Futures Pop 70pts on Holiday Tariff Reprieve… (and then another 80pts)

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

The weekend news pops and pumps are getting beyond the pale!

Still, we trade mechanically. I closed the week on Friday (technically Thursday) with a bearish bias despite a bullish Tag ‘n Turn. Then I logged off, hit the beach with Mrs N – and then promptly spent Saturday in A&E after she caught her shin on a sharp corner. Lovely.

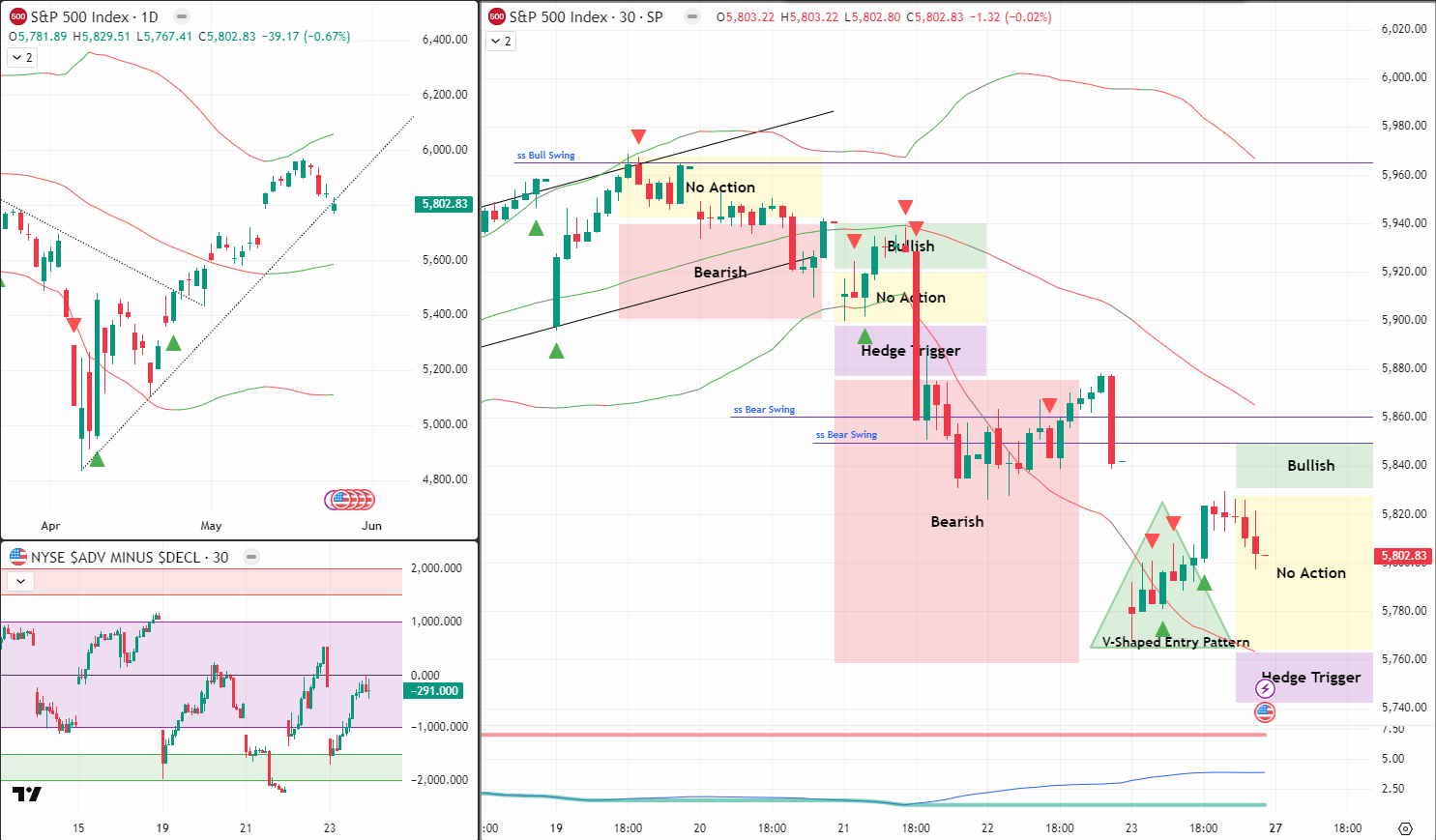

So yes, I paid the price for having a little fun – markets jumped 70+ points on Sunday night as Trump U-turned on the EU tariff, and another 80 points ahead of tuesdays open. The bear position is underwater… but theta’s still grinding, and I’ve got eyes on 5840 for a clean switch.

Feet up. Film on. Acting nursemaid until the Tuesday bell rings.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

SPX Options = Cashflow Engine.

With this setup? It’s practically an ATM with a checklist.

SPX Market Briefing

Markets are closed today for Memorial Day in the US – but futures aren’t. And they’ve been busy.

Sunday evening, Trump stunned traders by shelving a planned 50% tariff on EU vehicles. Futures popped at the open and haven’t looked back. As of writing, we’re 70 points above Friday’s close and another 80points ahead of Tuesday’s open.

Thursday, I closed shop early and bearish. Friday the system had a bullish Tag ‘n Turn in play – but I chose discretion, stayed bear, and chose the beach.

Then came Saturday’s emergency room trip. And Sunday’s news pop.

Do I regret it? Not at all. This is why we trade with structure – not urgency.

While the initial move stings, theta on the bear spread is still profitable. And if price cools back to 5840, I’ll gladly rotate into a bullish position. That’s the conservative entry – and the one I’ll wait for.

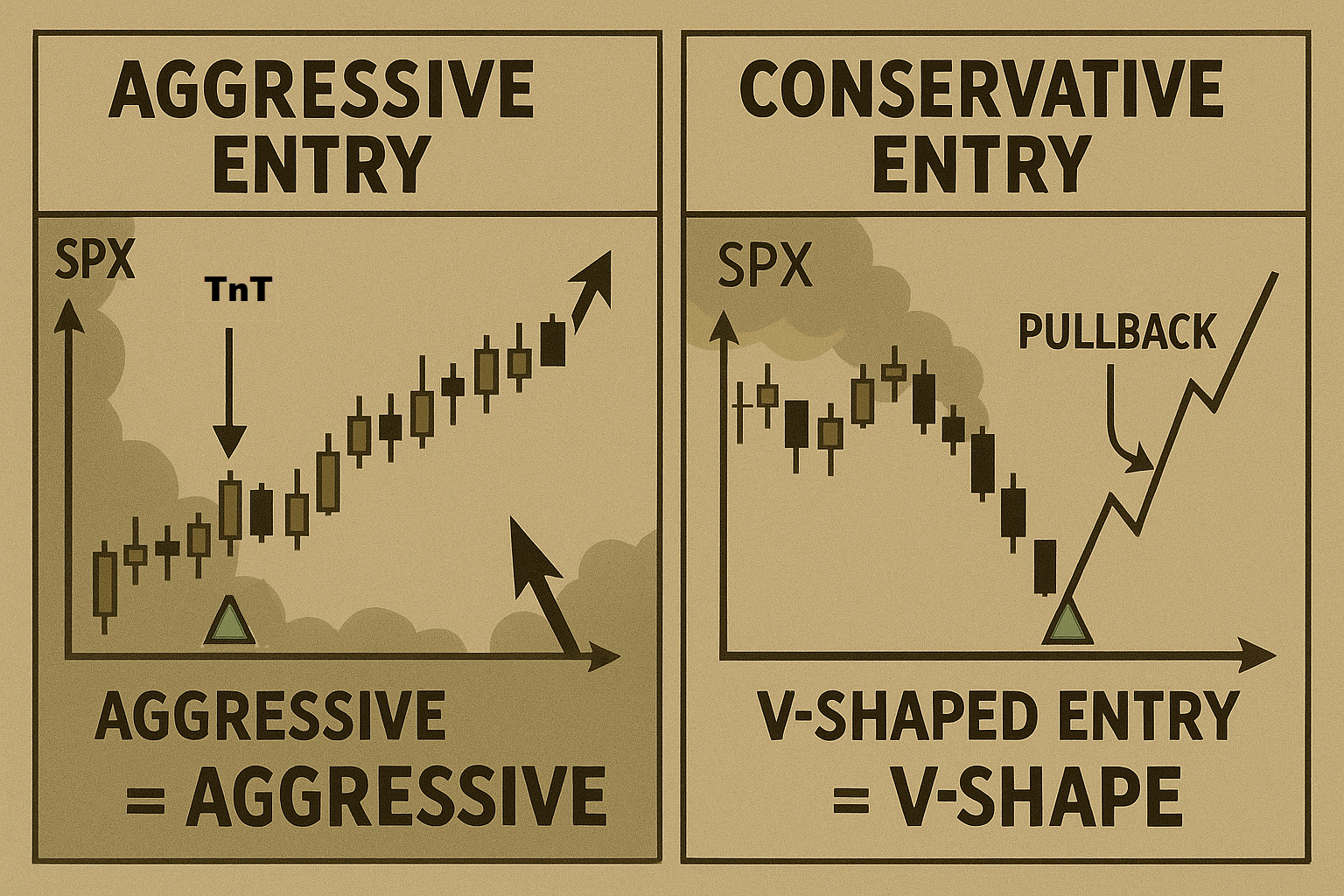

Several traders in the group raised smart points about the bullish entry. The upcoming 2025 SPX Income System update will reflect that:

-

Choice 1: Aggressive entry – tag + pulse bar = long

-

Choice 2: Conservative V-Shaped entry – wait for a pullback and right-shoulder break

I’ve started annotating charts with that green triangle to mark the V-entry zones. Simple to spot. Easier to trade. And coming soon in the official SPX Income materials.

Until then? Feet up. Long weekend continues. I’ll meet you at Tuesday’s bell.

Expert Insights:

Mistake: Reacting emotionally to holiday weekend gaps

Why it hurts: Leads to panic trades and abandoning the system

Fix: Define both aggressive and conservative entries before the news hits

Rumour Has It…

The official White House stance on tariffs now reads, “Maybe. Maybe not.” One Brussels official said the conversation was “productive.” Trump reportedly responded, “I love Europe. Especially the cheese.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact

Today, we close for barbecues and mattress sales.

Progress.

Meme of the Day

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.