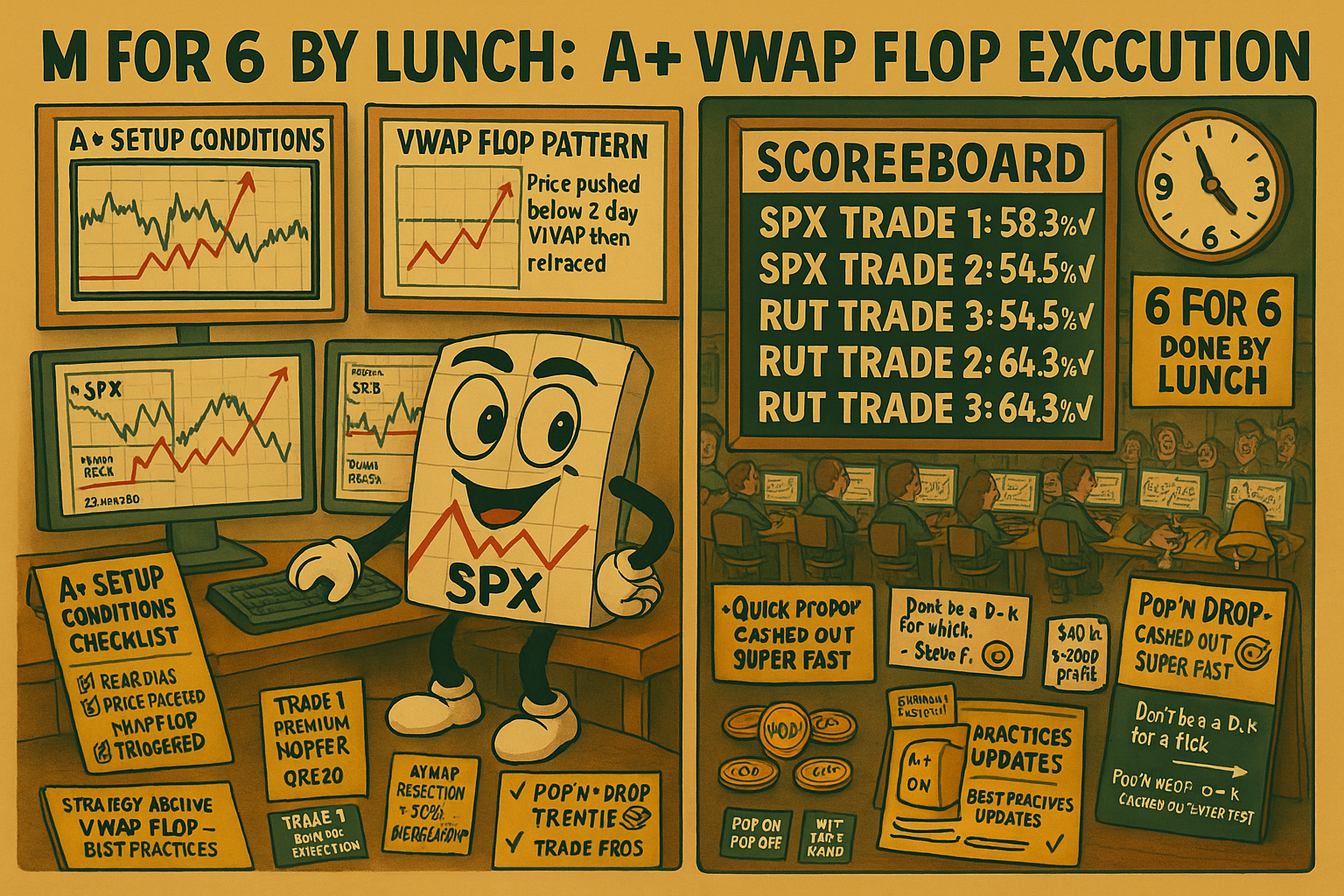

A+ Setup Day From Outset. Price Jumped Below 2-Day VWAP. VWAP Flop Triggered.

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Well, today was just a textbook bag full of trades day and done by lunchtime.

This started as an A+ setup day from the outset. Something we talked about in a recent best practices training day for my insiders, outlining some strategy updates and improvements.

Firstly, price jumped from above the 2-day VWAP to below the 2-day VWAP in my already bear-biased market – as we discussed in today’s and this week’s morning briefings. Moving from the larger timeframe range highs to the range lows, which is already in motion.

Whilst this is not needed for the setup, it certainly enhances the setup.

So price pushed lower below the 2-day VWAP and retraced. In one of my older trainings in the strategy archive, I refer to this as the “VWAP Flop” – giving me an A+ setup AND my usual opening range setup.

I’m all over that first bear Premium Popper on both SPX and RUT. Pop ‘n drop and cashed out super fast. 1st breakout trade with enhancements is on the scoreboard.

As we are below the 20-min opening range, I’m anchoring my VWAP to the high of the day. Price on both SPX and RUT retraced back to the AVWAP and rejected it quite quickly. Simply selling the low of the high bar is my entry here. Bonus points as we’re also seeing a 50% retracement from the day’s range.

This also quickly reached its exit.

While this is happening, the 3rd breakout setup as price moved through the 60-min opening range – another Popper was popped on as the prior trade popped off.

3 for 3 setups on 2 instruments. Total of 6 for 6 trades.

The bottom line is that this is what happens when you have a systematic approach and wait for your best setups and hit them hard when the conditions are right.

And it’s not just me… my students are absolutely smashing the scoreboard today too.

Keep scrolling for the A+ setup breakdown and student Wall of Wins…

6 For 6 By Lunch. Students Replicating. Systematic Perfection.

Trade Review: 6 November 2025

Today delivered what systematic traders live for: A+ setup conditions from the open, mechanical execution, quick exits, 6 for 6 perfection by lunchtime.

Setup Conditions – Why This Was A+ From The Outset:

- Bear-biased market – discussed in morning briefings all week, moving from range highs to range lows

- Price jumped below 2-day VWAP – from above to below creates enhanced setup

- VWAP Flop triggered – price pushed below then retraced back (A+ pattern from strategy archive)

- Range movement already in motion – larger timeframe confirming direction

This confluence of factors created textbook mechanical entry conditions.

Trade 1: Premium Popper ORB20 – SPX & RUT

Setup: First bear Premium Popper on both SPX and RUT

Entry trigger: VWAP Flop + Opening Range Breakout (20-min)

Enhancement: Price already below 2-day VWAP in bear-biased market

SPX Trade 1:

- Premium collected: (details from fill screen)

- Exit: Pop ‘n drop, cashed out super fast

- Result: 58.3% ROC

RUT Trade 1:

- Premium collected: (details from fill screen)

- Exit: Quick mechanical target hit

- Result: 58.3% ROC

Why it worked: VWAP Flop provided A+ entry signal with bear bias confirmation. Opening range breakout gave mechanical trigger. Enhanced by larger timeframe range movement already underway.

Trade 2: AVWAP Rejection + 50% Retracement – SPX & RUT

Setup: Price retraced to Anchored VWAP (anchored to high of day since below 20-min OR)

Entry trigger: AVWAP rejection + 50% retracement from day’s range

Entry execution: Sold low of high bar showing rejection

SPX Trade 2:

- Entry: Low of rejection bar at AVWAP

- Bonus: 50% retracement confluence

- Result: 54.5% ROC

RUT Trade 2:

- Entry: Low of rejection bar at AVWAP

- Quick exit as target reached

- Result: 64.3% ROC

Why it worked: AVWAP provided magnetic resistance level. 50% retracement added confluence. Rejection bar gave clear mechanical entry. Bear bias still driving price lower.

Technical note: Using cash market for SPX, no volume data available, but custom script pulling in proxy data for AVWAP calculations.

Trade 3: 60-Min ORB Breakout – SPX & RUT

Setup: 3rd breakout setup (no official 2nd breakout actually set up)

Entry trigger: Price moved through 60-min opening range

Execution: Another Popper popped on as prior trade popped off

SPX Trade 3:

- Entry: 60-min ORB breakout trigger

- Result: 54.5% ROC

RUT Trade 3:

- Entry: 60-min ORB breakout trigger

- Result: 64.3% ROC

Why it worked: Momentum continuation from earlier trades. 60-min timeframe providing next mechanical breakout level. Bear bias maintained throughout session.

Final Scorecard: 6 For 6 By Lunch

SPX Results:

- Trade 1: 58.3% ROC

- Trade 2: 54.5% ROC

- Trade 3: 54.5% ROC

- Total: 3 for 3

RUT Results:

- Trade 1: 58.3% ROC

- Trade 2: 64.3% ROC

- Trade 3: 64.3% ROC

- Total: 3 for 3

Combined: 6 trades executed, 6 trades profitable, done by lunchtime.

This is what systematic trading looks like when A+ conditions align: Wait for best setups. Execute mechanically. Take profits quickly. Repeat on multiple instruments.

The Bottom Line

This is what happens when you have a systematic approach and wait for your best setups and hit them hard when the conditions are right.

Not every day delivers A+ conditions. Most days deliver B or C setups at best. Some days deliver no setups at all.

Thursday 6 November delivered A+ from the outset:

- VWAP Flop pattern (from strategy archive training)

- Bear bias confirmed (from week’s morning briefings)

- Range movement in motion (larger timeframe analysis)

- Multiple mechanical triggers (ORB20, AVWAP rejection, ORB60)

When these conditions align: Hit them hard. Execute mechanically. Take profits. Repeat.

The systematic advantage: Knowing when to swing big (A+ days) vs when to wait (B/C days) vs when to sit out (no setup days).

Wall of Wins – Week Ending 6 Nov 2025

And it’s not just me… my students are absolutely smashing the scoreboard today too.

| Name | Strategy | Results | Highlights |

|---|---|---|---|

| Steve F. | [BWB][Spread] | $1.05→$0.50 · $1.10→$0.50 | 2nd BO sold 6775/80 CCS for $1.05, covered $0.50. SPX sold 6810/15 CCS $1.10 out at $0.50. “missed RUT by a tick…(Don’t be a d..k for a tick)” |

| Brian M. | [Popper] | $1.50→$0.55 | SPX Premium Popper doing great this week! In at $1.50 out at $0.55 |

| Andy D. | [Popper] | 50% roc | “Great day here as well. Premium Popper both wins!” |

| Laurence S. | [Popper] | 50% ROC | Premium Popper OUT “thanks for playing” |

| Bill H. | [Popper] | $1.35 · $1.10 | Only got into SPX’s but got in 2 accounts with entries at $1.35 and $1.10 |

| James W. | [Recovery][TnT] | $250 day | Messed up order entry showing $40 loss, but “by God’s grace” when closed individually ended up with $200 profit. Bull TnT showed up, closed within minutes for $60 profit. “$250 day and my account will be qualified. Blessings to all for all your insights you provide especially for someone still with a great amount to go on my learning curve.” |

| SLP | [Popper] | 50% ROC | Sold the 10/15’s as well and done! “quick hitters this AM”. “worked RUT and AGAIN no fill …grrrr but I’ll take what i get and won’t fuss a bit” |

| Zach | [ORB] | 50% ROC | “A fast RUT 20orb!” |

| Colin H. | [ORB] | 50% ROC | “Yes same hardly time to bracket it “ |

| Richard H. | [ORB] | 50% ROC | SPX and RUT ORB20 wins for 50% ROC. “Missed the ORB60’s, sadly. Better premiums today. I was above a dollar on both for the normal entry.” |

Key Statistics

Total Traders Featured: 11

Most Common Strategy: Premium Poppers (5 traders)

ORB Wins: 3 (Zach, Colin H., Richard H.)

Recovery Stories: 1 (James W. – turned $40 loss into $200 profit)

Multi-Account Traders: 2 (Steve F., Bill H.)

Notable Highlights

James W.’s Recovery Masterclass

Order entry mistake showed $40 loss, but by closing each side individually after market moved the right direction, turned it into a $200 profit, then caught a Bull TnT for another $60. Account qualification unlocked! “$250 day and my account will be qualified.”

⚡ Fast Action Premium Poppers

The team caught quick SPX & RUT 1st breakouts on November 6th with multiple traders reporting “quick hitters this AM” and barely having “time to bracket it”

Steve F.’s Double Dip

Executed both BWB and spread strategies on SPX, closing both for solid 50%+ gains

Richard H.’s Discipline

Hit 50% ROC on both SPX and RUT ORB20s whilst admitting he missed the ORB60 entries. “Better premiums today. I was above a dollar on both for the normal entry.”

System Replication Success

What makes this Wall of Wins significant: Students are executing the exact same mechanical setups as the teacher on the exact same day.

Phil’s trades: Premium Popper ORB20 (SPX & RUT), AVWAP rejection, 60-min ORB

Student trades: Premium Popper ORB20 (multiple traders), ORB wins, fast action

This is systematic trading validation:

- Same A+ setup conditions identified

- Same mechanical entry triggers

- Same quick profit-taking discipline

- Same results: 50%+ ROC across the board

When the system is mechanical and teachable, students replicate teacher results. Not by copying trades. By executing the same mechanical rules when the same setup conditions trigger.

“Fast action on the SPX & RUT 1st breakouts” – students identifying the same VWAP Flop pattern and ORB triggers Phil was trading. Multiple accounts reporting quick execution and fast exits.

This is what systematic education delivers: Not “follow my trades” dependency. But “execute your own mechanical rules” independence.

- Purple arrows = Entry

- Green arrows = Exit

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “VWAP Flop Formation Flying With 6-For-6-By-Lunch Execution” whilst analysing A+ setup conditions and claiming they had mastered “Textbook Bag Full Of Trades Advanced Cooing With Student Replication Celebration.”

Hazel updated her crisis management protocols to include “A+ Setup Recognition Emergency Procedures” alongside contingency plans for “VWAP Flop Integration With 50% Retracement Confluence Monitoring And Hit-Them-Hard-When-Conditions-Right Execution Protocols.”

Mac raised his Thursday victory whisky and declared, “When 6-for-6 systematic perfection by lunch validates student replication across 10 traders executing Premium Poppers whilst VWAP Flop delivers textbook entries, mechanical discipline becomes delightfully superior to discretionary guessing!”

Kash attempted livestreaming about “VWAP Flop being basically like DeFi liquidity pool reversions but with actual mechanical entry signals” but got distracted calculating whether 58.3% ROC counts as generational wealth in options terms.

Wallie grumbled that in his day, textbook trading meant “proper chart patterns rather than this modern VWAP Flop terminology with 2-day proxy data and 6-for-6-by-lunch celebration!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.