How systematic SPX selling turns market panic into payday—while portfolio managers pray Burry’s wrong

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Michael Burry—the bloke who shorted the housing market in 2008 and made £700 million look easy—just filed an SEC disclosure that sent shockwaves through Wall Street.

$1.1 billion in put options. Against Nvidia and Palantir. The two AI darlings everyone and their pension fund manager owns.

Cue the tech selloff. Nasdaq dropped 2% in a day. Palantir’s CEO called Burry “batshit crazy” on CNBC (which, historically, is never a good sign).

But here’s what nobody’s connecting properly…

Keep Scrolling & Keep Reading;

Burry’s $1.1B bet (and why we’re not worried)

When The Magnificent Seven Sneeze, The Market Catches Pneumonia

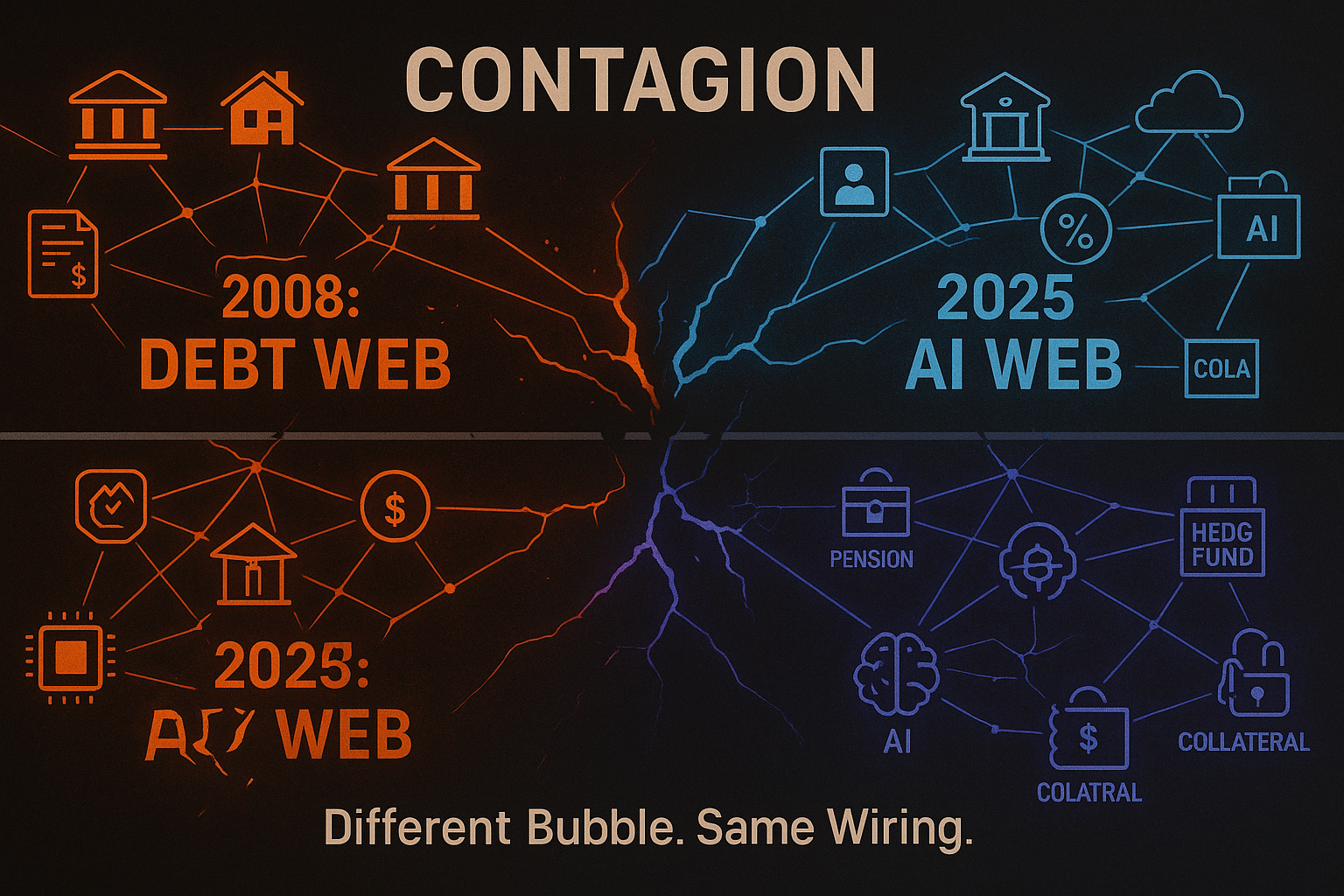

The problem isn’t just tech valuations. It’s structural contagion.

Remember 2008? One piece breaks, the whole structure shifts. The issue wasn’t that housing was overvalued—it was that everything was wired together through derivatives, leverage, and counterparty risk.

Fast forward to November 2025.

The Magnificent Seven tech stocks—Apple, Microsoft, Nvidia, Amazon, Meta, Tesla, Alphabet—now account for over 80% of the S&P 500’s total returns this year, according to Bank of America.

Not diversification. Not broad market strength. Seven companies.

And who owns them?

Everyone.

- Private wealth portfolios ✓

- Corporate treasuries ✓

- Pension funds ✓

- Hedge funds using them as collateral for leverage ✓

This summer, I interviewed an analyst at one of America’s largest global banks. As a senior private banker I asked him point-blank: “Do you think your clients should hold exposure to the Magnificent Seven?”

The implication was clear: They already do. The question isn’t whether to hold these positions—it’s how overexposed everyone is.

Which means when the tide turns, everyone drowns together.

The Displacement Everyone’s Missing

Here’s the darker version nobody’s pricing in:

AI won’t take your job—but portfolio rebalancing might.

Mass layoffs could arrive through financial contagion before they arrive through automation. Not because models got smarter, but because the fund managing your company’s pension was over-leveraged on Nvidia.

The unemployment wave might come from deleveraging and market mechanics, not gradual technological displacement.

That’s the bit everyone’s getting wrong.

What We Discovered Trading Through The Weird Times

While the retail crowd and institutional money managers were sweating over whether Burry’s put options would print, we were doing what we always do:

Selling premium systematically into the chaos.

Last week alone, 19 traders in our community documented wins using our mechanical setups. On Thursday, one of our members banked £34,000 in a single day using Premium Popper strategies while volatility spiked.

Not because they predicted Burry’s move.

Not because they “had a view” on tech.

Because systematic options selling profits from reaction instead of prediction.

Here’s what we’ve learned operating through these uncertain times:

Volatility Is Your Mate (When You’re Selling It)

When fear spikes, implied volatility explodes. Option premiums fatten. For buyers, that’s expensive insurance. For sellers? That’s payday. Our members collected bloated premiums on Thursday because everyone else was panicking.

Directional Bias Kills Accounts. Mechanical Systems Don’t.

If you were “long AI” or “short tech” based on conviction, this week hurt. If you were running Tag ‘n Turn and Lazy Popper setups? Business as usual. Our systems work whether markets rip, chop, or crater—because we’re selling volatility, not predicting direction.

Boring Consistency Beats Exciting Unpredictability

When institutional money gets nervous and retail follows, option premiums get mispriced. That’s the trade. Not the narrative. Not the guru predictions. The mathematics.

Why Both Scenarios Work For Premium Sellers

If Burry’s right and AI stocks implode, volatility spreads everywhere. Including SPX.

Which means one of two things happens:

Scenario A: Markets rip higher because Burry’s early (again), and systematic sellers capture theta decay as implied volatility collapses.

Scenario B: Markets crater, volatility explodes, and systematic sellers bank fat premiums on elevated fear.

Notice something? Both scenarios work for premium sellers.

That’s not smugness. That’s mathematics.

While everyone else debates whether Burry’s a genius or a madman, we’re executing setups. Done by lunch. Family time by dinner.

Why SPX. Why Now. Why Systematic.

SPX options settle in cash. No assignment risk. No early exercise nonsense. Tax advantages (60/40 treatment in the US). Deep liquidity even when markets are falling apart.

And unlike stock portfolios that bleed when contagion spreads, properly structured premium selling strategies make money when everyone else is panicking.

Our SPX Income System isn’t about “being bearish” or “being bullish.” It’s about:

- Mechanical entry signals (no guessing, no FOMO)

- Defined risk management (you know your max loss before you enter)

- Statistical edges that compound (probabilistic frameworks, not hope)

You don’t need to forecast bubbles. You just need a process that profits when others panic.

The Bottom Line (For Traders Who Want Protection That Pays)

Michael Burry might be right about an AI bubble. He might be early. He might be completely wrong.

Doesn’t matter.

What matters is whether your trading system works regardless of market direction.

If your strategy depends on being right about macro, you’re gambling. If it depends on probabilistic edges and mechanical execution, you’re trading.

The 19 traders who documented wins last week weren’t lucky. The bloke who banked £34,000 on Thursday wasn’t clairvoyant. They were systematic.

And when the next “Big Short” finally hits—whether it’s AI, something else, or nothing at all—they’ll still be collecting income while everyone else panics.

That’s the difference.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

P.S. If you’re sitting there thinking “I need to learn this before the next crash,” you’re already late. The book breaks down exactly how systematic SPX selling works in plain English. No PhD required. Just probabilistic edges explained clearly. Get the book here.

P.P.S. Ready to actually execute? The course + software package gives you everything: mechanical signals, trade management software, risk calculators, video walkthroughs. No fluff. No upsells. Just the system that works when markets go sideways, up, or completely mental. Grab the SPX Income System here.

P.P.P.S. Want to fast-track everything with direct mentorship, weekly live trade reviews, and access to our private community documenting wins in real-time? We’ve got 3 spots left for Q1 2026 mentorship. Apply here.

Remember… There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.