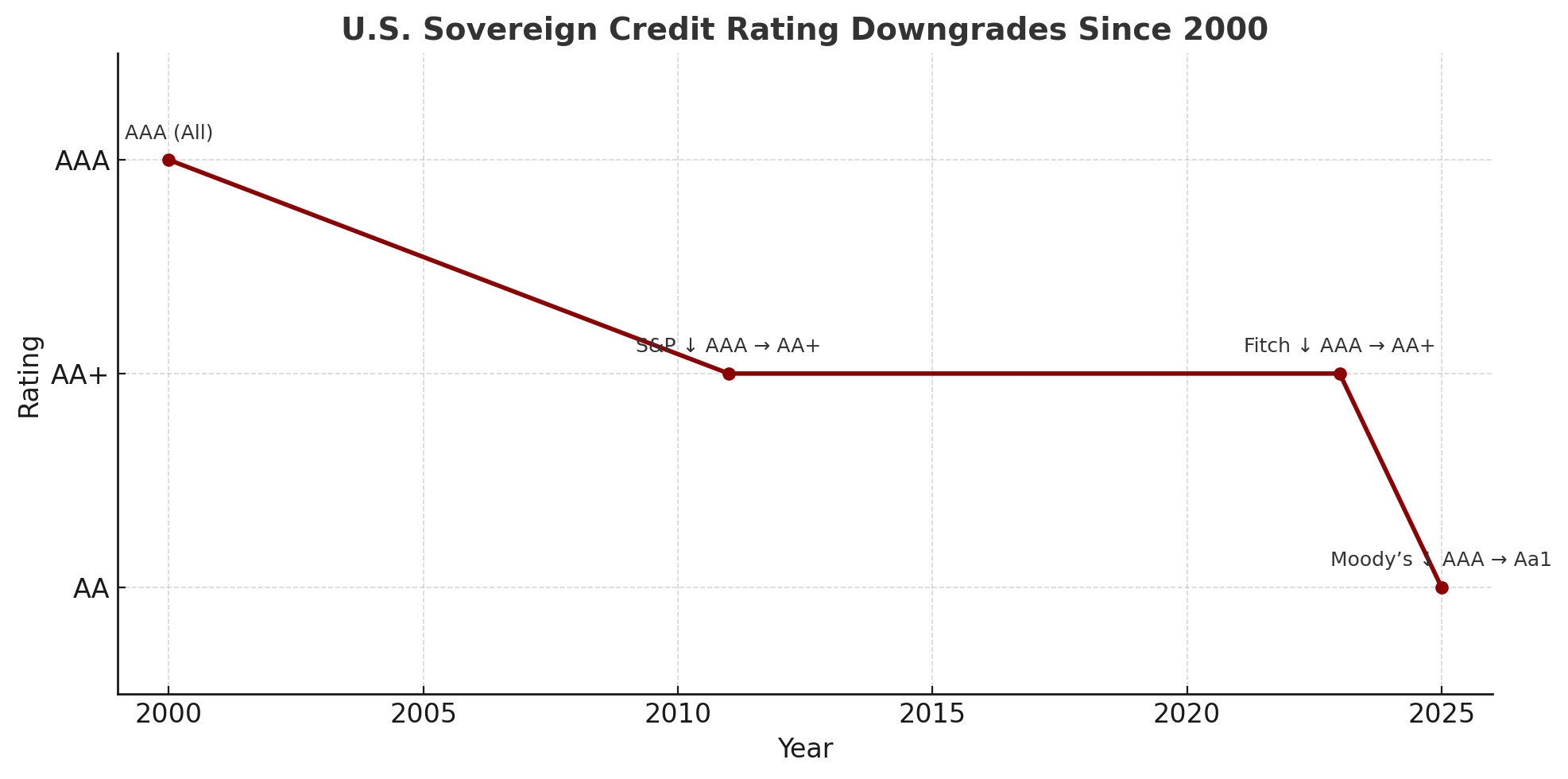

Welcome to Financial Fight Club, where we break the first rule and talk about the ugly truths of finance. The United States just got slapped with a credit downgrade again, and the usual spin machines want you to hit snooze. Moody’s has finally joined S&P and Fitch in stripping America of its AAA crown – a historic all-three-agencies verdict that Uncle Sam’s finances aren’t what they used to be pgpf.orgpgpf.org. Meanwhile, Washington is busy playing tariff hardball and chest-thumping “economic nationalism” as if deficits don’t matter. This deep dive pulls no punches, AntiVestor style. We’ll decode what the downgrade really means, revisit the ghosts of 2011 and 2023, and connect the dots between ballooning debt, tariffs, and why the market hasn’t fully freaked out… yet.

What a Credit Downgrade Really Means (Mechanics vs. Perception)

A sovereign credit rating is basically Uncle Sam’s credit score – an outsider’s view of the U.S. government’s ability (and willingness) to repay its debts pgpf.orgpgpf.org. A cut from AAA to AA+ (or Aa1 in Moody’s lingo) is not saying default is around the corner, but it’s a warning sign. Mechanically, a downgrade could raise borrowing costs over time (investors demand a touch more yield for perceived extra risk) and knock some treasuries out of “AAA-only” portfolios. In theory, lower rating = higher interest rates to compensate lenders bbc.com.

But perception is king. In markets, a downgrade is a headline that screams “Fiscal dysfunction ahead!” It chips away at the myth of risk-free Treasuries. Remember, these same rating agencies once rubber-stamped toxic mortgage bonds as AAA, so when even they are sounding alarms about U.S. debt, it’s notable. Moody’s explicitly cited the U.S. failure to tackle “large and growing deficits” and soaring interest costs pgpf.orgpgpf.org. In plainer English: the U.S. government’s spending like a drunken sailor while its interest bill rockets higher – and no one in D.C. can agree on how to stop it.

However, a credit downgrade isn’t a death sentence. It’s more like a report card with an “Improvement Needed” note. Many nations live just fine with AA or lower ratings. The U.S. still retains immense strengths – a huge, dynamic economy and the almighty dollar as global reserve currency (for now). Moody’s itself acknowledged America’s “exceptional strengths” – from economic resilience to the dollar’s reserve status – even as it knocked off the AAA bbc.com. The real question is whether this downgrade becomes a self-fulfilling prophecy or just another footnote in market history.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

SPX Isn’t Random. It’s a Paycheque Waiting to Be Claimed.

Zero-day options + pulse bar = fast cash, low stress.

Deja Vu Downgrades: 2011 S&P, 2023 Fitch – How Does This Compare?

This isn’t Uncle Sam’s first credit spanking. Back in August 2011, S&P made headlines by yanking America’s AAA amid a brutal debt-ceiling standoff. That was the first-ever U.S. downgrade, and it shocked the system. Politicians bickered, S&P balked, and the S&P 500 stock index plunged ~6.7% in a day on the news money.cnn.com. Yet, interestingly, Treasury bonds rallied in the aftermath – yes, up was down. Investors, spooked by economic malaise and a brewing European debt crisis, fled to the safety of U.S. debt despite S&P’s slap. The 10-year Treasury yield fell by about 50 basis points in the weeks after the 2011 downgrade as Treasuries were still seen as the safest haven janushenderson.com. In other words, the market’s knee-jerk response was “Sell stocks, buy Treasuries,” downgrade be damned.

Fast forward to August 2023: Fitch Ratings cut the U.S. to AA+ (echoing S&P) citing “expected fiscal deterioration over the next few years and repeated debt-ceiling standoffs” that put payment at risk reuters.com. By then, America’s debt addiction was hardly a secret. The timing surprised some (coming after a debt-ceiling deal was reached), but Fitch pointed to the forest, not the trees: high and rising debt, no credible plan to rein it in, and a “steady deterioration in governance” over 20 years reuters.com. Translation: Washington’s a hot mess, and the rest of the world sees it. The White House bristled, calling the downgrade “arbitrary” and touting a strong recoveryreuters.com, but Fitch’s move underscored that the U.S. fiscal trajectory was on a concerning path.

Market reaction in 2023? Far more muted than 2011. Stocks dipped modestly and yields ticked up ~0.19% on the 10-year after the Fitch announcement janushenderson.com. Why no rally in bonds this time? Because in mid-2023, inflation was the big bad wolf. The idea of more U.S. borrowing when prices were already spiking made investors less eager to pile into Treasuries – safe haven status be damned. So 2011 and 2023 gave a tale of two downgrades: one where Treasuries were still the hero refuge, another where they were cast as part of the problem (inflation risk). The common thread: initial headlines screamed doom, but the actual market impact was limited. In both cases the S&P 500 was down only ~2% a month later janushenderson.com – hardly the Armageddon pundits warned of. A slight uptick in perceived credit risk, yes, but “far from a left-tail shock” as one analysis put it janushenderson.com.

Now in 2025, Moody’s downgrade comes as the last of the Big Three to budge. It was widely telegraphed (Moody’s put the U.S. on watch back in November 2023 janushenderson.com), so smart money had time to brace. Analysts noted the move was “widely anticipated” and “not a material risk event” – any overreaction could even present a trading opportunity for the contrarians janushenderson.com. Indeed, by the time Moody’s dropped the hammer in May 2025, the market mostly shrugged. No cliff dive for stocks, no mass bond exodus. It’s like the market said, “We knew this party was getting rowdy; tell us something we don’t know.”

Treasuries and Trust: Impact on the Bond Market and Investor Confidence

Uncle Sam’s IOUs (Treasuries) are the bedrock of global finance – the “risk-free” asset that powers everything from 401(k) models to bank reserves. So a downgrade strikes at confidence in that bedrock. Does AA+ vs AAA really matter to investors? In practice, so far it hasn’t caused panic. U.S. Treasury yields are influenced by so many factors (Fed policy, inflation, growth outlook) that a one-notch rating cut is just one ingredient in the soup.

In 2011, as noted, confidence in Treasuries remained so strong that yields actually fell after the downgrade janushenderson.com. Investors worldwide still saw U.S. bonds as the safest port in a storm. In 2023, with inflation raging, Treasuries lost some appeal and yields rose a bit post-downgrade janushenderson.com – but that was more about the inflation outlook than suddenly questioning U.S. solvency. The key point: so far, no credit downgrade has meaningfully impaired the U.S. Treasury market’s role as global safe haven. If anything, Moody’s final downgrade in 2025 was so expected that bonds barely blipped. Traders know the U.S. isn’t unable to pay its debts – it prints the world’s reserve currency, after all – the fear is whether it’s unwilling (say, via political gridlock) or whether inflation will erode those payments’ value.

Investor confidence in Treasuries remains cautious but intact. Credit default swaps (CDS) on U.S. debt – basically insurance against a U.S. default – have risen slightly over the years of debt drama, but they still signal very low default risk (the U.S. isn’t exactly Argentina). Yields on 10-year notes hovering in a “new normal” range reflect inflation and Fed tightening far more than a one-notch rating difference. Notably, the market hasn’t demanded extortionate premiums to lend to Uncle Sam post-downgrades. In plain terms: people are still buying U.S. bonds, just maybe with a bit more side-eye than before.

That said, confidence is a funny thing – it’s lost gradually, then suddenly. Each downgrade chips another flakes of paint off America’s once-spotless credit facade. The real danger is complacency. If Washington keeps running up debt (and they are, big-time) and something finally spooks Treasury buyers, yields could jump for real – which would itself balloon the deficit further (a vicious circle of higher interest costs). For now, investors seem to believe the U.S. will muddle through: there’s simply no alternative deep and liquid market to park trillions (Euro? Too fragmented. China? Not convertible. Gold? Not yield-bearing). The U.S. Treasury market remains the “cleanest dirty shirt” in the laundry basket of global finance – slightly stained but still the go-to safe asset. Until that perception changes, downgrades alone won’t break the bond market.

Debt, Deficits and Dysfunction: How We Got Here (Ballooning Debt 101)

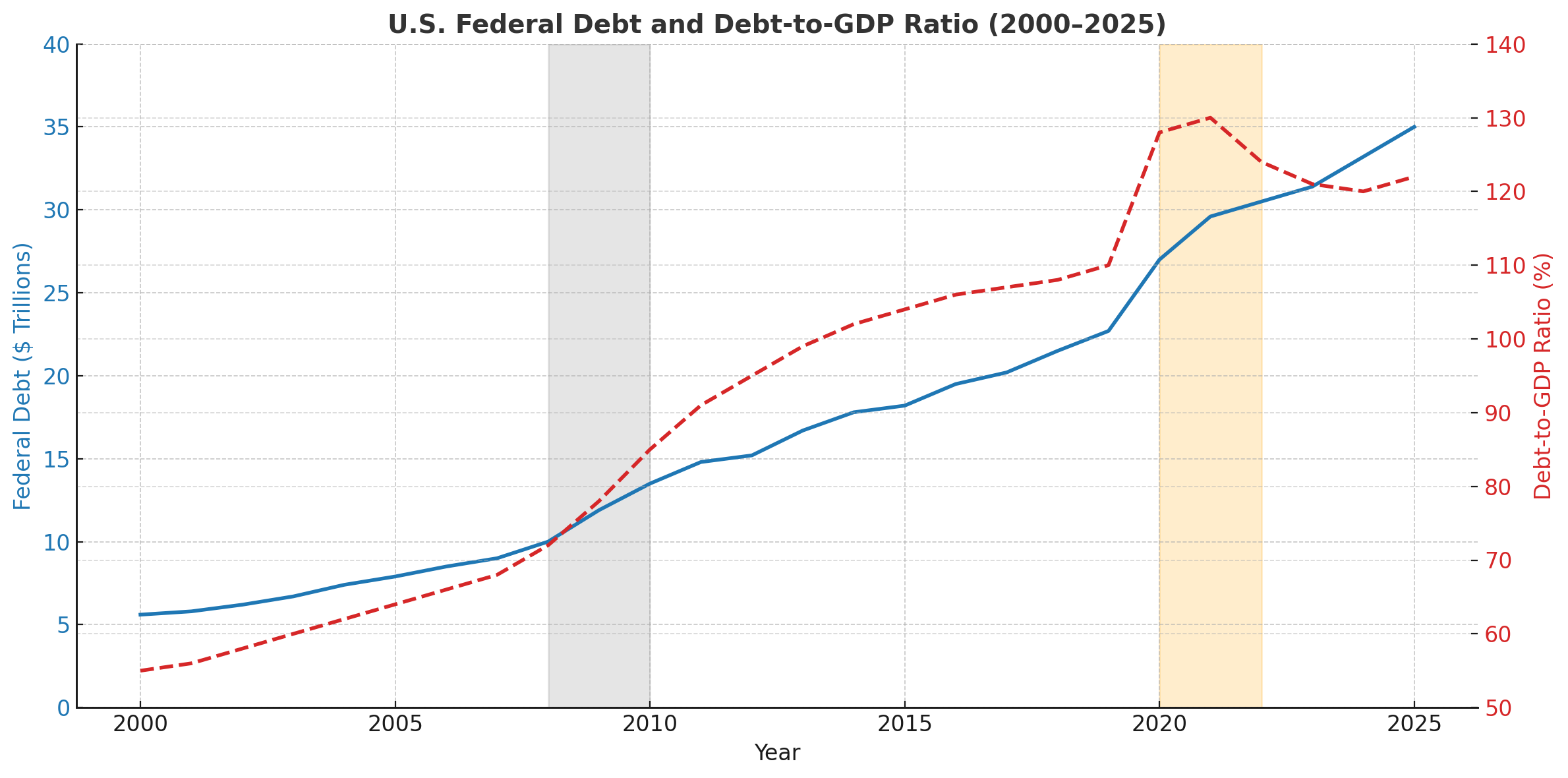

Let’s talk debt – the $35 trillion elephant in the room. The United States has been on a borrowing binge of historic proportions. We’re now at roughly 120% of GDP in debt, double the level from the pre-2008 era capitalgroup.com. In raw numbers, the national debt has exploded from about $9 trillion in 2007 to around $35 trillion today capitalgroup.com. That’s an unsustainable trajectory, and everyone (including the credit rating agencies) knows it. Moody’s downgrade specifically flagged the recent drivers: massive federal spending increases coupled with tax cuts that shrank revenue pgpf.org. In fact, Moody’s assumed that extending the 2017 tax cuts (originally set to expire in 2025) will add another $4 trillion to the debt in the next decade pgpf.org. Tax cuts might be politically popular, but if you don’t also cut spending, you’re just fueling the debt fire. And guess what – spending keeps rising too, from pandemic stimulus to defense budgets to entitlements. It’s the worst of both worlds: lower income, higher outlays.

Ballooning debt isn’t just a number – it has real consequences. Interest payments on that debt are soaring as rates go up. The cost to service U.S. debt jumped because Treasury yields climbed sharply post-2021 pgpf.org. Think of it like racking up a giant credit card balance right when the issuer hiked your interest rate – your monthly payment just got a lot bigger. The U.S. is on track to spend over $1 trillion a year on interest alone in coming years if yields stay elevated, rivaling the defense budget. That’s money burned just to pay for past spending. It’s a vicious cycle: more debt → higher interest costs → bigger deficits → more debt… you get the picture. Moody’s warned bluntly that “persistent, large fiscal deficits will drive the government’s debt and interest burden higher” and the U.S. fiscal position will deteriorate versus other AAA peers if nothing changes pgpf.org.

Why can’t Washington get its act together? Political dysfunction. Partisan warfare has made even talking about debt reduction a rarity. S&P’s 2011 downgrade cited the weakened “effectiveness, stability, and predictability” of U.S. policymaking pgpf.org – a polite way to say Congress was a circus that summer. Fitch in 2023 harped on “erosion of governance” and the repeated last-minute debt ceiling dramas reuters.comreuters.com. Indeed, we’ve seen debt ceiling standoffs in 2011, 2013, 2021, 2023… each time Congress plays chicken with default until the eleventh hour. It’s fiscal malpractice, and it spooks allies and rating agencies alike. Add in events like government shutdown threats, the near-ousting or ousting of House Speakers, and grandstanding over budgets – it all signals that the U.S. has no coherent long-term fiscal plan.

Both major parties share blame: one side pushes tax cuts (“deficits be damned, growth will save us!”), the other pushes spending programs (“invest now, worry later!”), and few are willing to make hard choices. The result? Structural deficits as far as the eye can see. Even in a strong economy, the U.S. is running trillion-dollar yearly deficits pgpf.orgpgpf.org. What happens in a recession when revenues drop? The debt pile gets even heavier. The recent downgrade trifecta is essentially the credit agencies waving a red flag: “Fix this before it’s too late.”

Tariffs and Economic Nationalism: Throwing Stones from a Glass House of Debt

Amid this debt drama, the U.S. has been cranking up tariffs and preaching “Buy American” like it’s a cure-all. News flash: tariffs are taxes by another name – and they can have unintended side effects on the debt and economy. In recent years, we’ve seen an escalation of import tariffs, particularly targeting China. What started under the Trump administration’s trade war has, if anything, been amped up under Biden (albeit more selectively). Case in point: in 2024 the White House announced hefty new tariffs on strategic imports – raising duties on steel and aluminum up to 25%, jacking semiconductor tariffs from 25% to 50%, and even slapping a whopping 100% tariff on electric vehicles from China commerce.govcommerce.gov. They even hiked tariffs on mundane items like medical syringes from 0% to 50% commerce.gov. That’s right – the same government that can’t balance its budget is busy taxing imported needles and EVs in the name of “fair trade”.

So how do tariffs intersect with debt perception? Economic nationalism – be it via tariffs, export bans, or “friend-shoring” supply chains – can be a double-edged sword. On one hand, tariffs might protect certain U.S. industries, potentially boosting domestic jobs and (in theory) tax revenue from those businesses. On the other hand, tariffs raise costs for consumers and importers, feeding inflation. In effect, the government is choosing import taxes over more broad-based taxes to raise revenue. It’s a politically palatable move (foreigners pay, ostensibly), but economically it can backfire. Higher inflation from tariffs means the Fed might hike rates more, which then means higher interest on the debt – you see the loop? Tariffs also tend to slow growth by making things more expensive and invite retaliation (which can hurt exporters’ profits and, by extension, tax revenues). Slower growth + unchanged spending = larger deficits. Simply put, playing tough on trade doesn’t magically fix the fiscal hole; it can actually widen it indirectly.

Moreover, aggressive tariff policies can erode global goodwill. If you’re a major creditor of the U.S. like China once was, constant trade conflicts are a big incentive to reduce exposure. Indeed, since the trade war began, China has been systematically trimming its Treasury holdings. China’s stockpile of U.S. Treasuries has fallen to around $0.8 trillion (dropping from the #1 foreign holder to #3) as they diversify away chathamhouse.org. Some of that is geopolitics – why bankroll a country that’s hitting you with tariffs and sanctions? The U.S. “weaponization” of trade and the dollar (through sanctions) has prompted many countries to seek insurance against overreliance on the U.S. financial system.

There’s a touch of irony here: The U.S. is thumbing its nose at global trade partners with tariffs while asking them to keep buying its mountains of debt. It’s like yelling at your bank manager in one breath, then asking for a bigger loan in the next. Economic nationalism plays well domestically (“we’re tough on China!”), but it subtly undermines the willingness of others to finance America’s deficit. If foreigners buy fewer Treasuries (whether for political reasons or because tariffs hurt their dollar earnings), the slack must be taken up by domestic buyers or the Federal Reserve. In fact, the foreign share of U.S. debt ownership has dropped sharply – from about 50% of the market a decade ago to roughly one-third today chathamhouse.org. Tariffs aren’t the sole cause, but they’re part of a broader trend of de-globalization and distrust that nudges global investors to think twice about putting all their eggs in the USD basket.

In short, tariffs and economic nationalism might score political points, but they don’t solve the debt addiction. If anything, they add new pressures (inflation, alienated allies, supply chain costs) that can circle back and bite the fiscal outlook. It’s a bit of a red-pill moment: realize that behind the patriotic posturing, the government is scrambling to manage an overstretched balance sheet by any means except the hard choices (like cutting spending or raising broad taxes). Tariffs are a distraction – one that could ultimately hurt more than help in the grand debt equation.

Global Shockwaves (or Lack Thereof): Bonds, Gold, Crypto, and De-Dollarization

When the U.S. sneezes, the world usually catches a cold. A credit downgrade of the world’s largest economy is a sneeze of sorts – so how has the world reacted? Thus far, it’s been more subtle shifts than seismic shocks. Here’s the breakdown:

-

Bond Markets (Home and Abroad): Global bond investors didn’t bolt en masse from U.S. Treasuries after any of the downgrades. Instead, many stuck with Uncle Sam or even bought more when panic elsewhere struck (recall 2011’s post-downgrade rally in Treasuries janushenderson.com). That said, some foreign players have been quietly reducing U.S. bond exposure over the past decade. Major holders like China and Japan have trimmed their Treasury holdings. Partly this is diversification, partly necessity (e.g. Japan defending its own bond market), and partly geopolitical tit-for-tat. U.S. fiscal slippage has raised eyebrows, but so far there’s been no mass exodus – more a slow leak. Notably, the dollar actually strengthened immediately after Fitch’s 2023 downgrade, as investors moved out of equities into the safety of cash and U.S. bonds reuters.com. In 2025, after Moody’s move, U.S. bonds saw a modest uptick in demand from value hunters. The thinking: if some funds are forced to sell AA+ Treasuries, others are happy to scoop them up at a slightly higher yield. Any significant jump in U.S. yields due to credit fears would likely attract disciplined buyers (including possibly the Federal Reserve, if push came to shove). It’s a weird equilibrium, but it exists… until it doesn’t.

-

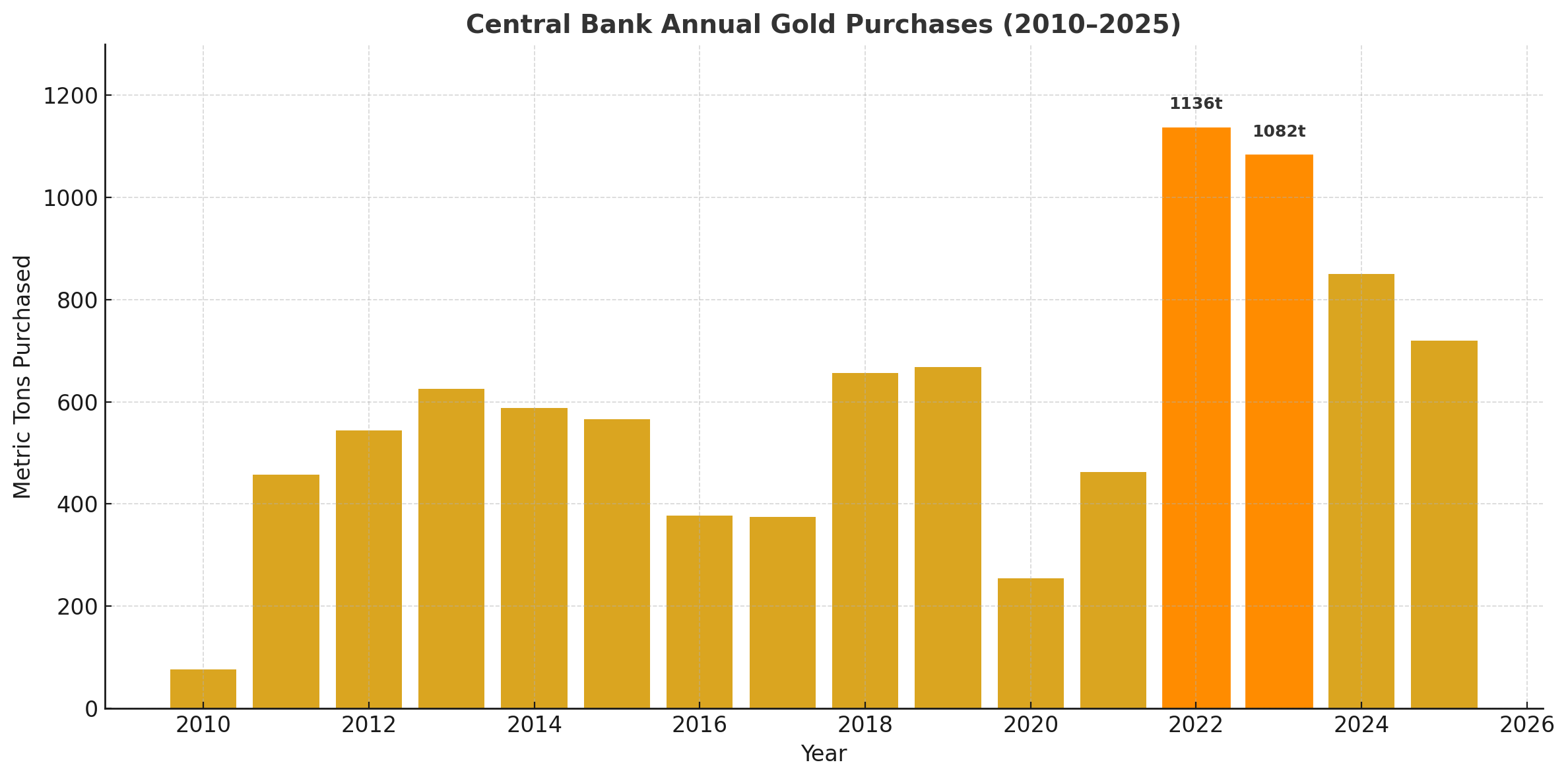

Gold – The Undollar: Gold has been the big winner in the global response to U.S. credit concerns. You might say gold bugs have been vindicated lately. Central banks are stockpiling gold at a record pace – over 1,000 tons a year in 2022 and 2023, the fastest in decades reuters.com. Why? To diversify reserves away from the U.S. dollar. Countries like China, Russia, and even middle powers have upped their gold allocations as a hedge against a dollar downturn or financial sanctions. By early 2025, gold prices hit all-time highs (north of $3,000/oz) reuters.com as both investors and central banks raced for a crisis hedge. The logic is simple: if the trust in U.S. Treasuries is slowly eroding, gold is the classic refuge. It’s no one’s liability, and it doesn’t get downgraded by Moody’s. As one strategist noted, uncertainty about U.S. policy means less incentive to add Treasuries and “more incentive to… de-dollarise” reserves reuters.com. Gold is a direct way to do that. So the U.S. downgrade cycle has been a tailwind for bullion.

-

Crypto – Digital Rebel Asset: Crypto, especially Bitcoin, often gets touted as “digital gold” and a hedge against fiat fiascos. During acute debt-ceiling scares or downgrade news, Bitcoin has seen bumps as some contrarians seek an alternative outside government control. While crypto is far more volatile (and not yet a mainstream reserve asset), there’s a narrative that if trust in government paper erodes, crypto gains appeal. Indeed, in the wake of the Fitch downgrade, Bitcoin’s price saw a modest rally, echoing gold’s move, as a subset of investors bet on the “end of dollar hegemony” storyline. That said, crypto remains a fringe player compared to gold. It’s like the edgy new kid in the asset class block – attractive to those who truly want out of the system. If downgrades and fiscal woes continue, crypto could gradually win more converts looking to store value outside traditional finance. For now, consider it a sentiment gauge: when Washington dysfunction headlines spike, so do tweets about Bitcoin as a safe haven.

-

De-dollarization Moves: Perhaps the biggest strategic shift worldwide is the deliberate push by some countries to reduce reliance on the U.S. dollar. The downgrade news only amplifies the calls from Beijing, Moscow, and even parts of the Middle East to not keep all eggs in the dollar basket. We’ve seen the BRICS nations talk up plans for trading in local currencies or even a potential new currency bloc. Deals that would have been in dollars are starting to happen in yuan, rupees, or rubles – for example, China buying oil from certain exporters in yuan. The euro and yen see occasional bumps in usage, though they’re not about to replace the dollar broadly. The reality is the dollar’s dominance, while still huge, is slowly slipping: it’s about 58% of global FX reserves now, down from 65% a decade ago chathamhouse.org. And a notable stat: foreign central banks and investors own a smaller share of U.S. Treasuries than they used to (about one-third now vs. 50% in 2014) chathamhouse.org. These trends didn’t start with the downgrades, but the downgrades reinforce them. They feed the narrative that the U.S. is on an unsustainable path – giving more impetus for rivals (and even allies hedging their bets) to slowly disengage from the dollar-centric system. We’re not at a turning point yet, but the trajectory is set: the world is cautiously preparing for a future where the dollar isn’t quite as dominant, just in case.

Why the Market Hasn’t Panicked… Yet

Given all these red flags – record debt, serial downgrades, de-dollarization rumblings – one would think markets would be in full-blown panic. Yet here we are: the S&P 500 is holding up, the VIX (volatility index) is subdued, and investors aren’t demanding 10% yields to hold Treasuries. Why the relative calm? A few reasons:

-

“Still the Only Game in Town” Effect: The U.S. may be fiscally challenged, but compared to who? Europe has its own debt and growth issues, Japan is even more indebted (but prints in yen), China’s transparency and capital controls scare off many. So global capital keeps flowing to U.S. markets almost by default. This buys America a longer leash. As long as people believe the U.S. economy remains more dynamic than others (and recent years of U.S. tech-driven growth support that), money comes in chathamhouse.orgchathamhouse.org. The strong U.S. economy of the past decade attracted capital despite rising debt, masking a lot of structural problems.

-

The Fed’s Invisible Hand: Don’t underestimate the calming effect of the Federal Reserve. The Fed isn’t explicitly backstopping the government’s debt (aside from periods of QE where it bought trillions in Treasuries), but everyone knows in a dire pinch the Fed can step in. Unlike Greece or Argentina, the U.S. borrows in a currency it creates. This means the risk of outright default is extremely low – the Fed can always print dollars to ensure Treasuries get paid (the cost being inflation, not non-payment). This implicit backstop keeps big bond players from freaking out. It’s like a safety net: not pretty if used (monetizing debt can tank the dollar’s value), but it prevents worst-case default fears. So far, each time markets have wobbled (2011, 2020 pandemic, etc.), the Fed has intervened to restore order. Investors are betting it will do so again if needed.

-

Historically Low Bar for Panic: We’ve been through a lot – the 2008 crisis, 2020 pandemic crash, etc. A one-notch downgrade feels almost quaint in comparison. The 2011 S&P cut felt apocalyptic at the time, but a decade later it’s clear the sky didn’t fall. That precedent actually reassures investors today: they’ve seen this movie before, and it ended with markets hitting new highs soon after. As one observer noted, a slight U.S. credit risk uptick is “far from a left-tail shock” scenario janushenderson.com. Absent some new catalyst, downgrades alone aren’t enough to spark a meltdown.

-

Complacency and Yield Hunger: Let’s face it, there’s a bit of complacency in the air. As long as stocks keep rising and interest on debt gets paid, many market players hit the snooze button on debt worries. The U.S. Treasury market is so liquid that even if a few sellers exit, others enter for the yield or safety. In fact, after Fitch’s downgrade, some contrarians saw it as a buying opportunity (yields slightly higher = bargain) janushenderson.com. The same with Moody’s – by the time it happened, it was old news, and any slight sell-off was quickly bought. Big institutions like pension funds need the yield from bonds; they can’t all flee to gold or cash with zero return. This structural demand keeps things stable… until some tipping point is reached.

So the market hasn’t panicked yet because the can is still being kicked down the road effectively. But “yet” is doing a lot of work in that sentence. Complacency can turn into crisis quickly if conditions change – say, if inflation reignites and the Fed can’t step in without making things worse, or if political brinkmanship actually causes a technical default (even a short-lived missed payment). The lack of immediate panic doesn’t mean all is well; it just means the timing of the reckoning is uncertain. As contrarian traders, we live by the mantra: market calm often precedes the storm.

Sidebar (AntiVestor POV): The SPX income traders reading this know the drill – keep milking those option premiums as long as volatility stays low, but don’t forget to hedge for tail risks. When everyone else is calm, an AntiVestor stays alert. The downgrade saga hasn’t spooked the herd yet, which is exactly when a contrarian starts looking for the exit nearest the door… while still enjoying the party.

Conclusion: Endgame or Business as Usual?

Here’s the gritty reality: America’s credit downgrade is both a nothingburger and a harbinger of trouble. In the short term, it’s largely symbolic – an embarrassment for the “richest nation on earth” and fodder for political grandstanding, but not a market-killer by itself. The U.S. is still borrowing on decent terms and stocks are near highs, suggesting business as usual for now. This is why mainstream finance media might shrug and move on, and why the White House (whoever occupies it) downplays the downgrade as “outdated” or “no big deal.”

But zoom out, and the picture darkens. The fact that all three major rating agencies have now felt compelled to downgrade the U.S. for the first time in history pgpf.orgpgpf.org is a loud warning siren. It speaks to a decade-long trend of fiscal decay: skyrocketing debt, partisan paralysis, and a global order shifting under our feet. The U.S. government’s balance sheet is getting stretched like never before outside of world wars. Eventually, something’s gotta give. Either policymakers get serious about reform (don’t hold your breath), or the market will force the issue via higher borrowing costs or inflation. As traders and investors, we don’t have the luxury of living in denial – we take the red pill and see reality for what it is.

AntiVestor’s take: The U.S. credit downgrade and tariff wars are like two sides of the same coin – symptoms of a superpower grappling with its limitations. One side (downgrades) shows the world losing patience with our fiscal insanity. The other side (tariffs) shows us flailing to regain control via economic aggression. Both point to a more volatile future. For now, the system chugs along: the Treasury holds its auctions, the Fed fine-tunes the machine, and Wall Street hums a tune of “Don’t Worry, Be Happy.” The markets haven’t cracked yet, which means opportunity for the nimble and attentive. Rule-based traders (like those running SPX income strategies) can continue to harvest premium from the apparent calm – but must stay vigilant for that sudden volatility storm when the complacency bubble pops.

In the end, this downgrade is a reality check. The U.S. isn’t bulletproof, and the world is slowly adjusting to that fact. In true contrarian fashion, we embrace the gritty truth rather than the comforting lie. Maybe the party continues another year or five; maybe it ends next quarter – we can’t know exactly. But we do know that you can’t defy fiscal gravity forever. The AntiVestor ethos is to see the cracks forming in the foundation while others admire the pretty facade. So keep your eyes open and your hedges ready. The U.S. just got a credit wake-up call, even if the mainstream is hitting snooze. When the next alarm sounds – and it will – you’ll be glad you didn’t drink the Kool-Aid.

Punchline: America’s credit rating might be lower, but a true hustler knows there’s profit in chaos. The downgrade saga isn’t an obituary for the U.S. economy – it’s a plot twist. And as any trader worth their salt knows, plot twists are where opportunity lives. Stay cynical, stay savvy, and don’t buy the spin. The fight’s just getting started.

Want to read more?

-

“U.S. credit rating downgrade” → Moody’s Official Press Release

-

“debt ceiling drama” → 2023 Debt Ceiling Analysis – Brookings

-

“Trump’s 2025 tax plan” → WSJ on 2025 Tax Cut Proposals

-

“de-dollarisation trend” → IMF on Global Reserve Currencies

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.